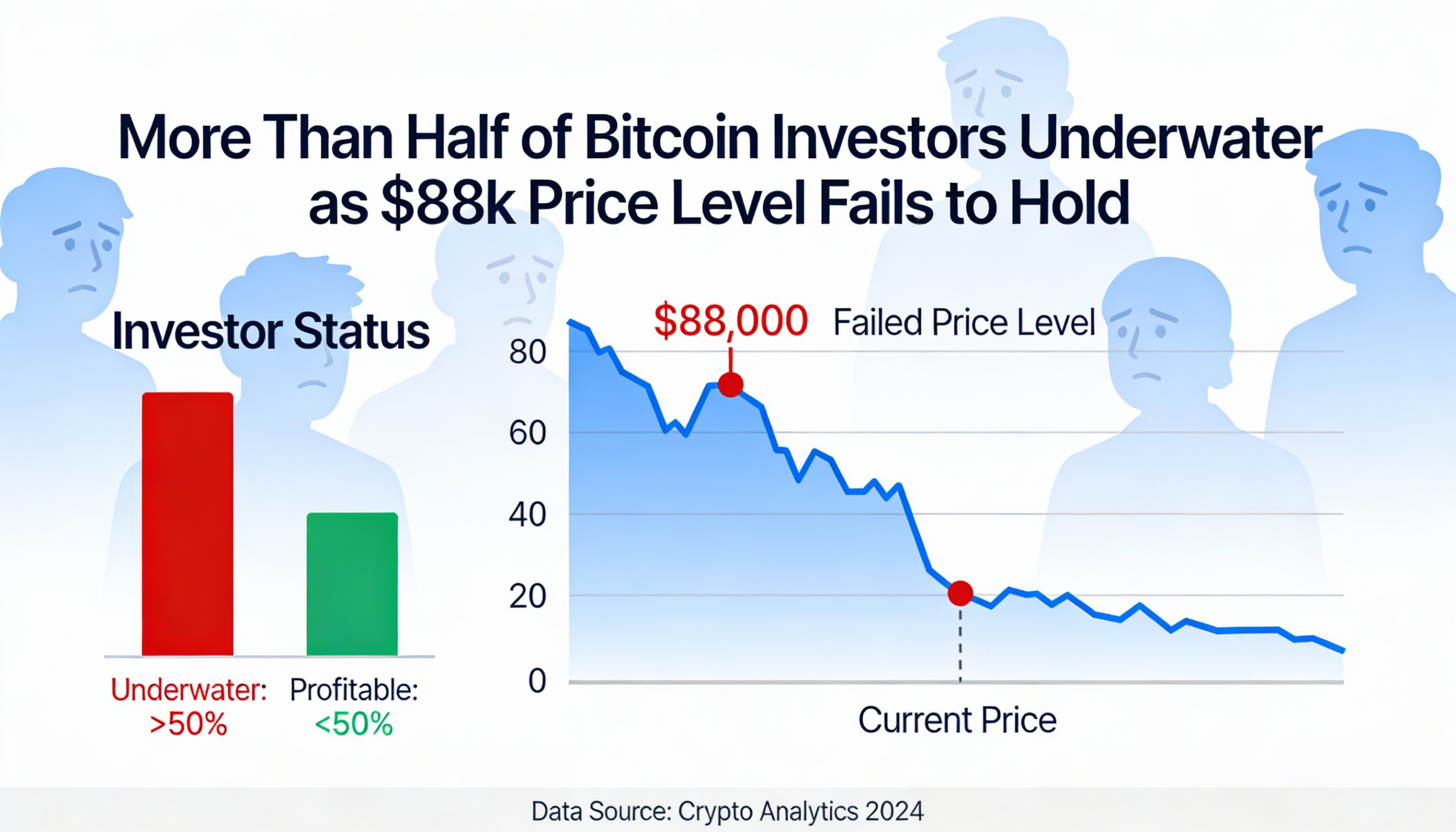

Most of bitcoin’s invested supply currently sits above today’s prices, raising the risk of further downside if key support levels fail to hold.

On-chain data from Checkonchain shows that 63% of all bitcoin BTC $82,703.53 wealth has a cost basis above $88,000. In other words, the majority of capital entered the market at higher prices than bitcoin is trading at today. Invested wealth measures the total value of capital deployed in bitcoin when coins last moved on-chain, while cost basis reflects the average price at which those coins were acquired.

This insight comes from the UTXO Realized Price Distribution (URPD), which maps the price levels at which the current supply of bitcoin last moved on-chain. Each bar represents the amount of bitcoin whose most recent transaction occurred within a specific price range, highlighting where capital is concentrated.

Since November, bitcoin has traded between $80,000 and $90,000. URPD data show that tens of billions of dollars of capital sit between $85,000 and $90,000, meaning much of the market is underwater. A breakdown below $85,000 could trigger increased selling as investors seek to limit losses, and long-term holders are already selling at the fastest pace in six months.

Adding to the risk, there is relatively little supply between $70,000 and $80,000. If the $80,000 support — last tested in November — fails, a rapid move toward $70,000 becomes increasingly likely.

Looking ahead, bitcoin is on track to close January little changed, failing to deliver the relief rally often seen after three consecutive months of declines. Historically, February has been a strong month, averaging gains of around 13%, according to Coinglass data. Whether history repeats itself may depend on how the market absorbs the current overhang of underwater supply.