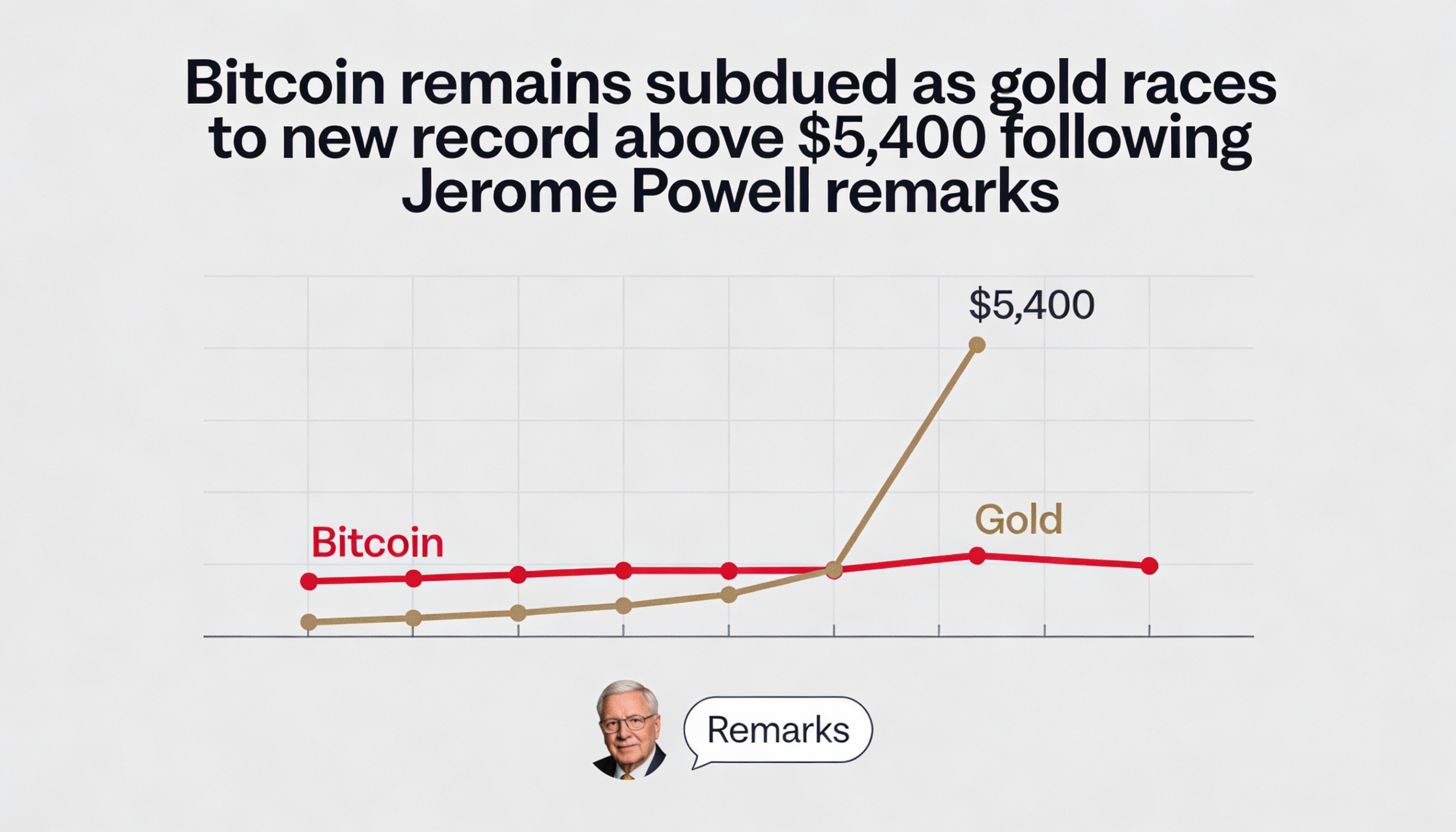

Gold surged to new heights on Wednesday as investors piled into the precious metal, following remarks from Federal Reserve Chair Jerome Powell. The yellow metal jumped 6% to over $5,400 per ounce, marking a fresh milestone in its ongoing bull market.

Silver and platinum posted even larger percentage gains, but gold—whose market capitalization is estimated around $40 trillion—remained the standout asset.

Much of gold’s upward momentum came after Powell addressed the rapid rally during a press conference, following the Fed’s widely anticipated decision to keep the benchmark federal funds rate steady at 3.50%–3.75%. When asked about gold and silver’s price surge, Powell urged caution against reading too much into the rally as a macroeconomic signal. “Don’t take too much message into [that] macroeconomically,” he said, adding that while some may question the Fed’s credibility, “it is simply not the case.”

“Looking at inflation expectations, our credibility is right where it needs to be,” Powell added. Gold bulls, however, appeared unconcerned.

Bitcoin lags

Meanwhile, bitcoin (BTC $82,740.49) remained largely on the sidelines. The cryptocurrency traded in a narrow range throughout the day, dipping slightly after the Fed decision and hovering around $89,000, essentially flat over the past 24 hours. Other major cryptocurrencies showed similar subdued movement.

U.S. equities were also mostly unchanged as investors awaited earnings reports from major tech firms including Microsoft, Meta, and Tesla.

Digital gold under pressure?

The divergence between gold and bitcoin raises questions about BTC’s status as “digital gold.” Despite macro factors that typically support bitcoin—such as a weaker U.S. dollar and heightened geopolitical risks—BTC has struggled, while gold has climbed more than 90% over the past year.

“The market is clearly in a regime where crypto is underperforming some of the very assets it was designed to supplant,” said James Harris, CEO of crypto yield platform Tesseract Group. “Part of gold’s outperformance reflects a repricing of geopolitical and fiscal risk, but it also represents gold reclaiming relative market share from bitcoin.”