Crypto markets remain highly sensitive to moves in global bond yields, and while conditions have steadied for now, another spike in rates could quickly place renewed pressure on bitcoin and other digital assets.

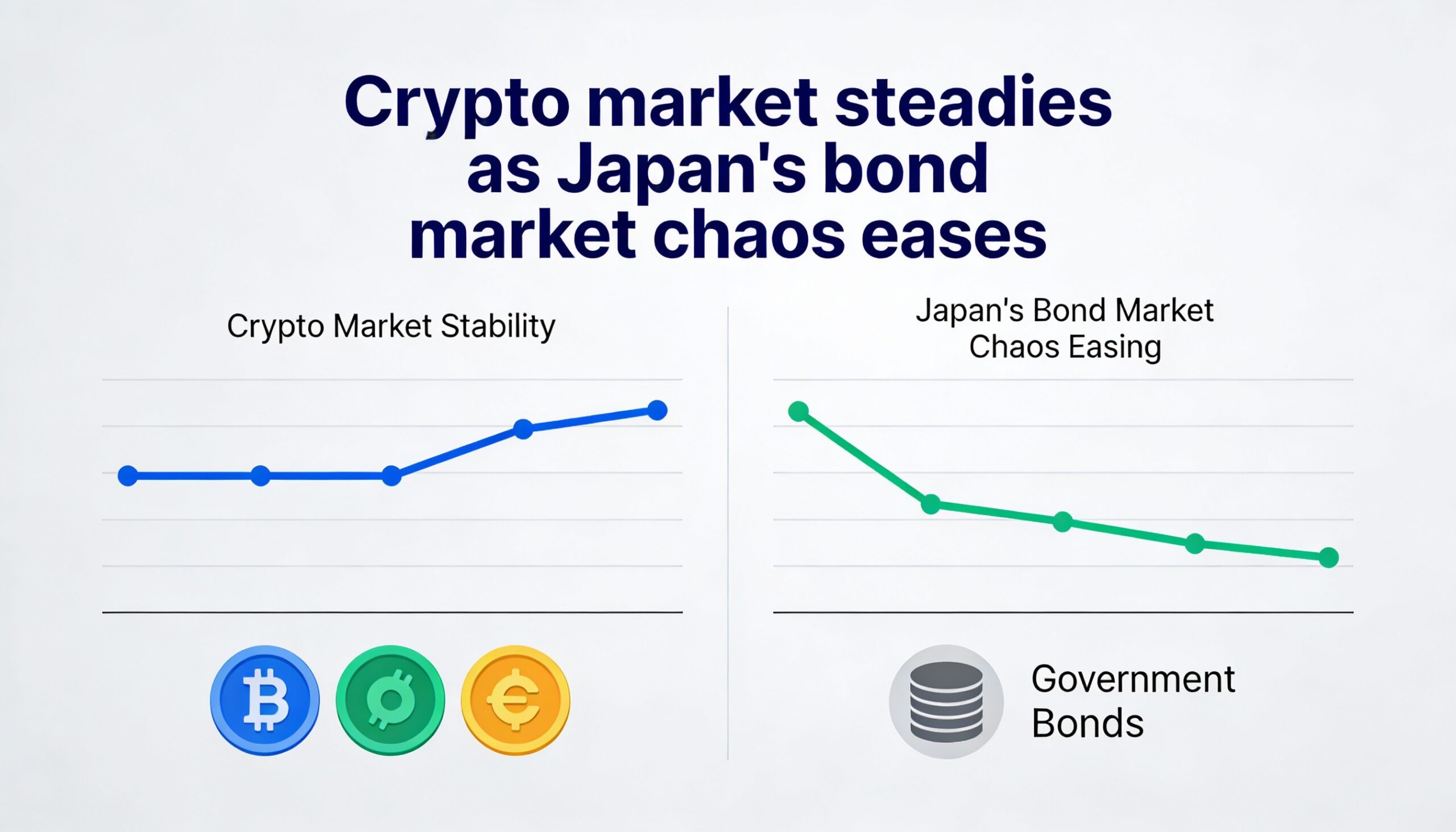

Major cryptocurrencies stabilized on Thursday after Japanese government bonds rebounded for a second consecutive session, easing a key macro concern that had weighed on bitcoin and the broader market earlier in the week.

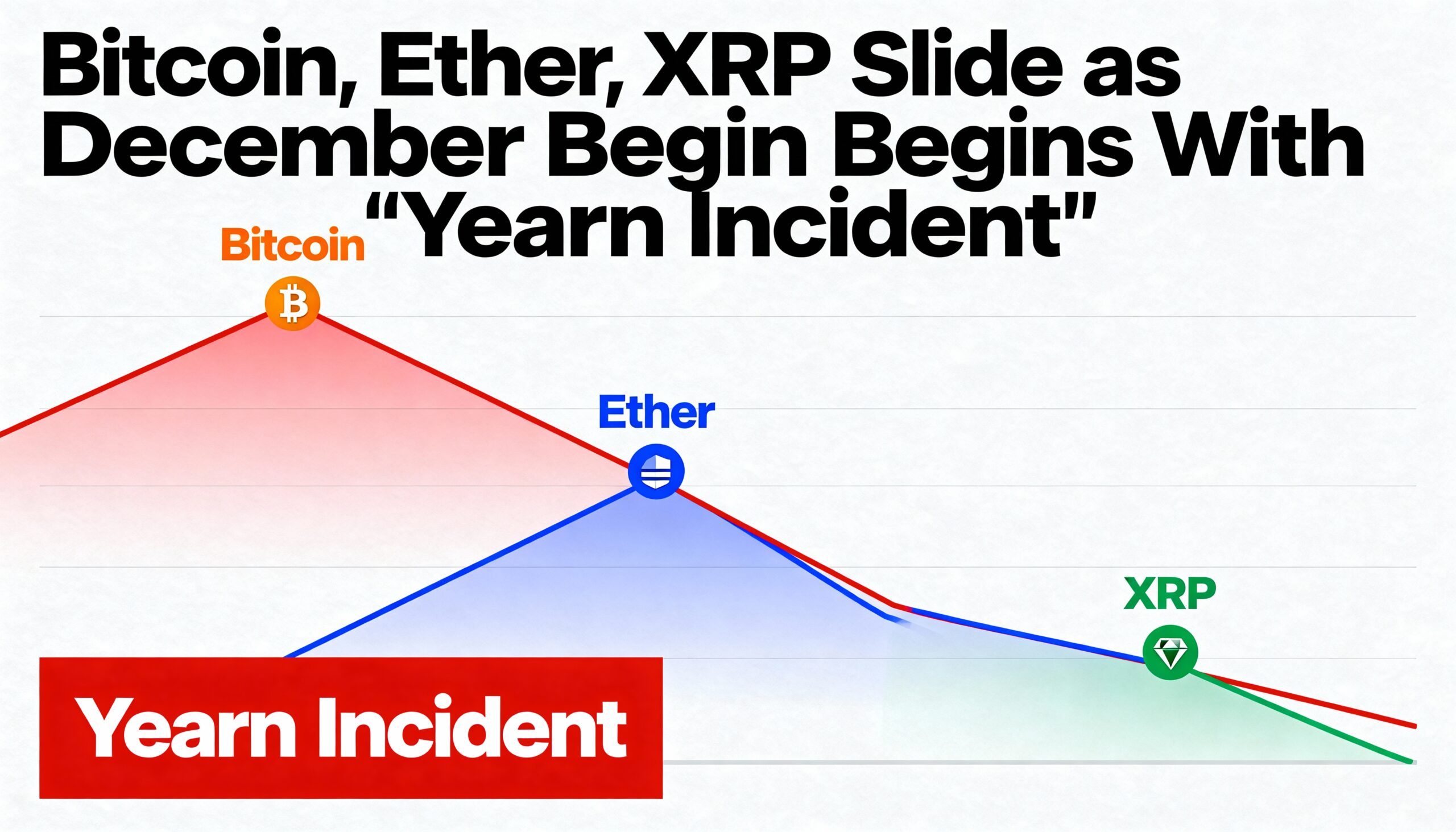

Bitcoin hovered near $90,000 during Asian trading hours following sharp swings over the past day, while ether climbed back above $3,000. Other major tokens, including Solana, XRP and Cardano, also steadied after suffering steep losses earlier in the week, according to CoinGecko data.

The calmer tone followed a recovery in longer-dated Japanese government bonds, which pushed yields lower. Yields on 30-year Japanese debt fell sharply after government officials urged restraint, reversing part of a surge that had driven borrowing costs to multi-decade highs.

While the rebound in Japanese bonds does not signal a return to risk-on positioning, it has removed one immediate source of stress that had forced traders into defensive mode earlier in the week.

Japanese debt markets were hit hard at the start of the week, rattling global markets, including cryptocurrencies. The selloff also lifted bond yields worldwide, including U.S. Treasury yields, which underpin global financial conditions.

Rising yields matter for crypto in part because Japan’s bond market plays a central role in global capital flows. When long-dated Japanese yields spike, global borrowing costs tend to rise, encouraging investors to rotate into safer, yield-bearing assets.

That shift typically weighs on speculative markets such as crypto, which rely on loose financial conditions and ample liquidity. Bitcoin briefly slipped below $88,000 as traders cut exposure, while altcoins fell more sharply as leverage was flushed from the system.

For now, easing pressure in Japan’s bond market has helped crypto prices regain stability. Still, the episode underscores how exposed digital assets remain to renewed volatility in global interest rates.