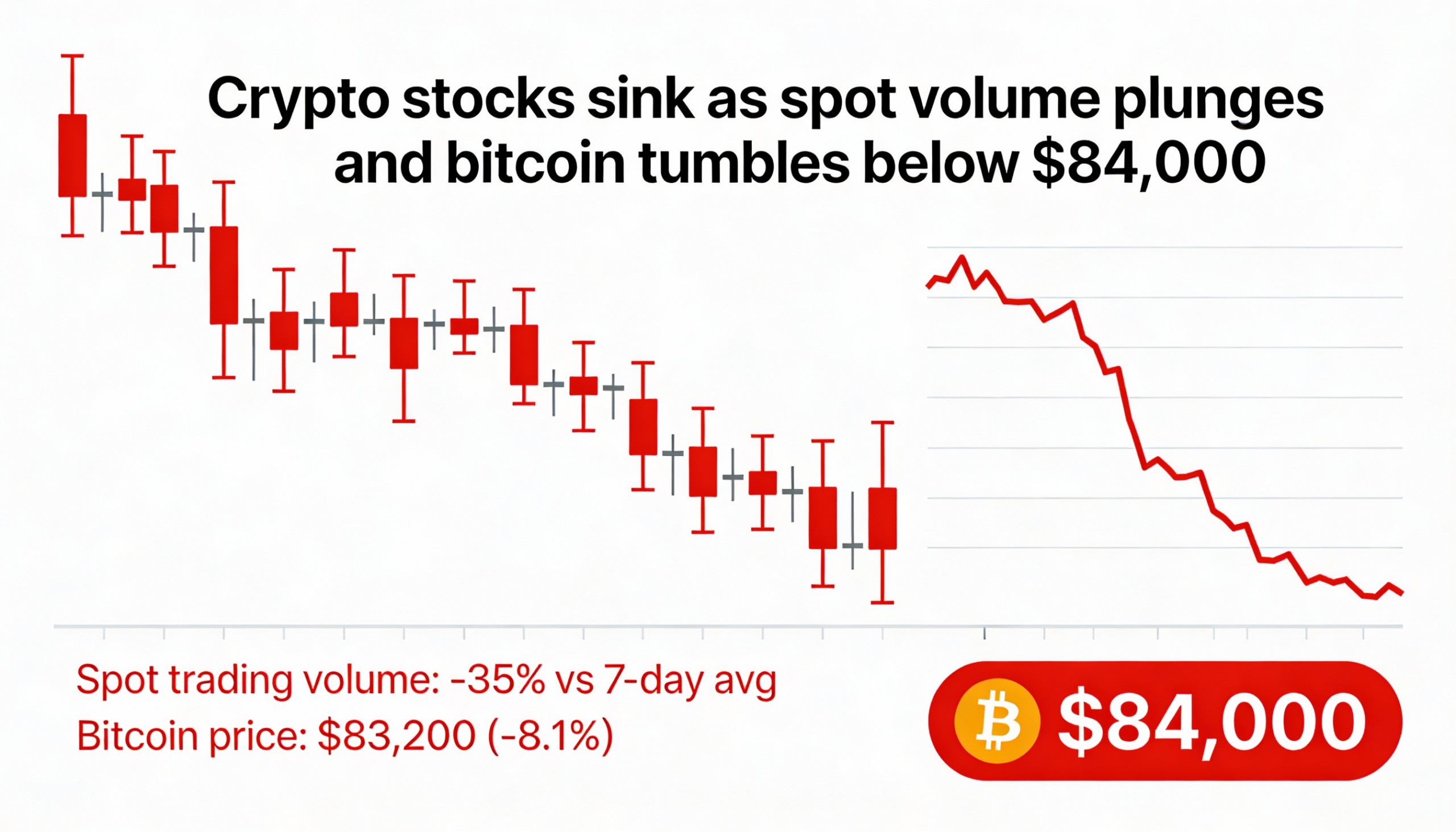

Crypto Exchange Stocks Slide as Bitcoin Falls Below $84K

Shares of leading crypto exchanges continued to slide on Thursday, extending January losses as Bitcoin dropped 6% below $84,000. Coinbase (COIN), the largest publicly traded crypto firm by market capitalization, fell 7% on the day and is down 17% year-to-date, marking its eighth consecutive losing session—its longest streak since September 2024. At $195, the stock has retraced to levels last seen in May 2025.

Competing platforms also struggled. Gemini (GEMI) fell 8% Thursday and 21% year-to-date, while Bullish (BLSH) and Circle (CRCL) are down 16% and 20% this year, respectively. The declines reflect not only falling crypto prices but also lower spot trading volumes. Data from TheTie shows January spot volumes across exchanges totaled $900 billion, roughly half of the $1.7 trillion recorded a year earlier.

“Bitcoin has been stuck around $85,000, and there’s clear hesitation in the market,” said Eric He, Community Angel Officer and Risk Control Adviser at crypto exchange LBank. “With rising geopolitical tensions, investors are staying cautious, and that’s showing up across assets—not just crypto. While stocks and commodities are moving higher, crypto is clearly in a wait-and-see phase.”

Analysts will be watching February for signs of rebounding trading volumes, easing geopolitical tensions, and macroeconomic signals that could reignite risk-on sentiment.

AI Pivot Keeps Some Crypto Firms Afloat

Among the few bright spots are crypto companies that have diversified beyond pure crypto exposure. Bitcoin miners leveraging their energy and computing resources to support AI workloads have fared better despite the broader selloff. Hut 8 (HUT), IREN (IREN), CleanSpark (CLSK), and Cipher Mining (CIFR) are all posting year-to-date gains.

Mike Novogratz’s Galaxy Digital (GLXY) is another standout, down on Thursday but up strongly in 2026. The firm has expanded into data centers, tapping the growing AI-driven demand for computing and storage.