Gold and other hard assets are rallying amid dollar weakness, but bitcoin has lagged, as markets continue to treat it more like a liquidity-sensitive risk asset than a traditional hedge.

Despite the greenback’s recent slide, bitcoin has failed to respond with its usual gains. J.P. Morgan Private Bank sees this behavior as a reflection of the nature of the U.S. dollar’s decline rather than a sign of weakness in crypto.

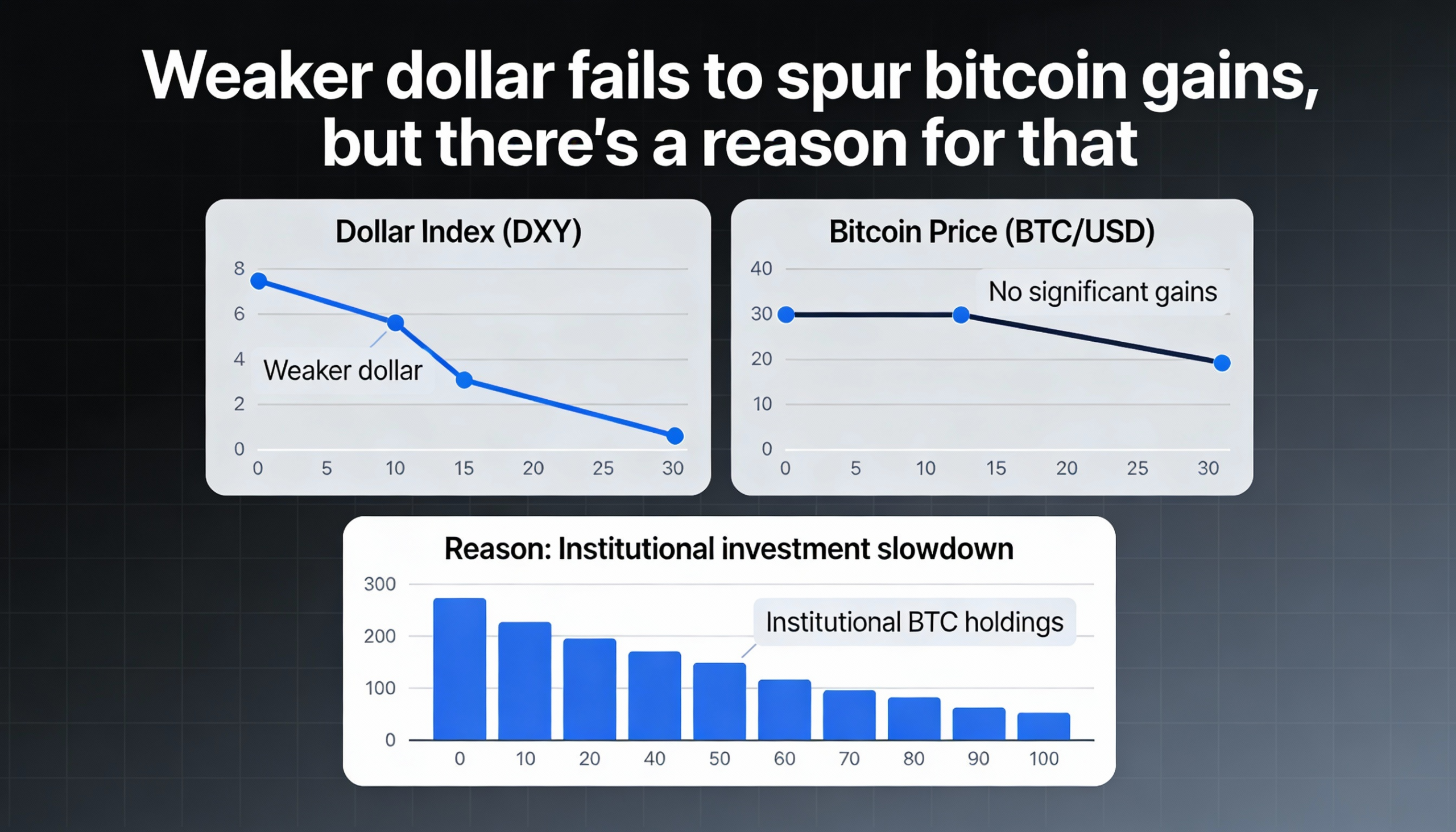

The Dollar Index (DXY), which tracks the dollar against a basket of major currencies, has fallen roughly 10% over the past year. Historically, periods of dollar weakness have supported bitcoin, yet BTC has lost 13% during the same timeframe, while the broader CoinDesk 20 index (CD20) dropped 28%, according to CoinDesk data.

The key difference this time, J.P. Morgan strategists say, is that the dollar’s slide is driven by short-term flows and market sentiment, rather than fundamental shifts in growth or monetary policy expectations. U.S. interest rate differentials remain supportive of the dollar.

“It’s crucial to note that the recent dollar slide isn’t about shifts in growth or monetary policy expectations,” said Yuxuan Tang, J.P. Morgan Private Bank’s head of macro strategy in Asia. “If anything, interest rate differentials have moved in the USD’s favor since the start of the year. What we’re seeing now, much like last April, is a USD selloff driven primarily by flows and sentiment.”

The bank expects the weakness to prove temporary. As the U.S. economy gains momentum through the year, the dollar is likely to stabilize. That context helps explain why bitcoin has not behaved like a traditional dollar hedge. While gold and other hard assets have rallied with the greenback’s decline, BTC has remained range-bound, suggesting the crypto market does not view the dollar’s slide as a durable macro shift.

Bitcoin continues to trade more like a liquidity-sensitive risk asset than a store-of-value instrument. Without a clear change in monetary policy expectations, dollar weakness alone has not been enough to draw new capital into crypto markets.

J.P. Morgan Private Bank points investors toward assets such as gold and emerging-market exposure as more direct beneficiaries of dollar diversification. Until growth or rate dynamics, rather than flows and sentiment, dominate currency markets, bitcoin may continue to lag traditional macro hedges, even amid a soft dollar.