Bitcoin Hashrate Dips During U.S. Winter Storm, Highlighting Mining Concentration Risks

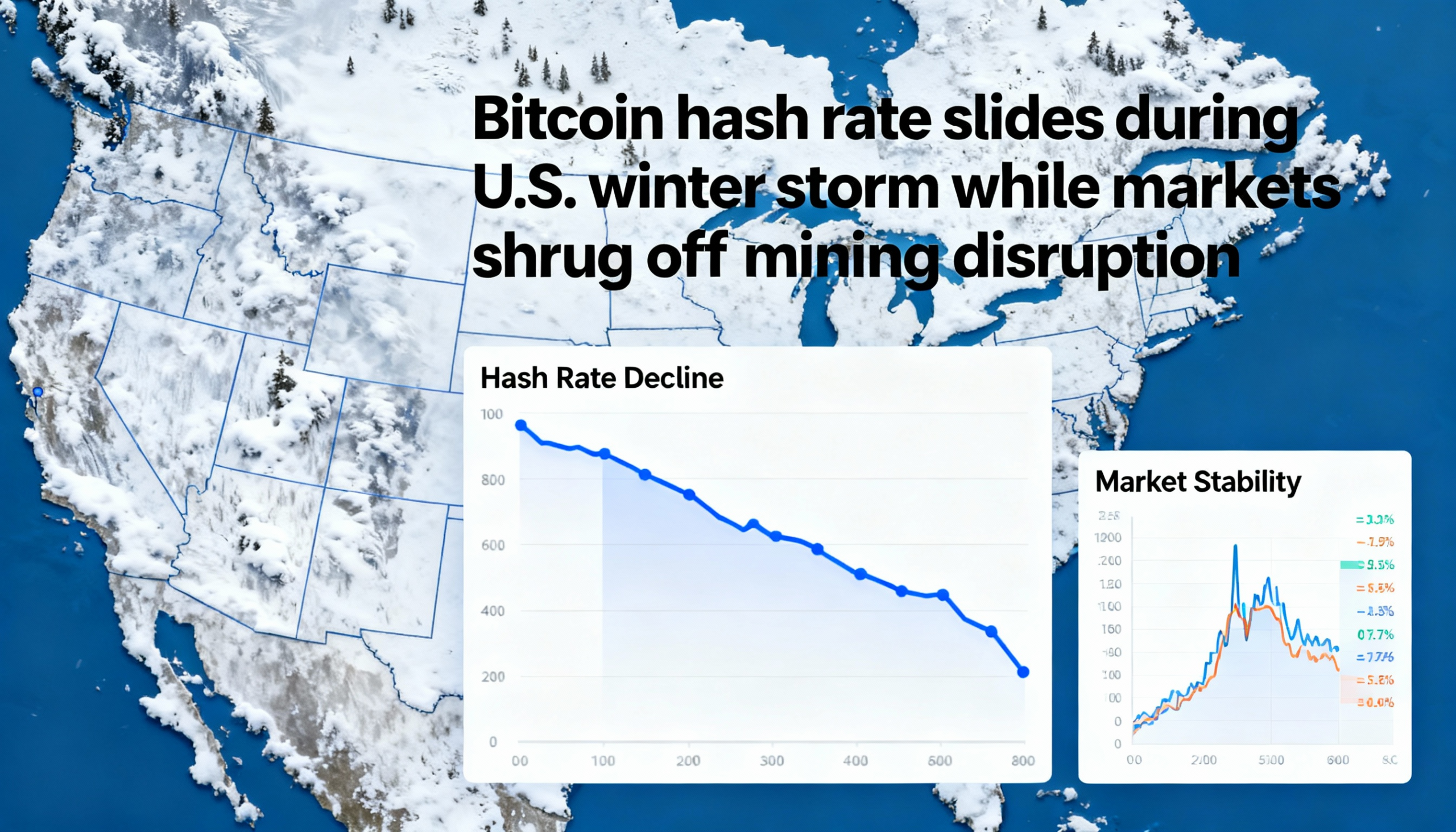

A sharp, temporary drop in Bitcoin’s hashrate during this week’s U.S. winter storm underscores long-standing academic concerns about mining centralization, even as markets showed little immediate reaction. On Sunday, the network’s hashrate fell roughly 10%, offering a real-world stress test of a risk researchers have flagged for years: concentrated mining can turn local infrastructure failures into system-level disruptions.

Hashrate measures the computing power available to process transactions on the Bitcoin blockchain. Sudden declines reduce the network’s capacity, potentially slowing transaction processing until difficulty adjusts. While only a fraction of the network—about 10%—went offline during the storm, the episode illustrates the blockchain’s growing vulnerability to concentrated infrastructure.

Research highlights these risks. In their 2021 working paper Bitcoin Blackout: Proof-of-Work and the Risks of Mining Centralization, Philipp Scharnowski and Jiahua Shi showed that a regional mining outage in China led to longer block times, higher transaction fees, and lower market quality, demonstrating how concentrated mining can amplify localized failures.

Rising concentration makes such events more consequential. According to the Mining Centralization Index, a few dominant pools now control the majority of block production: over the past two years, the top two pools have often accounted for more than 50% of hashrate, while the top six cover roughly 80–90% of all blocks. This clustering leaves much of Bitcoin’s transaction processing dependent on a handful of operators.

Despite the hashrate drop, markets remained largely unfazed, with BTC showing little movement on the day. Still, the storm highlights how the growing concentration of Bitcoin mining could transform local disruptions into network-wide stress—even without immediate impact on price.