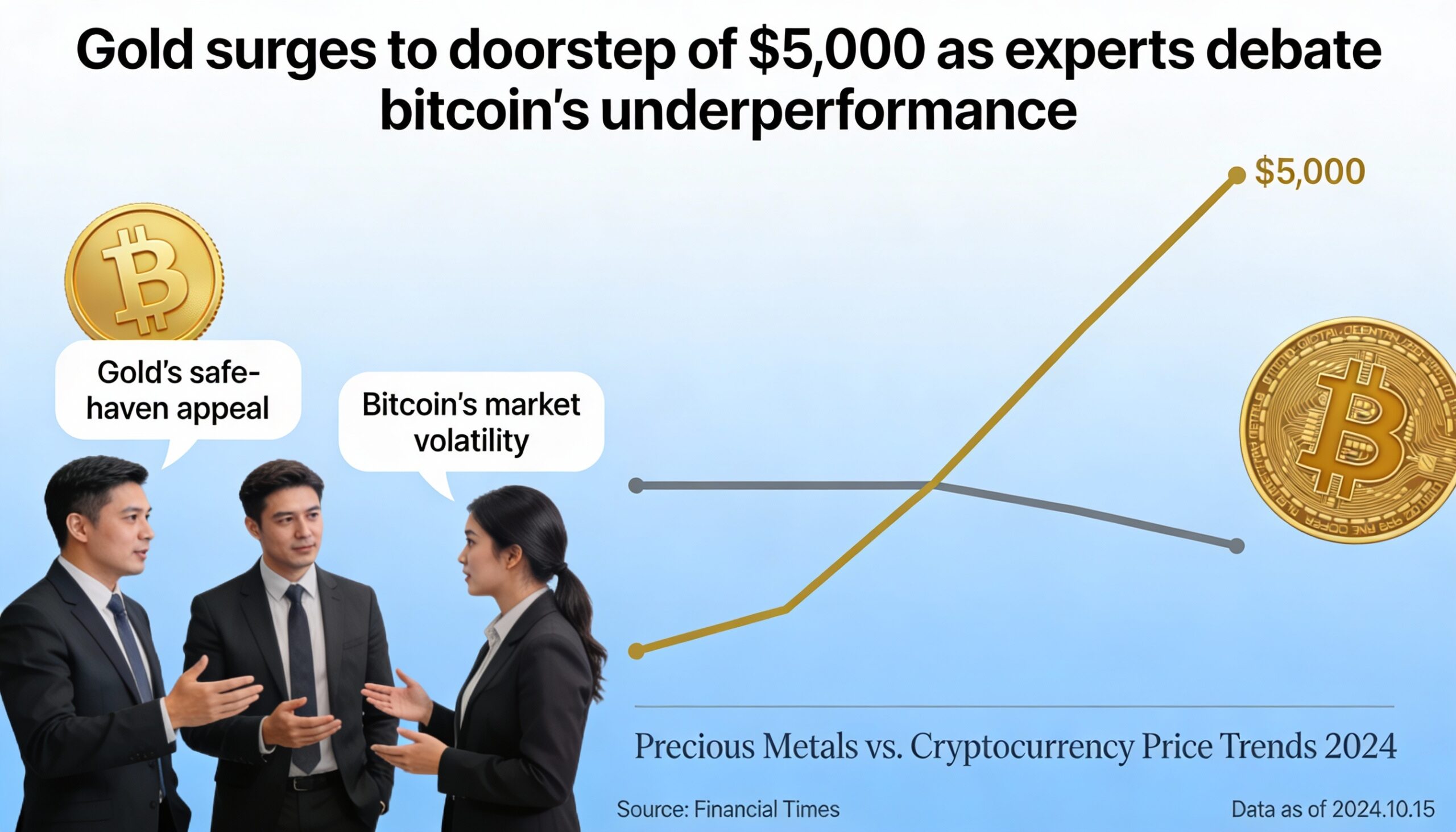

The rally in precious metals shows little sign of slowing, while bitcoin and the broader crypto market continue to lag, reigniting debate over whether BTC’s long-running adoption narrative has lost momentum.

Gold climbed another 1.7% on Thursday to trade near $4,930 per ounce, while silver jumped 3.7% to $96. Bitcoin, by contrast, slipped back toward $89,000, roughly 30% below its early October all-time high.

The divergence has fueled skepticism among some market watchers. Bianco Research president Jim Bianco questioned whether bitcoin’s adoption-driven story is still resonating with investors after months of lackluster price action.

“The adoption announcements are not working anymore,” Bianco wrote in a post on X. “We need a new theme, and that’s not evident yet.”

Bloomberg ETF analyst Eric Balchunas pushed back, urging a longer-term perspective. He noted that bitcoin is consolidating after an explosive rally from below $16,000 during the depths of the 2022 crypto winter to a peak of $126,000 in October.

“It went up something like 300% in the 20 months prior,” Balchunas said. “What do you want? Two-hundred percent annual gains with no pauses?”

Balchunas added that bitcoin’s recent underperformance may partly reflect profit-taking by early holders, a process he described as a “silent IPO.” As an example, he pointed to a long-term investor who sold more than $9 billion worth of BTC in July after holding the asset for over a decade.

Bianco countered that bitcoin has fallen behind a wide range of assets over the 14 months following President Donald Trump’s election victory in November 2024. Over that period, bitcoin is down 2.6%, he said, compared with gains of 205% for silver, 83% for gold, 24% for the Nasdaq and 17.6% for the S&P 500.

“And while we wait for that new theme,” Bianco added, “everything else is racing ahead as BTC stays stuck in the mud.”

Balchunas had the final word, noting that as recently as November 2024, bitcoin was up 122% year-over-year and solidly outperforming gold. The recent surge in precious metals, he said, reflects a period of catch-up rather than a definitive shift in long-term leadership.