Binance Eyes Return to Tokenized Stock Trading After 2021 Exit

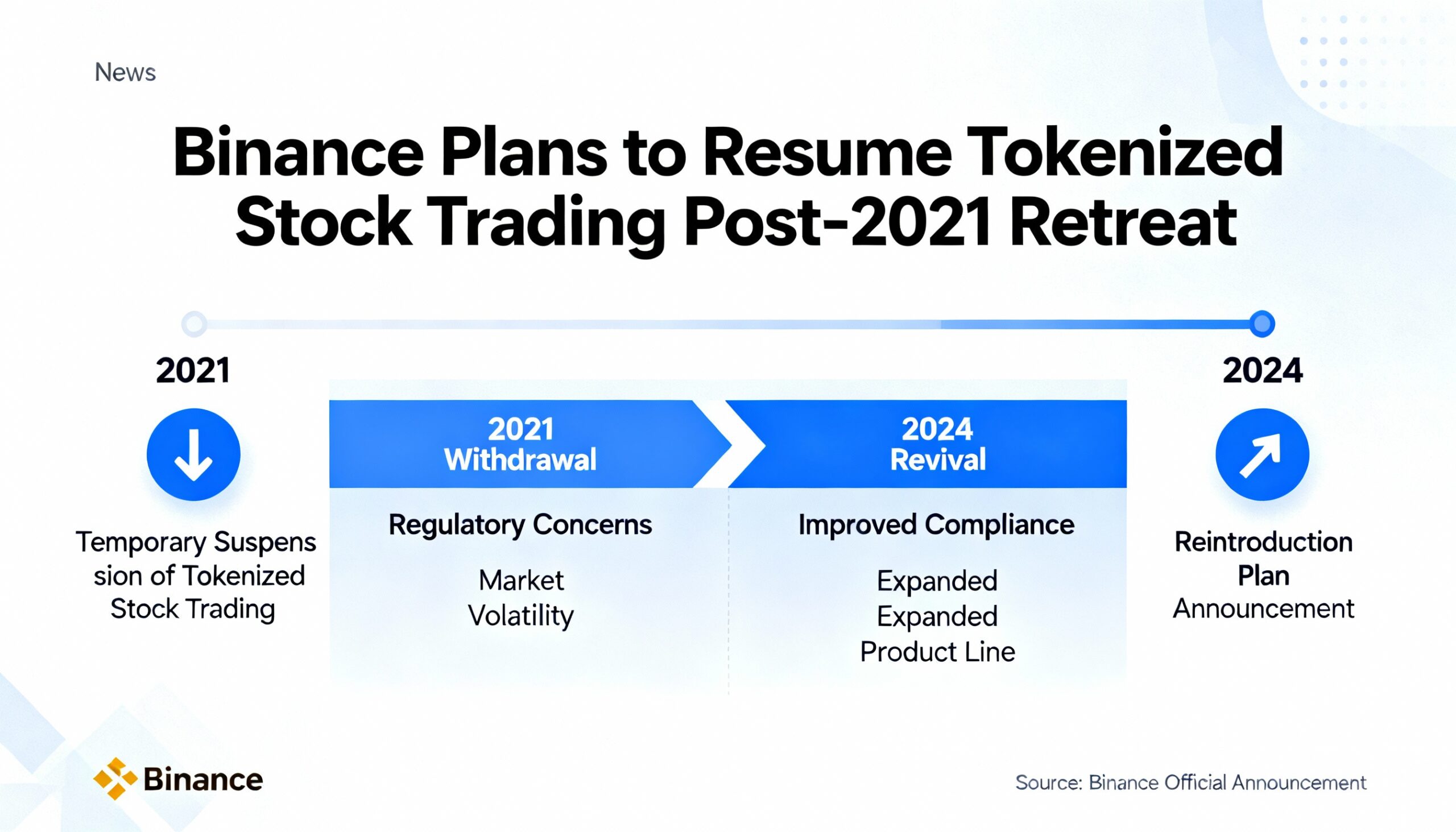

Binance is exploring a comeback for tokenized stock trading, revisiting a product it discontinued in 2021 amid regulatory scrutiny.

Stock tokens let investors buy fractional shares of companies such as Apple or Microsoft, settled on a blockchain and tracking real-time stock prices. The move reflects Binance’s ongoing effort to bridge traditional finance and crypto.

“Binance is committed to expanding user choices while upholding high regulatory standards,” a spokesperson told CoinDesk. “Since last year, we’ve supported tokenized real-world assets and launched the first regulated TradFi perpetual contracts settled in stablecoin. Offering tokenized equities is a natural next step in this mission.”

Early Launch and Regulatory Challenges

Binance first rolled out stock tokens in April 2021, beginning with Tesla and quickly adding Microsoft, Apple, Coinbase, and Strategy. Regulators in the U.K. and Germany questioned whether the tokens violated securities laws, prompting Binance to shut the program by July 2021.

Despite past setbacks, interest in tokenized stocks persists. Exchanges such as OKX are exploring offerings, while the NYSE and Nasdaq seek approval for stock token products. Coinbase is also reportedly planning on-chain stock offerings.

Regulatory hurdles remain significant. Tokenized stocks were highlighted in a pending crypto market structure bill in Congress, which could slow new launches. Coinbase CEO Brian Armstrong has called for revisions to allow the SEC to exempt certain tokenized products from standard securities rules.