Crypto markets were calmer on Tuesday following Monday’s tariff-driven volatility, though sentiment remained guarded as altcoins continued to underperform bitcoin.

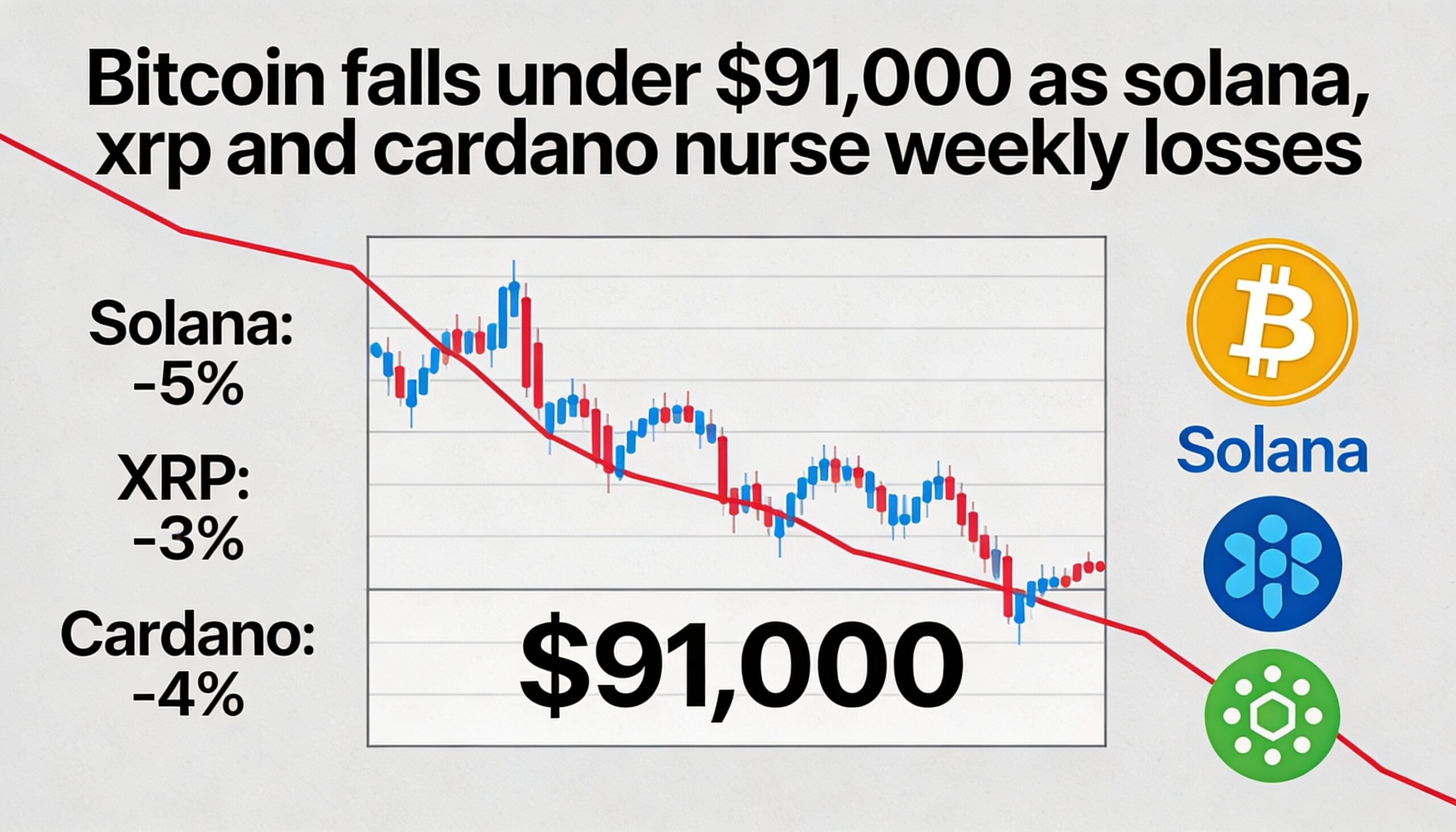

Bitcoin and major tokens traded lower during Asian afternoon hours, with derivatives positioning still defensive after a macro-led pullback. Bitcoin slipped below $90,000 in early European trading, little changed on the day after Monday’s decline tied to fresh tariff headlines and a broader shift toward risk aversion.

Ether held near $3,200, while Solana, XRP and Cardano were mixed on the session but remained sharply lower for the week, underscoring how altcoins have absorbed the bulk of the recent sell-off.

Macro uncertainty continues to weigh on markets. Renewed tariff tensions between the U.S. and Europe — linked to President Donald Trump’s comments on Greenland — have driven investors back toward traditional safe havens. Gold and silver advanced, while cryptocurrencies lagged even as some equity markets held steady.

Farzam Ehsani, chief executive of exchange VALR, said the weakness reflects crypto-specific fragility rather than a broad-based risk-off move.

“Capital is rotating into established safe havens, while crypto continues to trade as a high-beta risk asset,” Ehsani said, adding that bitcoin may struggle to maintain elevated levels without clearer signals on rate cuts or renewed institutional inflows.

Rising U.S. Treasury yields added to the pressure, as global bond markets sold off on fiscal and geopolitical concerns.

For now, traders appear content to remain defensive, waiting for a clearer catalyst to push markets out of their low-volatility range.