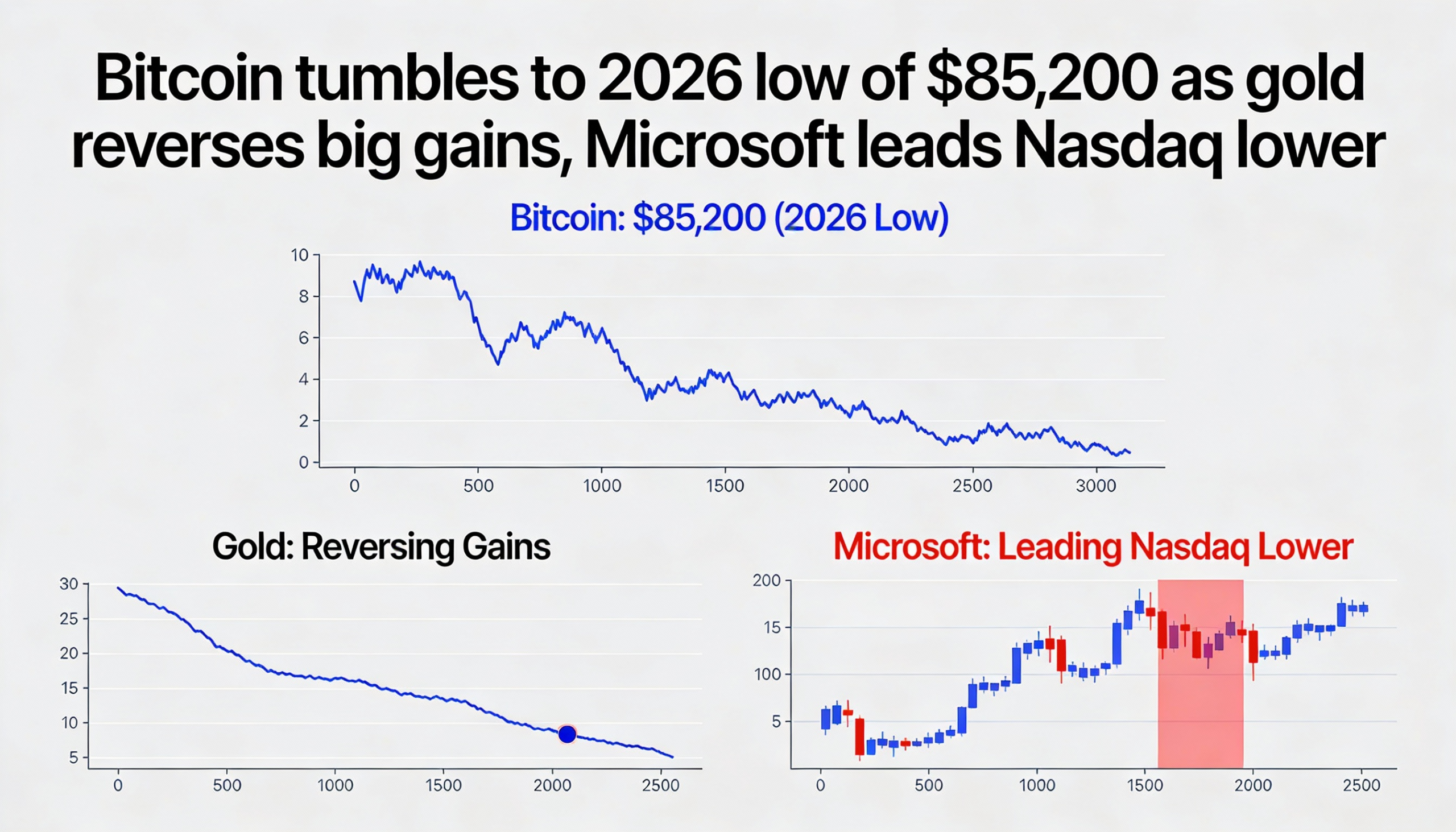

Gold Plunges After Rally, Bitcoin Hits One-Month Low as Tech Stocks Drag Markets

Gold surged above $5,600 per ounce on Thursday morning—its first move past $5,000 since Sunday—before collapsing nearly 10% to below $5,200 in U.S. trade. Silver followed a similar path, falling from $121 to $108 per ounce.

The sudden reversal coincided with a sharp sell-off in tech stocks, led by Microsoft (MSFT), whose shares dropped more than 11%, marking one of its worst days since March 2020. The tech giant’s decline dragged the Nasdaq down about 1.5%, amplifying risk-off sentiment across markets.

Crypto markets mirrored the downturn. Bitcoin BTC $81,527.05 fell from above $88,000 to $85,200, marking its lowest level since mid-December and a 4.5% drop over 24 hours. Altcoins were hit even harder: Ethereum ETH $2,544.07, Solana SOL $109.95, DOGE $0.1068, and ADA $0.2983 all declined 5%-6%.

Crypto-focused equities also suffered. Strategy (MSTR), the largest corporate bitcoin holder, dropped 8%, hitting 52-week lows and retreating to September 2024 levels—its worst day since Dec. 12. Other notable declines included Bullish (BLSH), Twenty One Capital (XXI), Circle (CRCL), and Coinbase (COIN), down 4%-8%.

Volatility spiked across broader markets. The S&P 500 Volatility Index jumped over 16% to 19, its second-highest level since late November, while the U.S. Dollar Index (DXY) rebounded to 96.6 from Wednesday’s 95.5 low, adding further pressure on risk assets.