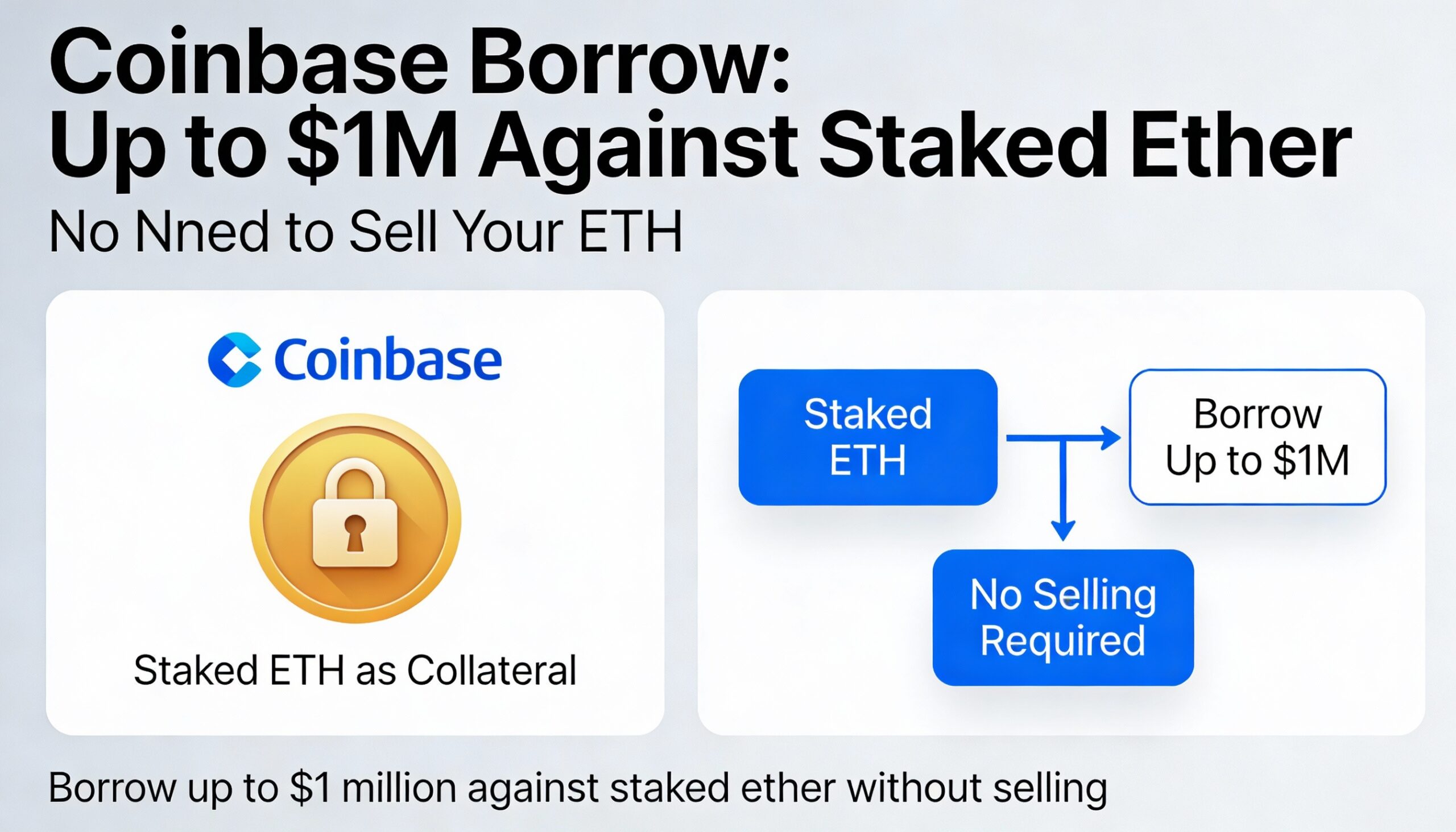

Coinbase has rolled out a new borrowing feature that allows U.S. users to tap up to $1 million in liquidity by pledging cbETH — its tokenized form of staked ether — as collateral, enabling investors to raise cash without selling or unstaking their ETH.

The product, available immediately to eligible U.S. customers excluding New York, lets users borrow USDC against cbETH held on Coinbase and convert the stablecoin into dollars directly on the platform.

The launch reflects rising demand for capital-efficient ways to unlock liquidity from staked assets, as ether staking increasingly shifts from a short-term yield strategy to a longer-term portfolio allocation.

Loans are facilitated through Morpho, an onchain lending protocol that supports overcollateralized borrowing via smart contracts. Interest rates are variable and market-driven, and borrowers can repay at any time with no fixed maturity date.

Collateral management remains the primary risk. According to a previously published Coinbase blog, borrowers must maintain a loan-to-value ratio below 86% to avoid automatic liquidation and associated penalties — a threshold that could be tested during periods of sharp price volatility in ether.

By enabling cbETH to serve as loan collateral, Coinbase is expanding the utility of staked ether beyond passive yield generation. Users can retain exposure to ETH price movements and staking rewards while accessing liquidity for expenses such as portfolio rebalancing, major purchases or one-off cash needs.

The rollout comes as competition intensifies among centralized exchanges and DeFi protocols to offer borrowing products linked to staking derivatives. Tokenized staking assets like cbETH have seen steady adoption, particularly among investors seeking to reduce the opportunity cost of locked capital.

Coinbase said the feature is available now across the U.S., excluding New York, and forms part of a broader effort to make crypto holdings more flexible without forcing users to sell into volatile market conditions.