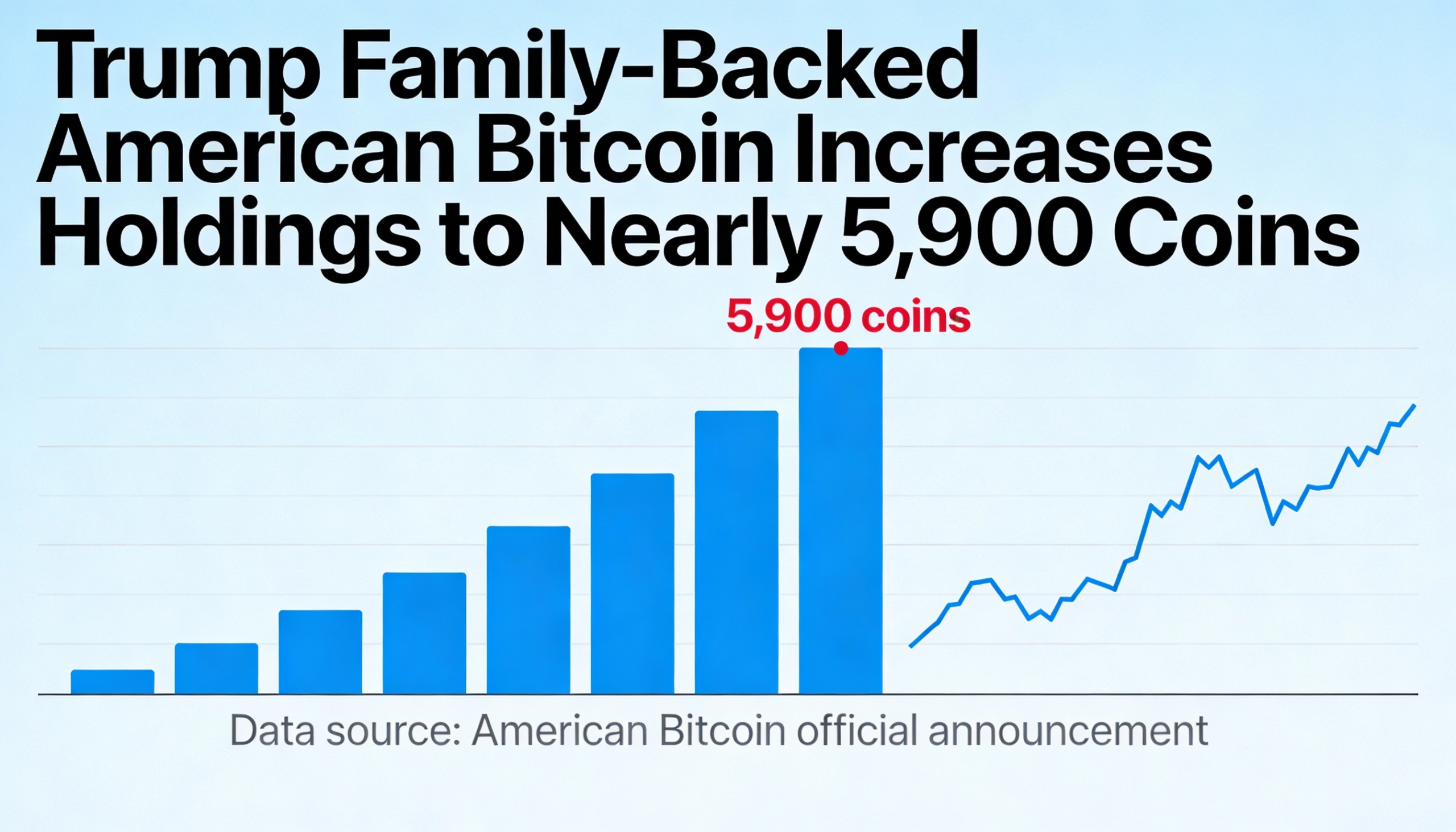

Trump family-backed American Bitcoin has boosted its bitcoin holdings to approximately 5,843 BTC, cementing its position among the world’s largest corporate holders of the cryptocurrency.

The miner reported a bitcoin yield of roughly 116% from its Nasdaq debut on September 3, 2025, through January 25, 2026, reflecting active accumulation during a volatile period for the broader crypto market. Bitcoin yield measures how much a company’s bitcoin reserves have grown over time, including coins mined or purchased, with higher yields often signaling efficient balance-sheet expansion without the need for additional capital.

The latest figures place American Bitcoin as the 18th-largest corporate bitcoin holder, ahead of companies such as Nakamoto Inc. and GameStop Corp. Shares rose about 2% in premarket trading Tuesday, according to Yahoo Finance, though the stock remains down roughly 11% year-to-date amid shifting macro conditions, geopolitical uncertainty, and recent weakness in bitcoin prices.

The reserve growth follows a strong operational period for the company since going public. American Bitcoin is roughly 20% owned by Donald Trump Jr. and Eric Trump and became a standalone public entity after merging with Gryphon Digital Mining and spinning out from Hut 8’s mining operations, with Hut 8 retaining about an 80% stake.

In its Q3 2025 earnings report, American Bitcoin returned to profitability and recorded a sharp revenue increase, driven by expanded mining capacity and earlier bitcoin price gains. At that time, the company held just over 4,000 BTC, meaning reserves have grown by more than 1,800 coins in recent months.

The accumulation reflects a broader trend among publicly listed miners to treat bitcoin as a long-term balance-sheet asset rather than a near-term liquidity source. This strategy has gained traction even as bitcoin trades below recent highs and markets show increased demand for precious metals and bonds.

For investors, American Bitcoin’s expanding reserves highlight how some mining firms are adapting balance-sheet strategies in a post-ETF, institutionally dominated bitcoin market.