Bitcoin and ether held steady in thin trading on Tuesday as a surge in gold and silver reinforced a broader risk-off shift that is also spilling over into select crypto tokens.

Crypto markets remained stuck in a narrow range, weighed down by weak volumes and limited liquidity. Bitcoin’s 24-hour trading volume dropped 25% to $35 billion, while ether volume slid 21% to $24.6 billion.

The lack of price movement reflects falling volatility and growing investor disengagement across digital assets, even as precious metals post eye-catching gains. Gold was last trading near $5,085 after setting multiple record highs over the past week, while silver has climbed more than 57% since the start of the year as investors rotate toward safe havens.

The move into metals is especially evident on derivatives platform HyperLiquid, where daily silver futures volume is closing in on $1 billion — second only to bitcoin and ether. Funding rates, however, remain skewed to the downside, suggesting traders are increasingly shorting the rally rather than chasing higher prices.

Macro uncertainty continues to underpin the cautious tone. U.S. President Donald Trump announced fresh 25% tariffs on South Korea on Monday, following a diplomatic clash with the European Union over Greenland last week, reinforcing risk-off sentiment.

Derivatives

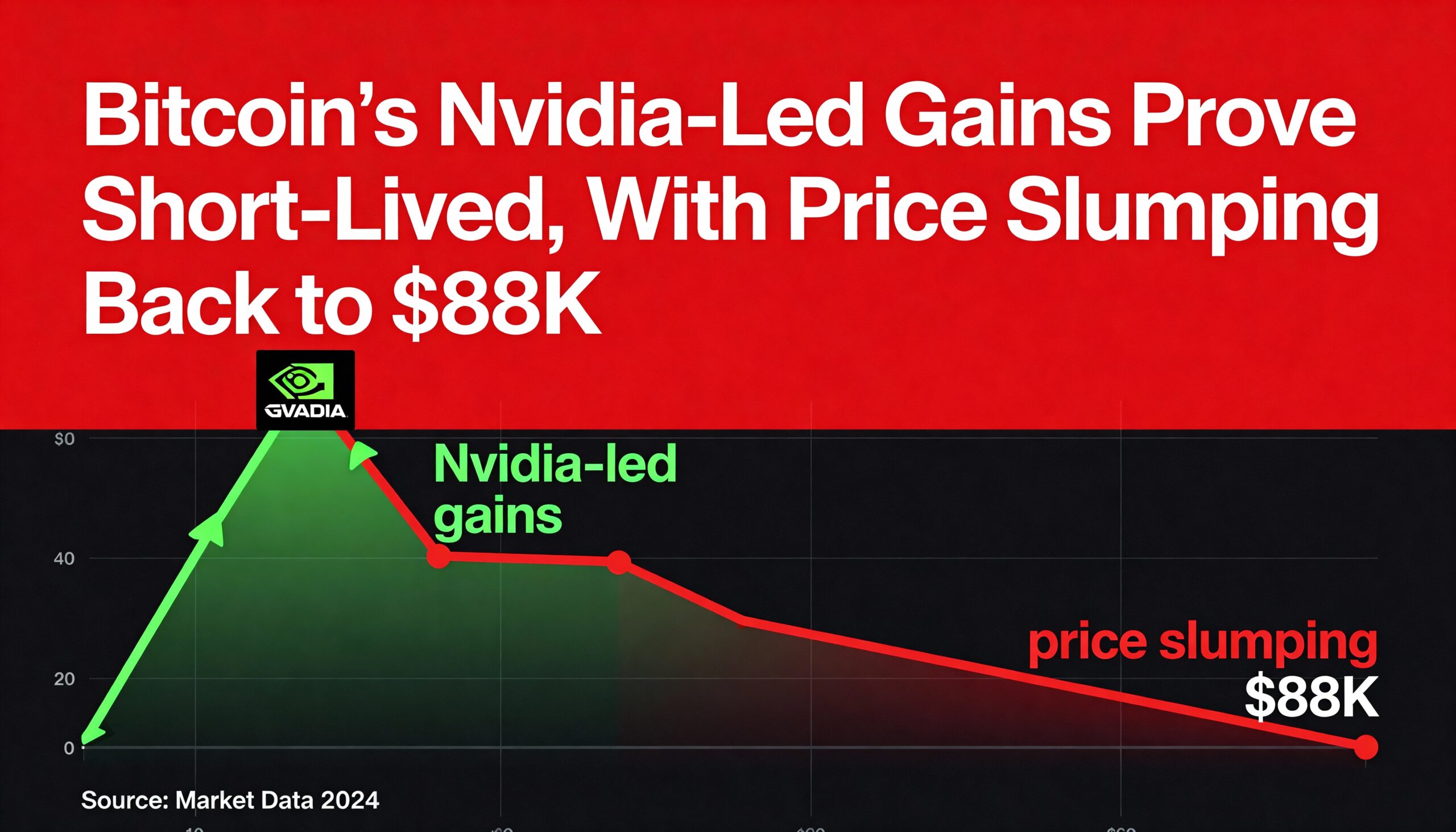

More than $270 million in leveraged crypto futures positions were liquidated in the past 24 hours, with shorts accounting for the majority. Traders had positioned for a deeper selloff after bitcoin’s 7% decline last week, only to be caught out by a rebound from around $86,000 to nearly $88,000.

Volmex’s 30-day implied volatility indices for bitcoin and ether remain near multi-month lows, pointing to limited fear despite bearish signals from flows and technical indicators.

Open interest in futures linked to HyperLiquid’s HYPE token jumped 30% to over 57 million HYPE, approaching December’s record high of 57.44 million. The decentralized exchange is said to have clawed back market share from competitors Aster and Lighter.

Futures open interest in ether, solana, XRP and dogecoin rose between 2% and 3%, while bitcoin open interest was little changed. Annualized perpetual funding rates across major tokens remain modestly positive, indicating a mild bullish bias, though TRX and DOGE funding has flipped negative, reflecting increased short interest.

On Deribit, BTC and ETH put options continue to command premiums over calls, signaling lingering downside concerns. Market participants note that downside hedging has become crowded, making calls comparatively inexpensive for traders betting on upside. Bearish structures — including put spreads, straddles and strangles — made up nearly half of all BTC block trades over the past 24 hours, while ETH traders favored iron condors, consistent with expectations for range-bound price action.

Token Talk

Heavy turnover in silver futures has helped propel HyperLiquid’s HYPE token up more than 22% in the past 24 hours, with trading volume more than doubling to $510 million.

Privacy-focused tokens zcash (ZEC) and monero (XMR) gained 4% and 3%, respectively, since midnight UTC, outperforming bitcoin and major altcoins such as ether, XRP and solana, which slipped between 0.4% and 1%.

Pump.fun’s native PUMP token jumped 14.5% over the same period as traders continued to seek opportunities in the memecoin sector despite subdued broader markets. January trading volume on Pump.fun has already topped $10 billion — the platform’s strongest showing since June — with four days left in the month, according to DefiLlama.

The bitcoin-heavy CoinDesk 20 Index (CD20) is little changed so far this year, while the altcoin-focused CoinDesk 80 Index (CD80) has advanced 3.6%.

If you want this skewed more bearish, more macro-led, or trimmed for a morning markets column, I can spin another version quickly.