Bitcoin has lost 55% of its value relative to gold since peaking in December 2024, highlighting its continued underperformance and raising questions about its role as “digital gold.”

Gold is nearing record highs just under $4,900 per ounce, up roughly 12% year-to-date, while bitcoin remains below $89,000 and has posted only modest gains this year.

The divergence is also visible over longer time frames. Over five years, gold has gained around 160%, slightly outpacing bitcoin’s 150% increase.

The BTC-to-gold ratio currently sits near 18.46, well below its 200-week moving average (WMA) of 21.90, roughly 17% beneath the long-term trend.

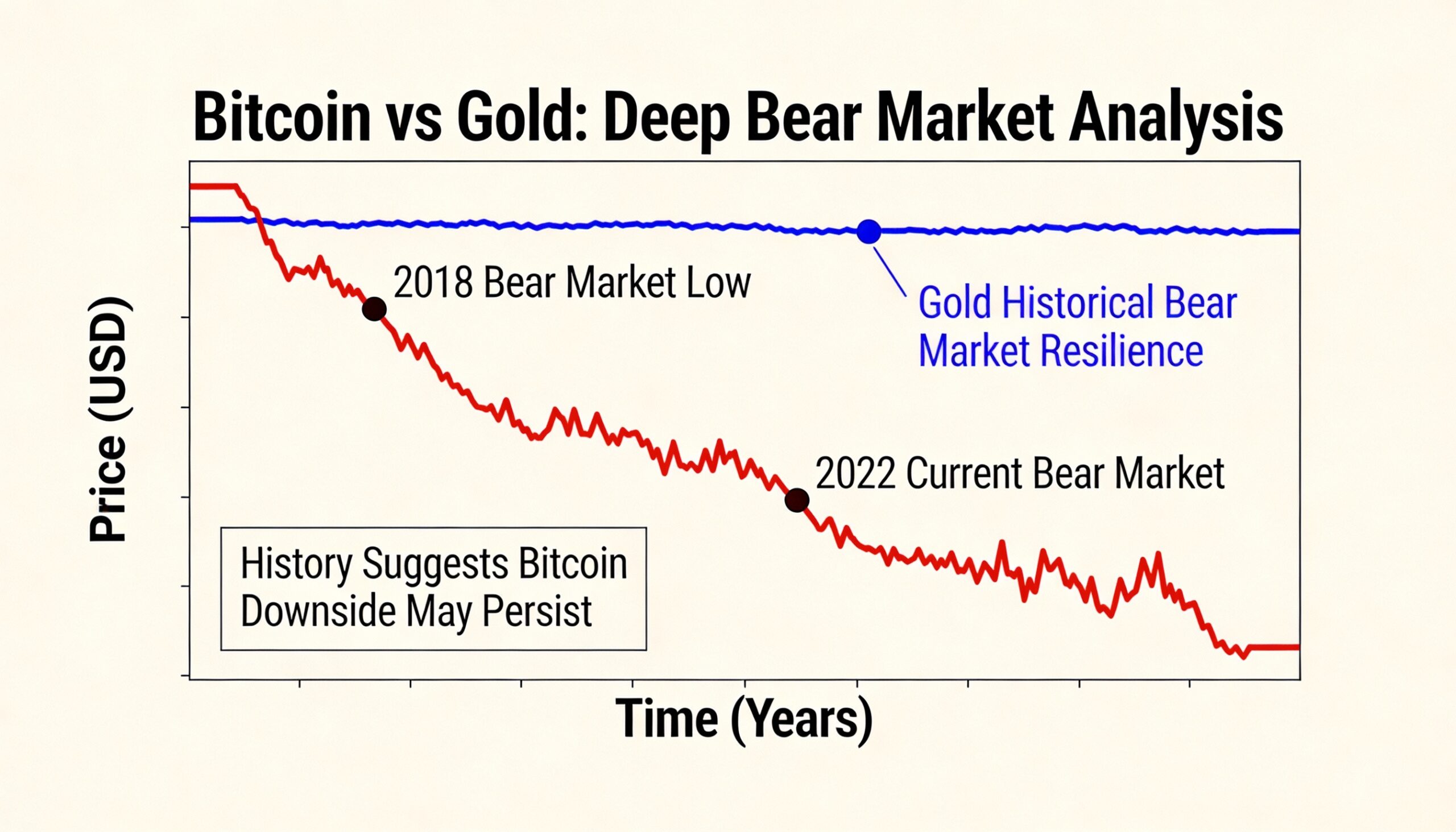

During the 2022 bear market, the ratio fell more than 30% below the 200WMA and stayed there for over a year. The current decline began in November, suggesting the ratio could remain below the 200WMA until late 2026 if historical patterns repeat.

The ratio peaked near 40.9 in December 2024, with bitcoin subsequently dropping about 55% against gold. Past cycles saw even deeper losses, including a 77% decline in 2022 and an 84% fall during the 2017–2018 cycle.