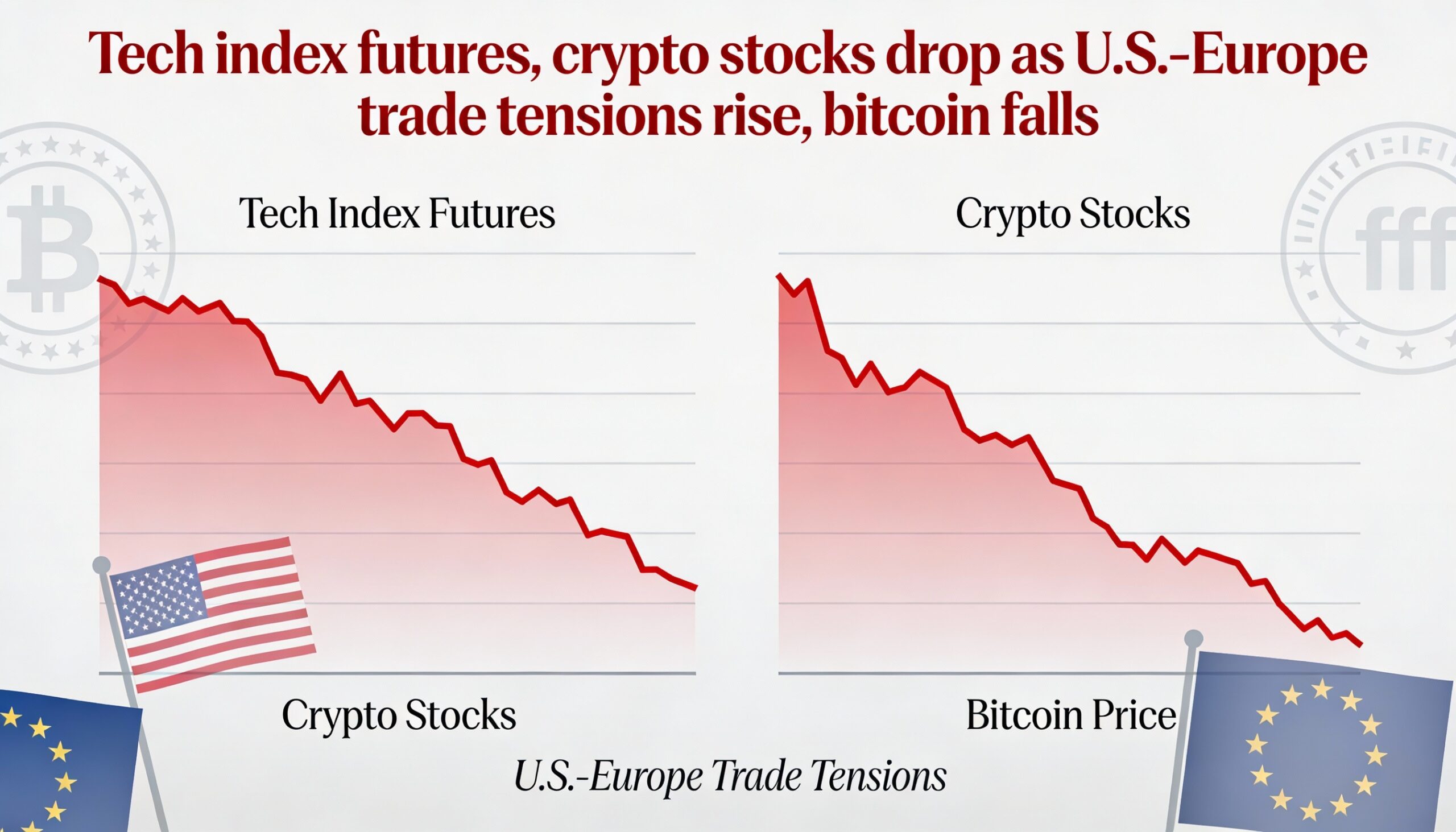

U.S. tech futures are under pressure ahead of Tuesday’s open as concerns rise over President Donald Trump’s blocked attempt to acquire Greenland and the risk of retaliatory tariffs with several European nations.

The Invesco QQQ Trust Series, an ETF tracking the Nasdaq 100, dropped 2% in premarket trading following Monday’s Martin Luther King Jr. Day holiday.

Trump threatened a 10% tariff on Denmark and select European countries, which may respond with countermeasures. Polymarket places only a 20% chance that Trump succeeds in acquiring Greenland before 2027.

Bitcoin fell to $90,000, down 8% from Thursday’s peak, pressuring crypto-linked equities. MicroStrategy (MSTR) dropped 6%, Galaxy Digital (GLXY) fell 8%, and IREN (IREN) lost 8%. Coinbase (COIN) and Circle Internet (CRCL) each fell around 5%, while all “Magnificent Seven” tech stocks slipped 1%-3%.

Safe-haven assets advanced, with gold trading above $4,700 per ounce (+9% YTD) and silver surpassing $95 (+32% YTD). U.S. Treasury yields rose, Japan’s 30-year bond yields neared 4%, and the DXY dollar index fell 0.5% to 98.5, reflecting broad market caution.