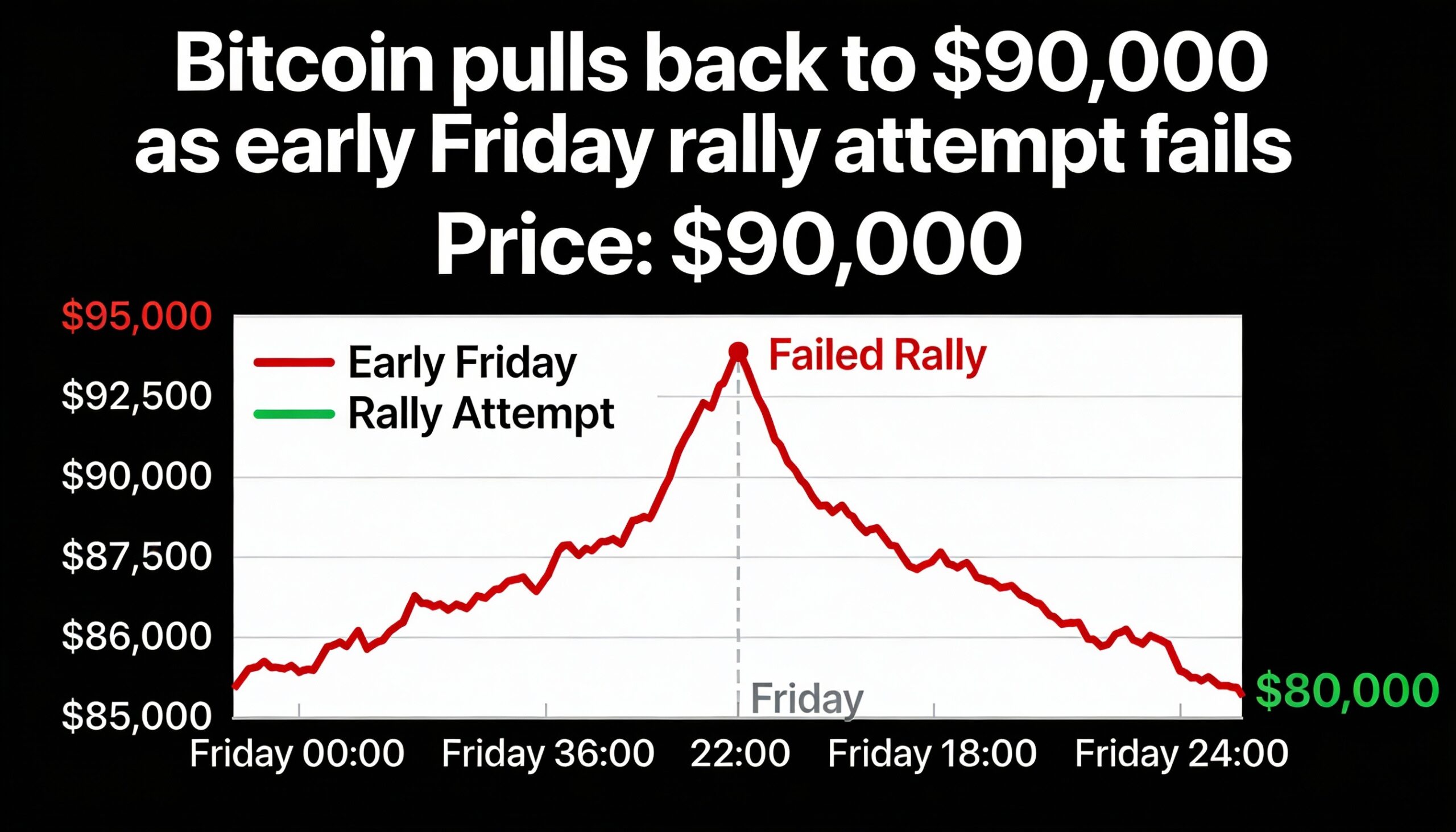

Bitcoin slipped back toward the $90,000 level on Friday after an early rally faded, as mixed U.S. economic data, rising inflation expectations and the absence of a key Supreme Court ruling weighed on sentiment.

BTC briefly climbed to the $92,000 area during U.S. mid-morning trading, but the move failed to gain traction and prices drifted lower through the rest of the session. About an hour before U.S. equity markets closed, bitcoin was trading near $90,300, down nearly 1% over the past 24 hours.

The price action has become a familiar pattern in recent weeks, with bitcoin struggling to advance even as traditional markets rally. The Nasdaq was up about 1% on the day, while the S&P 500 gained roughly 0.8%. Precious metals and crude oil posted broad gains, and bonds were modestly higher.

Friday’s U.S. December employment report delivered mixed signals. Nonfarm payrolls rose by just 50,000 last month, below expectations for a 60,000 increase, and prior months were revised lower. At the same time, the unemployment rate fell to 4.4% from 4.6% in November, beating forecasts for a decline to 4.5%.

Sentiment data showed a slight pickup. The University of Michigan’s preliminary consumer sentiment index for January rose to 54, above forecasts of 53.5 and December’s 52.9 reading. One-year inflation expectations edged higher to 4.2% from 4.1%, though the measure continues to show sharp political divides, with Democrats expecting much higher inflation than Republicans.

Adding to the uncertainty, the U.S. Supreme Court did not issue a ruling on the constitutionality of the Trump administration’s tariff regime, despite expectations for a decision Friday morning. The case was absent from the court’s published opinions, with additional rulings now expected next Wednesday.

Crypto-related equities mostly traded lower alongside bitcoin. Coinbase (COIN) fell 2.3%, Gemini (GEMI) dropped 4.5%, and Strategy (MSTR) slid 5.6%. Some bitcoin miners bucked the trend, particularly those that have expanded into AI infrastructure. Hut 8 (HUT), IREN (IREN) and Core Scientific (CORZ) each gained between 2% and 4%.