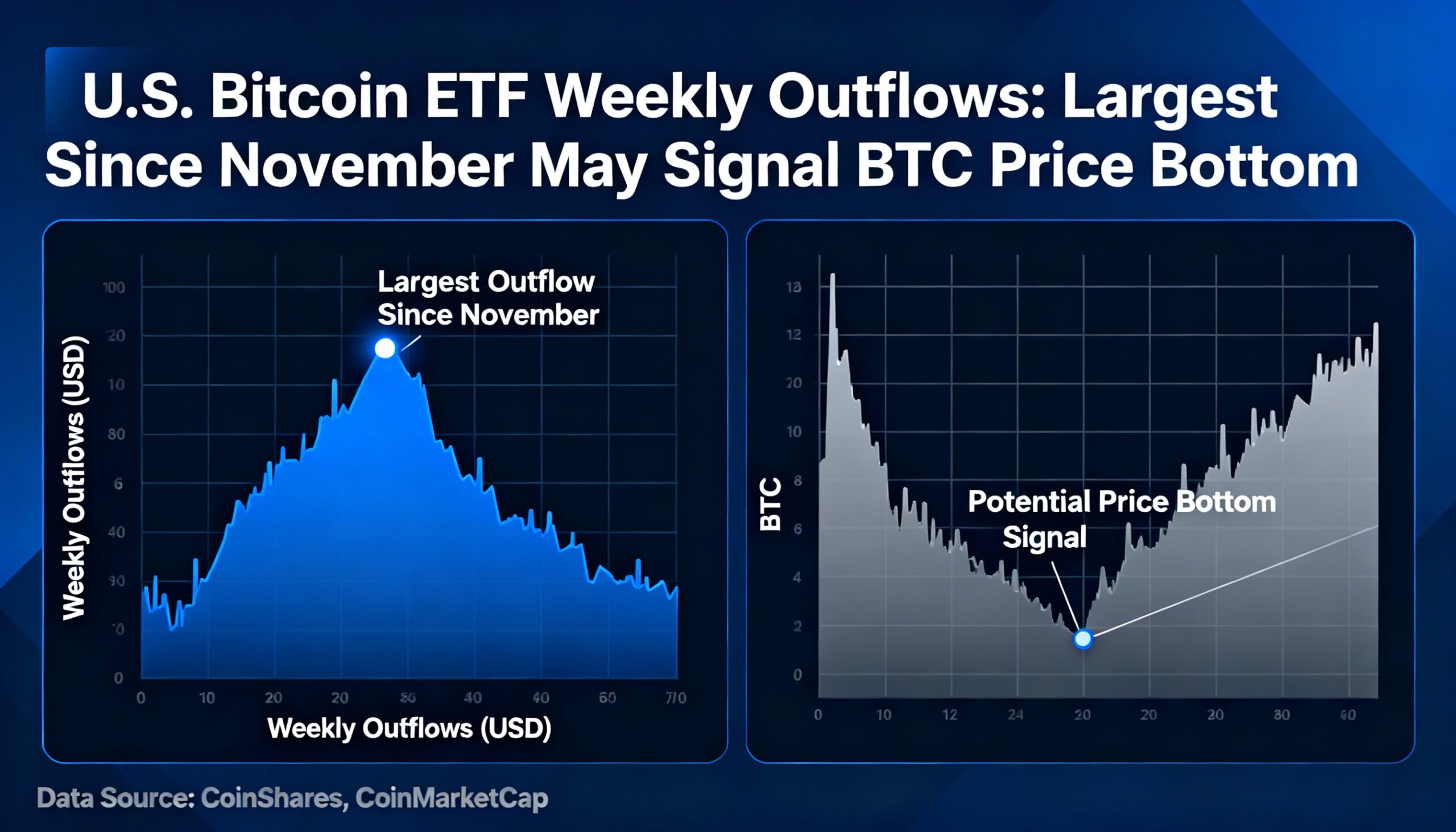

U.S. Bitcoin (BTC $88,748.27) exchange-traded funds (ETFs) recorded their largest weekly outflows since November, a signal that often coincides with local price bottoms for the cryptocurrency.

Over the four days ending Thursday, a net $1.22 billion exited ETFs, with $479.7 million withdrawn on Tuesday and $708.7 million on Wednesday, according to SoSoValue data. Bitcoin fell roughly 5% over the same period and has remained relatively flat since the start of the year.

Historically, heavy ETF outflows have aligned with short-term lows in Bitcoin’s price. In November, a four-day withdrawal totaling $1.22 billion preceded a rebound from around $80,000 to above $90,000. Similar patterns appeared in March 2025, just before tariff-related market turbulence, when Bitcoin fell to $76,000, and in August 2024, when the cryptocurrency bottomed near $49,000 amid the unwinding of the yen carry trade.

Glassnode data shows that the average cost basis for ETF investors currently sits at $84,099, a level that has historically provided support during pullbacks, including November 2025 and April 2025.

The combination of large outflows and historically significant support levels suggests that Bitcoin may be approaching a potential short-term bottom.