Crypto markets stabilized Thursday following Wednesday’s tariff-driven swings, with bitcoin reclaiming the $90,000 level as equities rebounded and traders rotated back into risk assets.

Bitcoin (BTC) traded between $89,300 and $90,200 during Asian hours after volatility triggered by U.S. President Donald Trump’s tariff-related comments. Tensions between the U.S. and European Union peaked in Davos, with Trump first easing concerns over Greenland and later canceling planned EU tariffs. The moves sent both equities and crypto higher in what has been dubbed the “taco trade.”

The recovery underscores crypto’s ongoing correlation with equities, while gold’s pullback from record highs signals a rotation from safe-haven assets back into risk-on positions. Ether (ETH) traded near $3,000, up 0.86% since midnight UTC, reflecting broader gains across the altcoin market.

Derivatives and Market Trends

Wednesday’s swings triggered roughly $593 million in liquidations across crypto derivatives, with long and short positions impacted equally during bitcoin’s dip to $87,200 and its subsequent rebound.

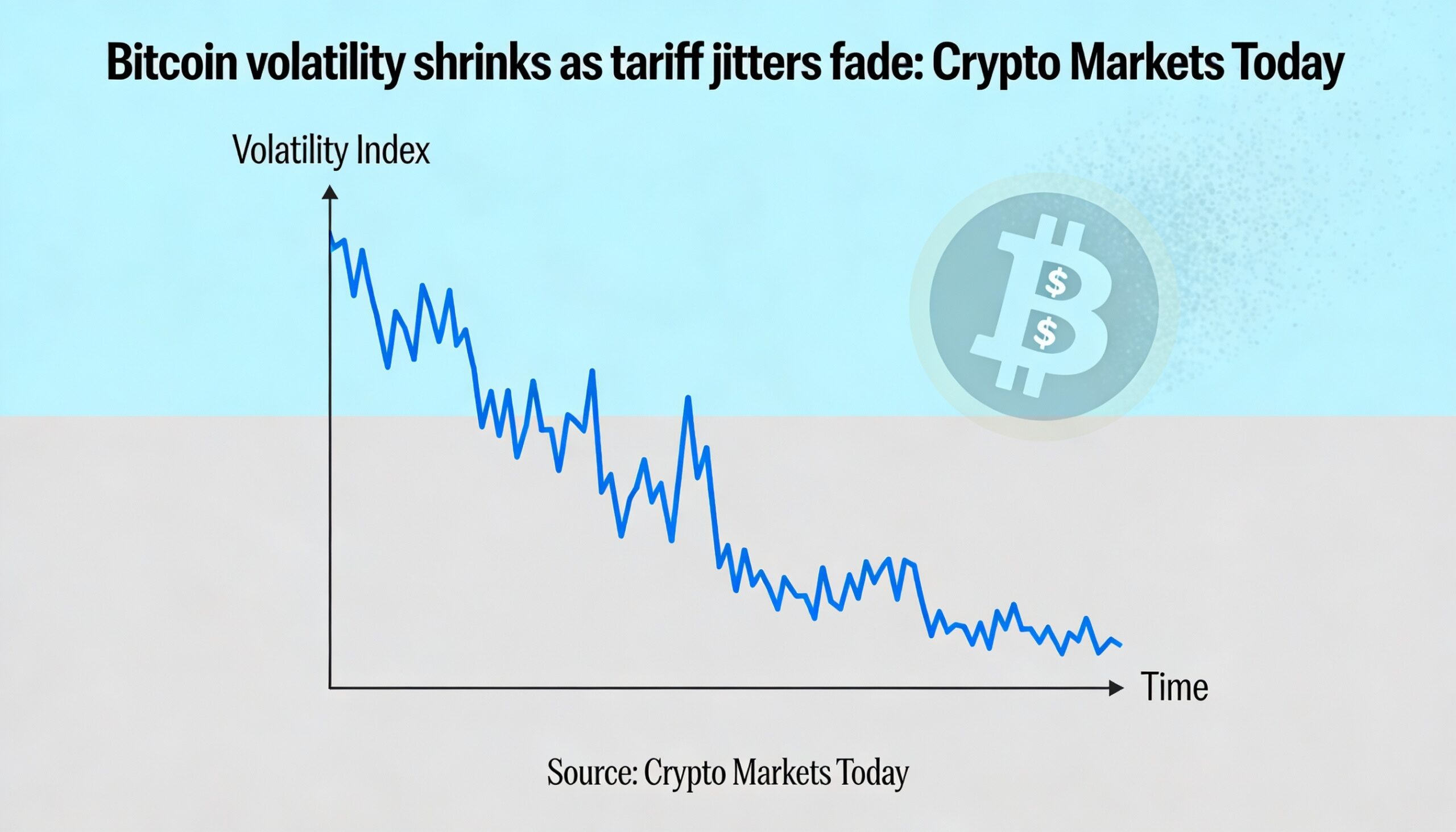

BTC’s 30-day implied volatility fell from 44.3 early Wednesday to 40.62, indicating reduced demand for options hedging. Bitcoin open interest dropped 0.34% over the past 24 hours while the price rose 0.84%, suggesting profit-taking among short positions amid limited new futures demand.

Funding rates across most crypto pairs remain positive, reflecting a general bullish bias. Axie Infinity (AXS) is an exception, showing negative rates after a 126% rally over the past week. Bitcoin’s long/short ratio — measuring accounts going long versus short — rose to 2.04 from last week’s 1.18, signaling increased bullish sentiment.

Altcoins and Sector Highlights

Metaverse tokens led gains in the altcoin market. The Sandbox (SAND) surged 10.8% in 24 hours as traders rotated profits from Axie Infinity. CoinDesk’s Metaverse Select Index (MTVS) rose 6.58% since midnight UTC and 50.8% year-to-date, outperforming other benchmarks and highlighting growing interest in blockchain gaming.

Privacy-focused tokens lagged, with Dash (DASH) down 2.8% and Night (NIGHT) off 4.4% over the past day. Monero (XMR) and Zcash (ZEC) fell 27% and 17%, respectively, over the past week.

The decentralized finance (DeFi) sector remains resilient, with stablecoin-dominated total value locked (TVL) continuing an upward trend since 2023, a contrast to the previous cycle when TVL spiked to $176 billion before crashing below $50 billion.

CoinMarketCap’s “altcoin season” indicator rose from 26/100 to 29/100 overnight, buoyed by gains in metaverse tokens and major cryptocurrencies XRP and BNB, both up roughly 2.5%, compared with bitcoin’s 0.74% rise.