On-chain data shows large bitcoin and ether transfers linked to BlackRock’s spot ETFs, echoing earlier January activity tied to creation and redemption flows.

Over the past several hours, wallets connected to BlackRock’s spot bitcoin and ether ETFs moved more than $430 million in crypto to Coinbase Prime, according to Arkham. The transfers represent one of the largest ETF-related clusters observed this week.

The movements coincided with significant outflows from U.S.-listed spot crypto ETFs, pointing to redemption-driven activity rather than discretionary selling. Spot bitcoin ETFs recorded $708.71 million in net outflows, including $356 million from BlackRock, while ether ETFs saw $297.51 million in outflows, $250 million of which came from BlackRock, per SoSoValue.

The transactions involved roughly 3,070 bitcoin, valued at $276 million, and about 52,800 ether, worth $157 million at current market prices. Assets moved from addresses tied to BlackRock’s iShares Bitcoin Trust (IBIT) and iShares Ethereum Trust (ETHA), with Coinbase Prime as the receiving platform.

Coinbase Prime is used by authorized participants and institutional clients to facilitate creation and redemption of shares for U.S.-listed spot ETFs. As with previous transfers earlier this month, these movements are largely operational and not direct spot-market sales, although hedging and settlement activity can contribute to short-term volatility.

This follows a January 13 transfer of roughly $300 million in bitcoin and ether from BlackRock wallets, which coincided with a brief push above $92,000 for bitcoin during U.S. trading hours.

As of mid-January, IBIT remains the largest institutional holder of bitcoin, while ETHA ranks among the largest regulated vehicles for ether exposure. On-chain activity from these funds is closely monitored during periods of market stress or recovery.

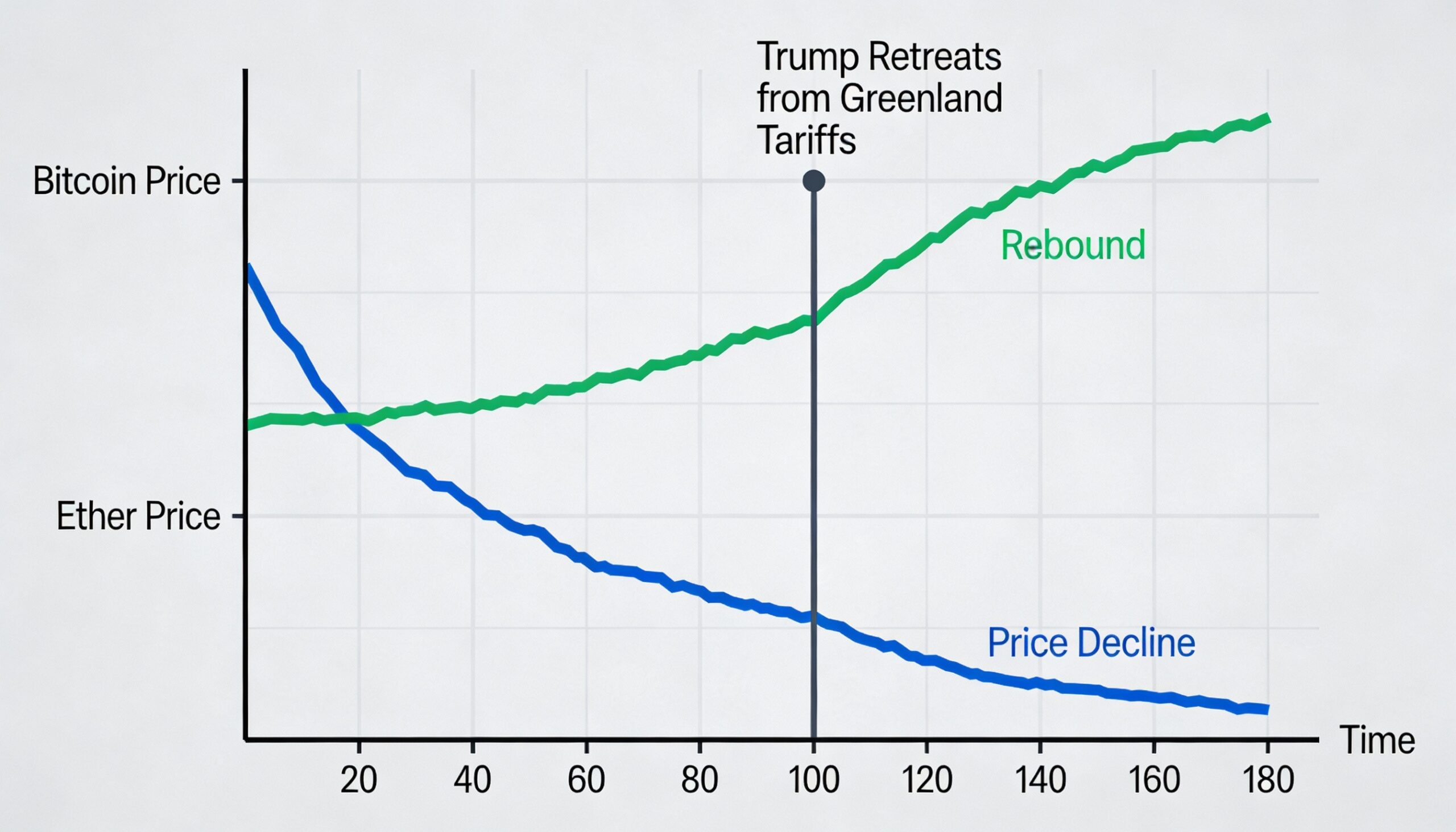

Ahead of U.S. market hours, bitcoin traded just under $90,000 and ether hovered near $3,000, as broader crypto markets stabilized following a volatile stretch driven by macro headlines and shifting risk sentiment.