Bitcoin Eyes Rare Fourth Straight Monthly Loss as January Options Expiry Looms

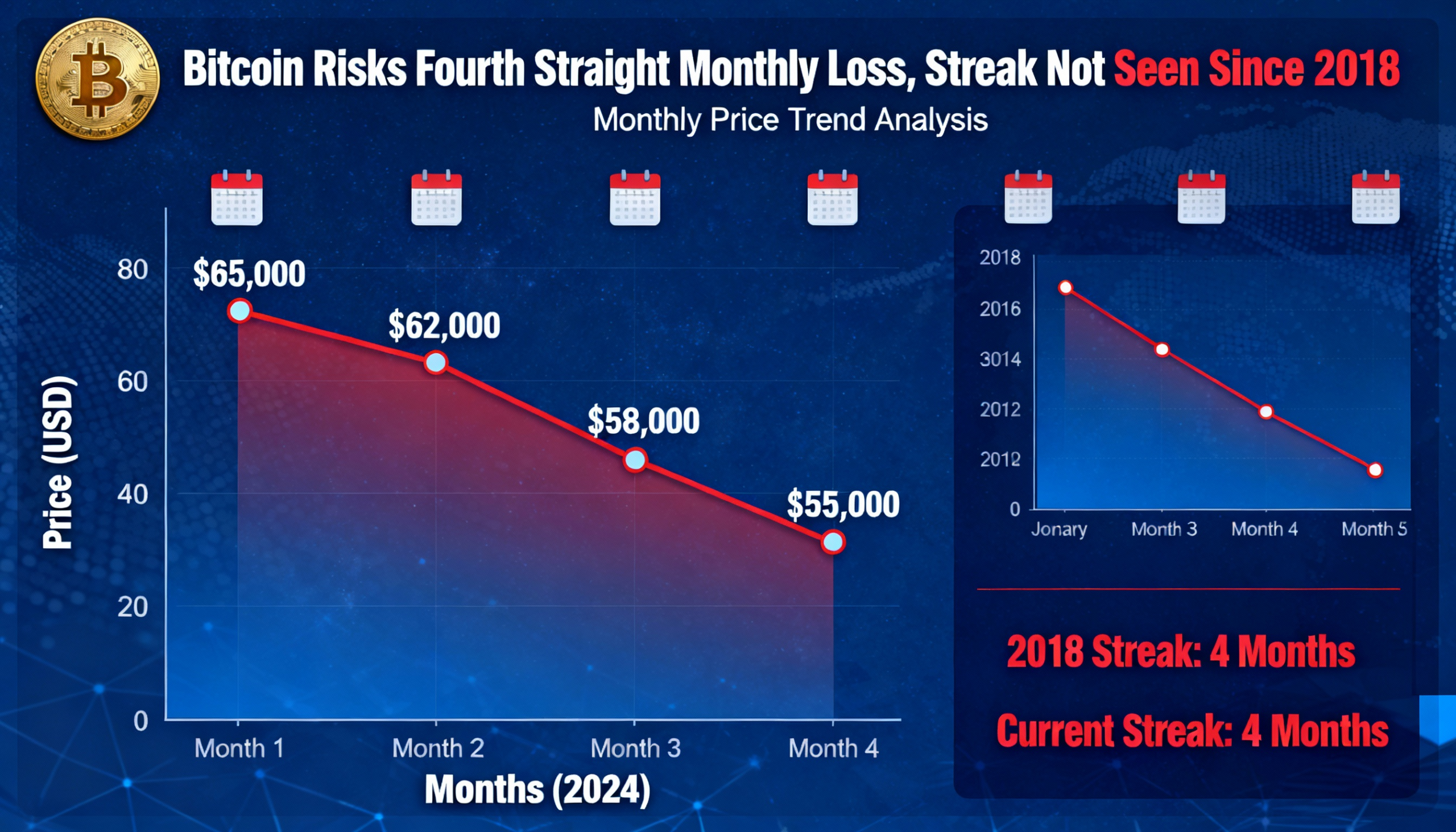

Bitcoin is on track for a fourth consecutive monthly decline, a rare streak not seen since 2018–2019, when the market recorded six straight months of losses. With one full trading week left in January, the cryptocurrency is slightly down for the month, trading near $87,000.

The digital asset closed October, November, and December in negative territory, reflecting a sharp pullback from its October all-time high. From peak to trough, bitcoin has fallen roughly 36% over this period.

Even during the 2022 bear market—when bitcoin plunged from $69,000 to $15,000 amid quantitative tightening and crypto-specific industry failures—the market never posted more than three consecutive losing months. This historical context underscores how unusual the current streak would be if January ends lower.

Despite the weakness in spot prices, derivatives markets hint at cautious optimism. Data from Deribit shows options positioning pointing to modest upside interest into month-end.

Bitcoin faces a significant options expiry on Jan. 30, with total open interest nearing $8.5 billion on Deribit. The $100,000 call option carries the highest notional value, close to $900 million, signaling that a meaningful cohort of traders are betting on a rebound to six-figure levels. Meanwhile, the max pain price—a level where the largest number of options contracts expire worthless—is near $90,000, a potential gravitational pull as the expiry approaches.