South Korea Considers 5% Cap on Corporate Crypto Investments

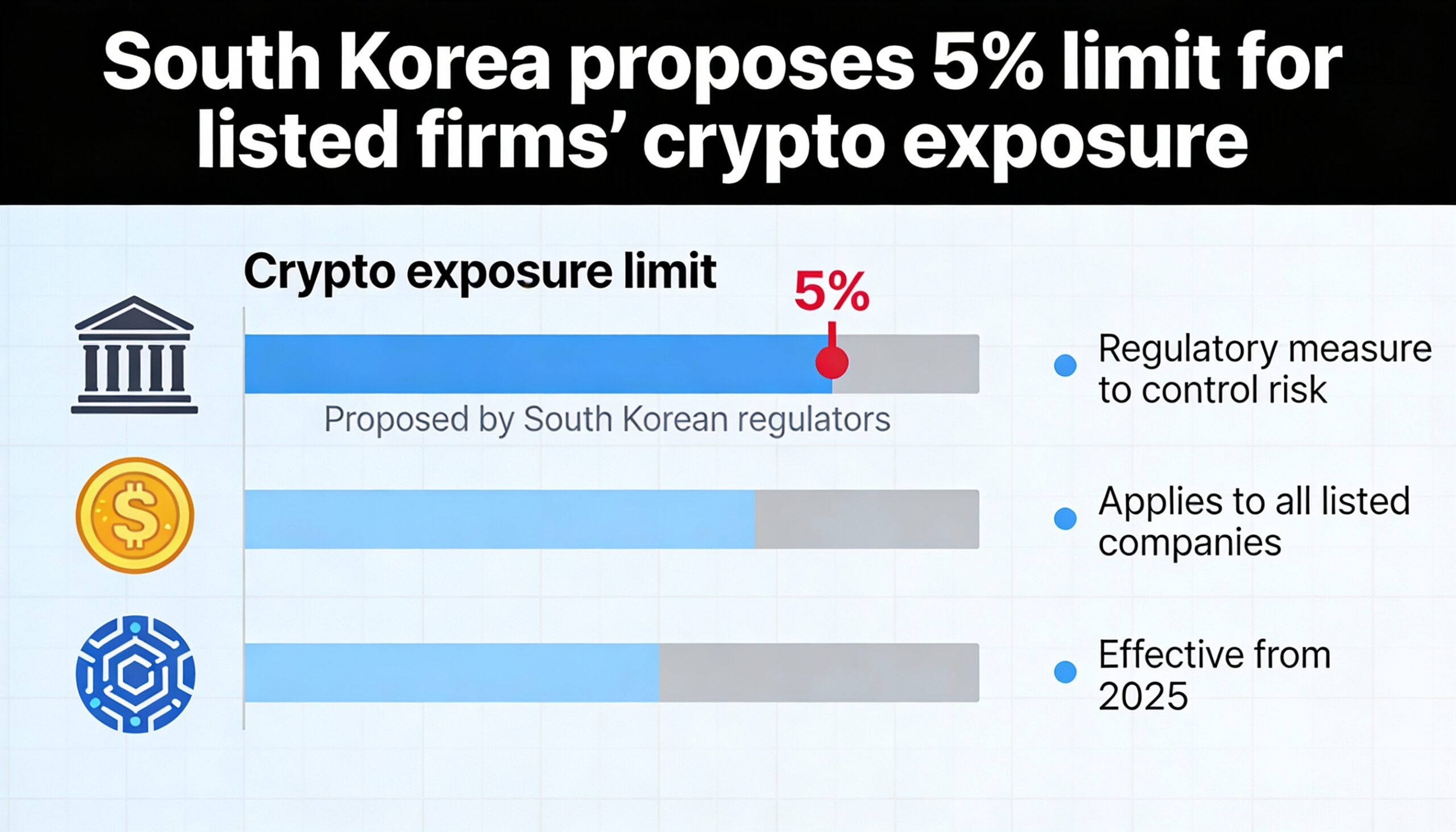

South Korea’s Financial Services Commission (FSC) is weighing a rule that would limit listed companies’ cryptocurrency holdings to 5% of their equity capital, according to local media reports. The move is part of the country’s broader effort to ease long-standing restrictions on institutional crypto trading.

Seoul Economic Daily reported that the FSC has drafted trading guidelines for listed companies and professional investors, with a final version expected as early as January or February. Corporate trading could begin later this year.

Under the proposed rules, eligible firms would be allowed to invest up to 5% of equity capital annually in digital assets, restricted to the top 20 cryptocurrencies by market value. Discussions are ongoing about whether U.S. dollar stablecoins, such as USDT, would be included.

The guidelines aim to gradually phase out what has effectively been a ban on institutional participation. South Korea began loosening rules in mid-2025, permitting nonprofits and crypto exchanges to sell certain holdings, and the FSC has previously indicated that listed firms and professional investors would eventually be allowed to trade.

The 5% limit is designed to reduce balance-sheet risk and mitigate volatility concerns if corporate crypto participation increases. Authorities are also expected to implement trade execution safeguards, including split trading requirements and price limits, to manage market impact as liquidity grows.

Analysts anticipate that investment flows would likely concentrate in bitcoin and, to a lesser extent, ether, even if the top 20 tokens are deemed investable, with limited impact on smaller cryptocurrencies. Market participants are also closely watching the upcoming Digital Asset Basic Act, expected in the first quarter, which could establish rules for stablecoins and spot crypto ETFs.