China’s ability to withstand U.S. tariffs is reshaping global liquidity dynamics, with consequences now spilling into bitcoin markets.

China’s response to President Donald Trump’s hardline trade strategy is proving more consequential than headline tariff rates suggest. By tightly managing its currency rather than engaging in overt retaliation, Beijing is influencing global cash flows in ways that extend well beyond traditional markets—and into crypto.

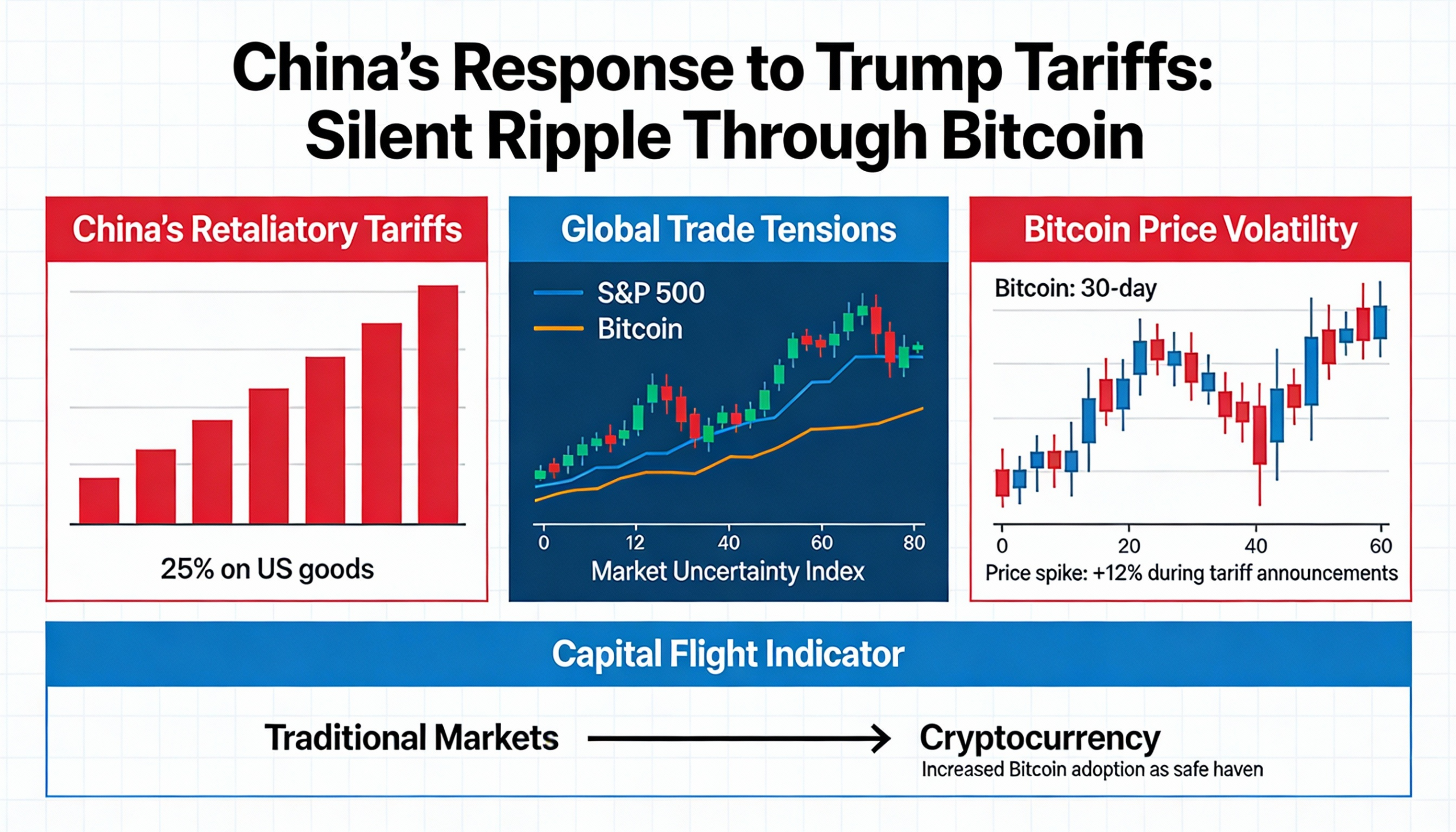

Since returning to the White House early last year, Trump has imposed broad-based import tariffs on nearly all goods entering the United States, including products from China, the world’s second-largest economy and a central node in global manufacturing. As of January 2026, average U.S. tariffs on Chinese imports hover near 29.3%.

Beijing’s counterstrategy has centered on currency discipline. Instead of allowing the yuan to weaken sharply or appreciate freely, policymakers have kept the exchange rate tightly controlled, helping shield exporters from tariff pressure while limiting deflationary risks at home.

A recent analysis from JPMorgan argues that this approach has preserved China’s export competitiveness even as trade tensions intensify. At the same time, it has amplified dollar-centric liquidity cycles, particularly during periods of trade-related stress.

When tariffs rise and uncertainty builds, managed FX dynamics tend to reinforce dollar strength and drain global liquidity—exacerbating risk-off conditions rather than offsetting them. That feedback loop has implications for assets sensitive to macro liquidity, including bitcoin.

Bitcoin has increasingly traded as a proxy for global liquidity conditions. It typically weakens when tariff-driven uncertainty tightens dollar funding and rebounds when those pressures ease. That pattern played out clearly in March and April of last year, when escalating trade tensions coincided with a sharp bitcoin selloff, followed by a recovery as conditions stabilized.

China’s impact on crypto markets appears to be indirect, flowing through currency management and global liquidity transmission rather than direct capital movements. This contrasts with the U.S., where bitcoin demand is increasingly shaped by exchange-traded funds and other institutional investment channels.

This view echoes arguments made by Arthur Hayes, who has described U.S.–China trade disputes as largely theatrical at the political level. In his framework, the real economic adjustment happens behind the scenes, through foreign-exchange policy, capital controls, and liquidity management.

Tariffs and negotiations may dominate headlines, but it is the quieter interaction between FX regimes and dollar liquidity that ultimately drives market outcomes—a view JPMorgan’s outlook broadly supports.

While China is unlikely to permit sustained yuan appreciation, the combination of tariffs, managed exchange rates, and dollar liquidity continues to define the macro backdrop against which bitcoin trades.

China’s export engine holds firm

JPMorgan Private Bank’s latest Asia outlook highlights the durability of China’s export sector. Real exports are projected to expand by roughly 8% in 2025, lifting China’s share of global trade to about 15%, despite an increasingly restrictive U.S. tariff environment. Exports to the U.S. now account for less than 10% of China’s total shipments.

This resilience reflects a strategic reorientation toward ASEAN and other emerging markets, alongside a deliberate decision to keep the yuan tightly managed rather than allow broad-based appreciation.

Although the yuan has risen about 4% from its 2023 lows, it remains only marginally stronger against the dollar on a year-to-date basis in 2025. That stability underscores how range-bound the currency remains under China’s low-volatility FX framework.

JPMorgan notes that recent yuan strength is likely seasonal, with policymakers expected to maintain a stable trading band over the medium term as they balance export competitiveness against persistent deflationary pressures.

The bank also emphasized that the hurdle for meaningful yuan appreciation remains high, with exchange-rate movements still largely dictated by shifts in the dollar.

For crypto markets, that reality shifts attention away from the yuan itself and toward the broader liquidity channels through which trade policy ultimately exerts its influence.