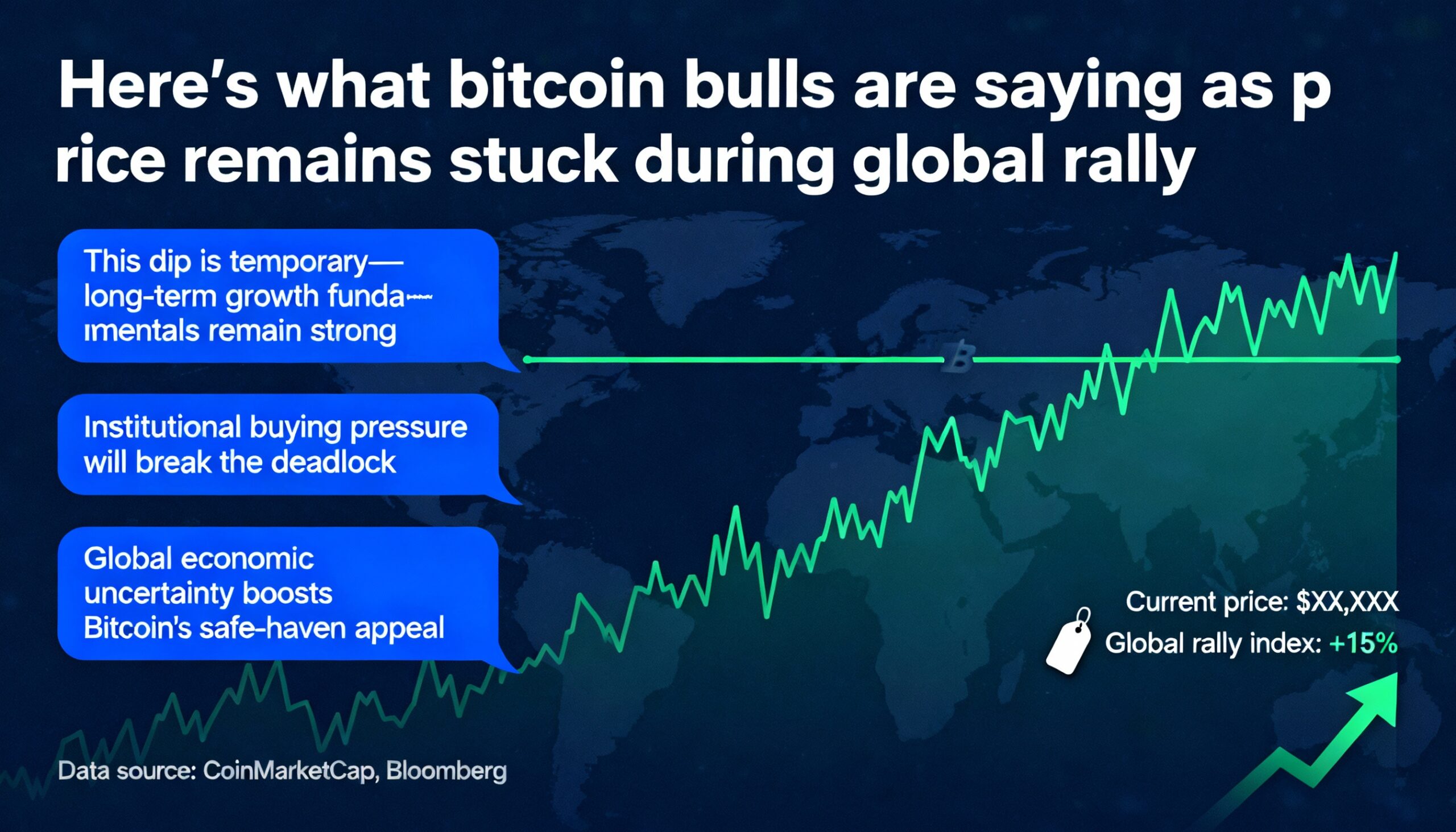

Bitcoin Bulls Defend the Asset as Gold and Equities Outperform

Bitcoin (BTC $87,780.36) is struggling to meet expectations as an inflation hedge or safe-haven asset amid global uncertainty. While gold has surged over 80% during this period of high inflation and geopolitical tension, Bitcoin has fallen 14% year over year.

This contrast raises a key question: why invest in Bitcoin when traditional assets like precious metals and equities are outperforming? Longtime Bitcoin advocates provide several explanations.

Comfort in the Familiar

Jessy Gilger, senior advisor at Gannett Wealth Advisors, sees gold’s rally as a reflection of investor “muscle memory.” “Institutions retreat to what they know during periods of fear,” she said. “Bitcoin has remained technically steady for over 15 years. Eventually, markets will recognize that digital scarcity is more efficient than physical gold, and Bitcoin should catch up.”

Supply and Distribution

Mark Connors, CIO at Risk Dimensions, emphasizes that Bitcoin’s weakness reflects supply flow rather than lack of demand. “Institutional ETF inflows are absorbing a decade’s worth of early-adopter supply,” he explained. “This is a transfer of ownership, not a failure of interest.”

Tech-Like Behavior

Charlie Morris, CIO at ByteTree, notes Bitcoin’s correlation with internet stocks. “Gold serves the real world; Bitcoin serves the digital world. Its recent struggles mirror tech stock behavior, not an inherent failure of the asset.”

Delayed Rotation

Peter Lane, CEO of Jacobi Asset Management, points to longstanding investor trust in precious metals. “Gold and silver remain familiar to mass-market investors. Bitcoin hasn’t earned that trust yet, but a rotation into BTC could happen as confidence grows.”

New Demand Needed

Anthony Pompliano, CEO of ProCap Financial, highlights shifting macro conditions. “With deflation possible, Bitcoin will need new demand drivers. Its long-term prospects remain strong.”

A Long-Term Inflation Solution

David Parkinson, CEO of Musquet, frames Bitcoin as more than a hedge. “Bitcoin’s fixed supply and network growth make it the Internet’s native monetary asset—a permanent solution to inflation, outlasting gold and other traditional hedges.”

Relative Value Opportunity

Andre Dragosch of Bitwise notes that precious metals benefit from familiarity during uncertain times, but Bitcoin remains undervalued relative to gold and global money supply, suggesting potential upside as capital rotates into more attractively priced assets.

Despite its short-term struggles, bulls argue that Bitcoin’s fundamentals, supply dynamics, and long-term positioning indicate eventual recovery and growth.