Rising oil prices are adding fresh inflation risks at a time when markets are hoping for rapid interest-rate cuts from the Federal Reserve — a backdrop that could prove hostile for bitcoin.

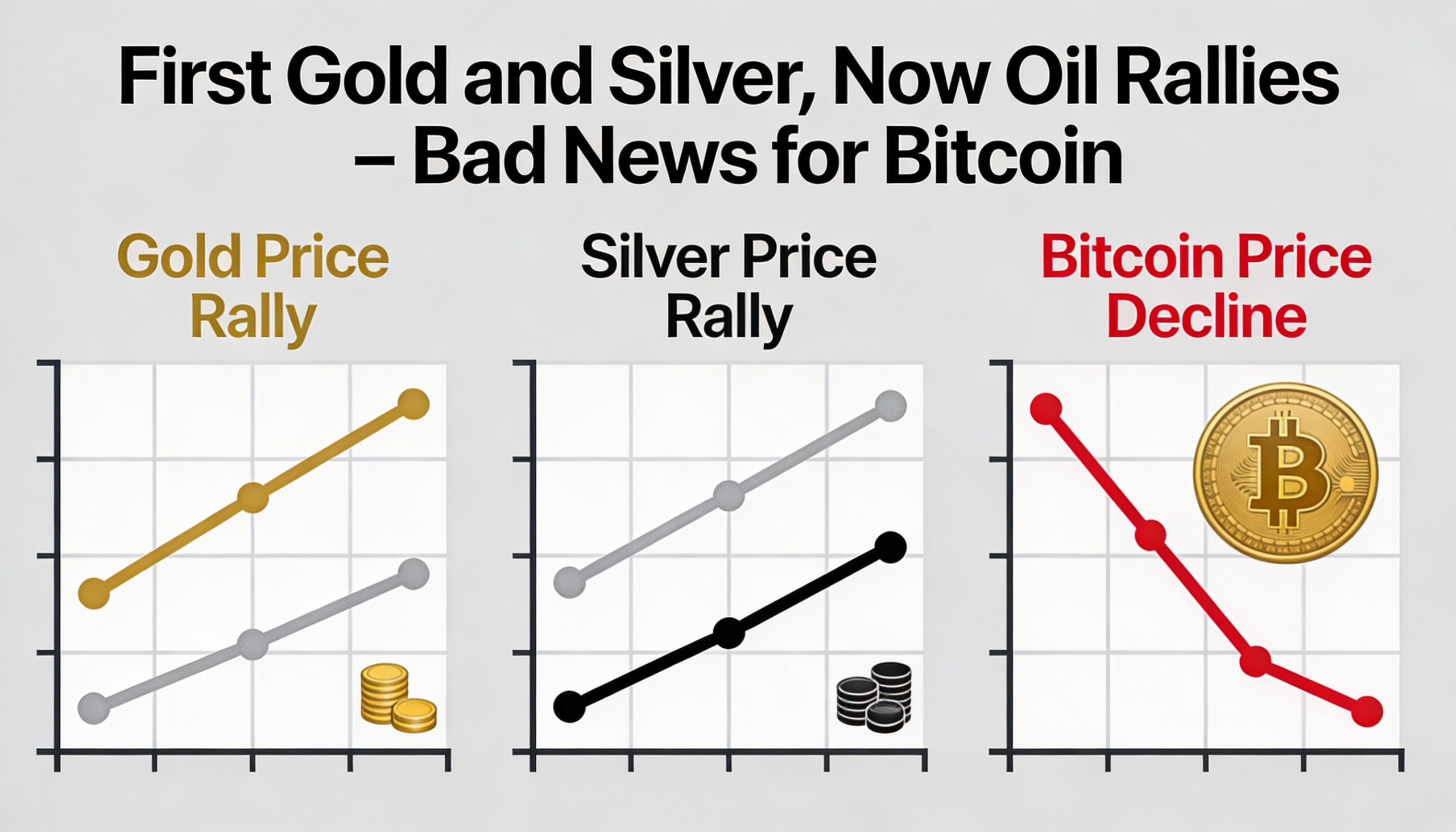

For bitcoin bulls, the macro narrative has gone from bad to worse. First, gold and silver surged to record highs, drawing capital away from risk assets and crypto markets. Now oil is joining the rally, threatening to tilt broader macroeconomic forces further in favor of bitcoin bears.

West Texas Intermediate (WTI) crude — the benchmark for North American oil prices — has climbed roughly 12% this month to $64.30 per barrel, its highest level since September. Global benchmark Brent crude has followed a similar trajectory, rising to around $68.22.

The move complicates the outlook for investors betting on stable inflation and lower interest rates to reignite bitcoin’s rally. After peaking above $126,000 in early October, bitcoin has since retreated to below $90,000, struggling amid tightening financial conditions.

Oil’s inflation problem

Oil prices play a central role in shaping inflation across the economy. When crude rises, gasoline and transportation costs increase, pushing up prices for goods ranging from food and clothing to electronics. Those higher costs are typically passed on to consumers, lifting the overall price level.

As inflation accelerates, workers often demand higher wages to maintain purchasing power, creating a feedback loop in which rising salaries lead businesses to raise prices further.

“We find that oil price pass-through to inflation is both economically and statistically significant, and that it occurs both directly and through second-round effects,” the Federal Reserve noted in an explainer. “Higher energy prices can also raise consumer and business expectations for future inflation, indirectly raising food and core prices now.”

Central banks generally respond to persistent inflation by keeping borrowing costs elevated. That dynamic weighed heavily on bitcoin in 2022, when aggressive Fed tightening helped drive the cryptocurrency down roughly 64% for the year.

The latest upswing in oil comes as the Fed is already grappling with renewed inflation pressures. On Wednesday, policymakers held rates steady in a 4.5% to 4.75% range, noting that inflation remains “somewhat elevated,” in part due to tariffs imposed by President Donald Trump on imported goods.

ING said the Fed’s statement and press conference signaled “more confidence that the policy easing cycle is close to a conclusion.”

In practical terms, that suggests little urgency to cut rates — a stance that rising oil prices could reinforce by keeping inflation risks alive.

What’s driving oil higher?

Geopolitical tensions and tightening supply are fueling the rally.

Markets are reacting to fears of escalating conflict involving Iran, a major oil producer, alongside shrinking U.S. inventories. In a Truth Social post on Wednesday, Trump warned that a large U.S. naval force was moving toward Iran, while referencing recent military action involving Venezuela. He urged Iran to strike a nuclear deal or face a “far worse” U.S. response.

Iran responded by vowing to retaliate “like never before,” underscoring the potential human and economic fallout of a broader conflict.

At the same time, data from the U.S. Energy Information Administration showed that domestic crude inventories fell by 2.3 million barrels in the week ending Jan. 24. Declining inventories typically indicate demand is outpacing supply, forcing refiners to draw down stockpiles.

Together, geopolitical risk and tightening supply conditions are pushing oil higher — and adding yet another macro headwind for bitcoin.