The Fed is expected to keep rates unchanged this week, but Chair Jerome Powell’s guidance could still set the tone for bitcoin, the dollar, and broader risk assets.

The Federal Reserve will announce its latest policy decision on Wednesday, and markets are overwhelmingly confident that interest rates will remain unchanged. The real focus, however, will be Chair Jerome Powell’s post-meeting press conference, where his comments could prove more consequential than the decision itself.

Investors will be listening closely for Powell’s assessment of the economic outlook, the likely path of monetary policy, and his views on politically sensitive issues such as President Donald Trump’s affordability agenda and renewed scrutiny of the Fed’s independence. Together, those signals could move both traditional markets and crypto.

Rates likely on hold

After delivering three consecutive quarter-point cuts, the Fed is widely expected to pause. CME FedWatch data showed a 96% probability that policymakers would keep the federal funds rate in the 3.5%–3.75% range.

That expectation is consistent with Powell’s December remarks that the Federal Open Market Committee (FOMC) plans to hold off on further cuts until at least 2026. Minneapolis Fed President Neel Kashkari, a voting member this year, recently echoed that view, saying it is “way too soon” to consider additional easing.

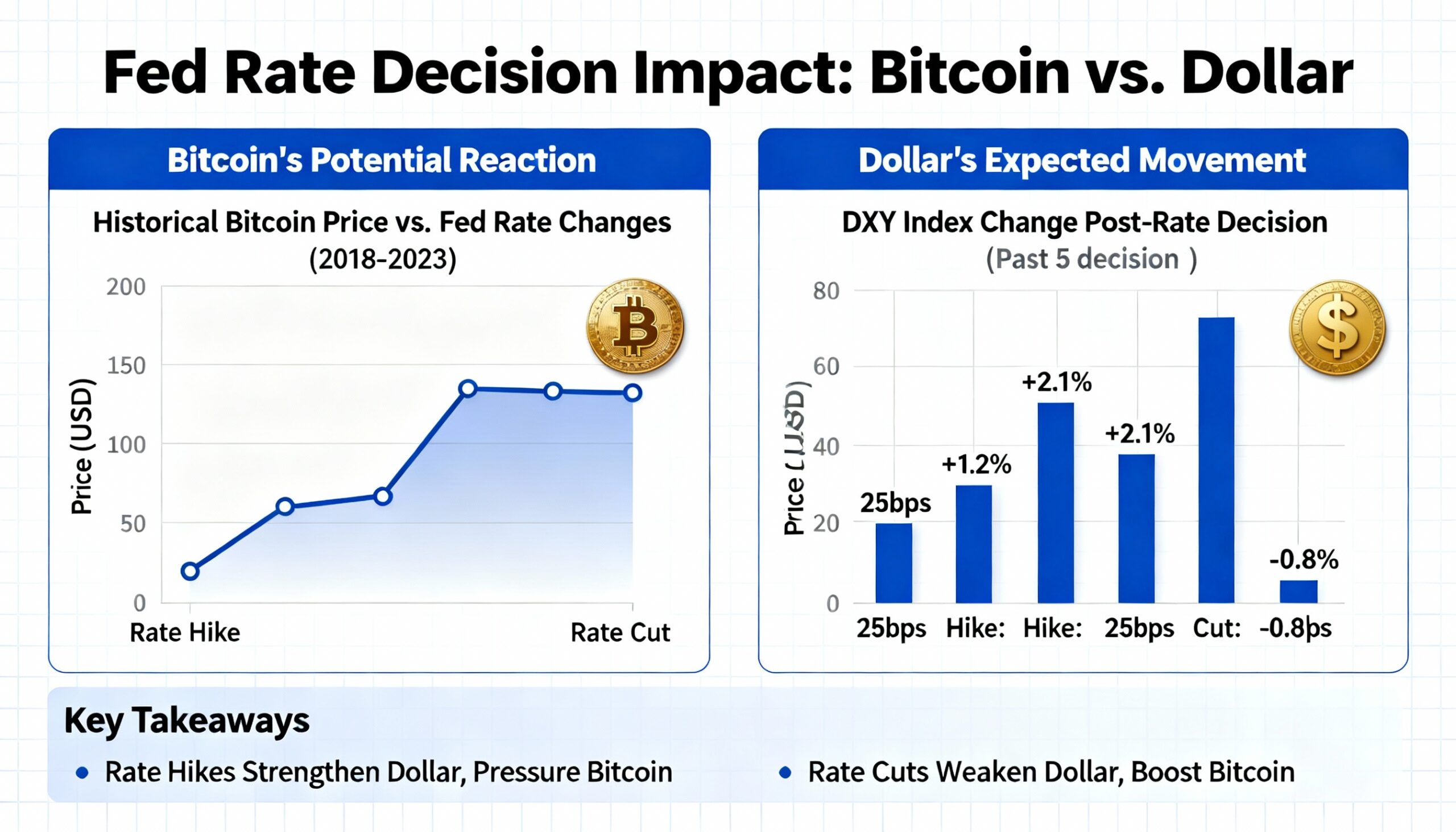

Unless the Fed delivers an unexpected cut—which would likely weaken the dollar and lift bitcoin and equities—the policy decision itself is expected to generate little immediate reaction.

Hawkish or dovish pause?

The bigger question for markets is how Powell frames the pause.

A hawkish tone, emphasizing lingering inflation risks, could push rate-cut expectations further out and weigh on risk assets. A dovish tone, signaling that the pause is temporary and cuts could resume later this year, would likely support stocks and bitcoin.

Morgan Stanley expects the Fed to lean toward a dovish pause by retaining language that it is “considering the range and timing for further adjustments” to rates, preserving flexibility while acknowledging the economy’s resilience.

Investors will also be watching for dissent among policymakers. Fed Governor Stephen Miran, a Trump appointee, is expected to dissent in favor of a larger 50-basis-point cut. Additional dissenters would strengthen the case for future easing and could bolster risk assets.

Most major banks currently forecast one or two rate cuts later this year. JPMorgan remains an outlier, projecting no cuts in 2025 and a rate hike in 2026.

Dollar implications and political pressures

Powell is also likely to face questions about the justification for holding rates steady and the potential inflationary impact of Trump’s affordability initiatives.

Analysts at ING argue that Powell may struggle to portray financial conditions as restrictive, given the strength of U.S. asset markets and recent economic data. Such messaging could support the dollar and weigh on dollar-denominated assets, including bitcoin.

ING added that a meaningful downturn in the dollar is more likely to be driven by weaker economic data than by dovish Fed commentary.

Trump’s housing policies may also come under scrutiny. The president has said he directed representatives to purchase $200 billion in mortgage-backed securities to lower borrowing costs and issued an executive order limiting large institutional investors from buying single-family homes.

Some economists warn these measures could pull demand forward and push housing inflation higher. Allianz Investment Management noted that large-scale MBS purchases risk inflating prices, while restrictions on institutional buyers may have only a limited impact due to their relatively small share of the housing market.

Trump’s tariffs are largely viewed as priced in, though their inflationary effects are expected to emerge gradually as higher import costs feed through to consumers.

Other issues in focus

Beyond monetary policy, Powell may be asked about a Justice Department investigation targeting him personally—an inquiry he has described as politically motivated—as well as recent volatility in global bond markets linked to Japan’s fiscal challenges. He is expected to avoid detailed comment on the investigation and to downplay broader bond-market risks.

With rates widely expected to stay put, markets will be parsing Powell’s tone for clues about how long the pause will last—and whether the next move in policy ultimately favors the dollar or risk assets like bitcoin.