Crypto Markets Slide Further as Bitcoin and Ether Extend Losses, Leveraged Traders Hit

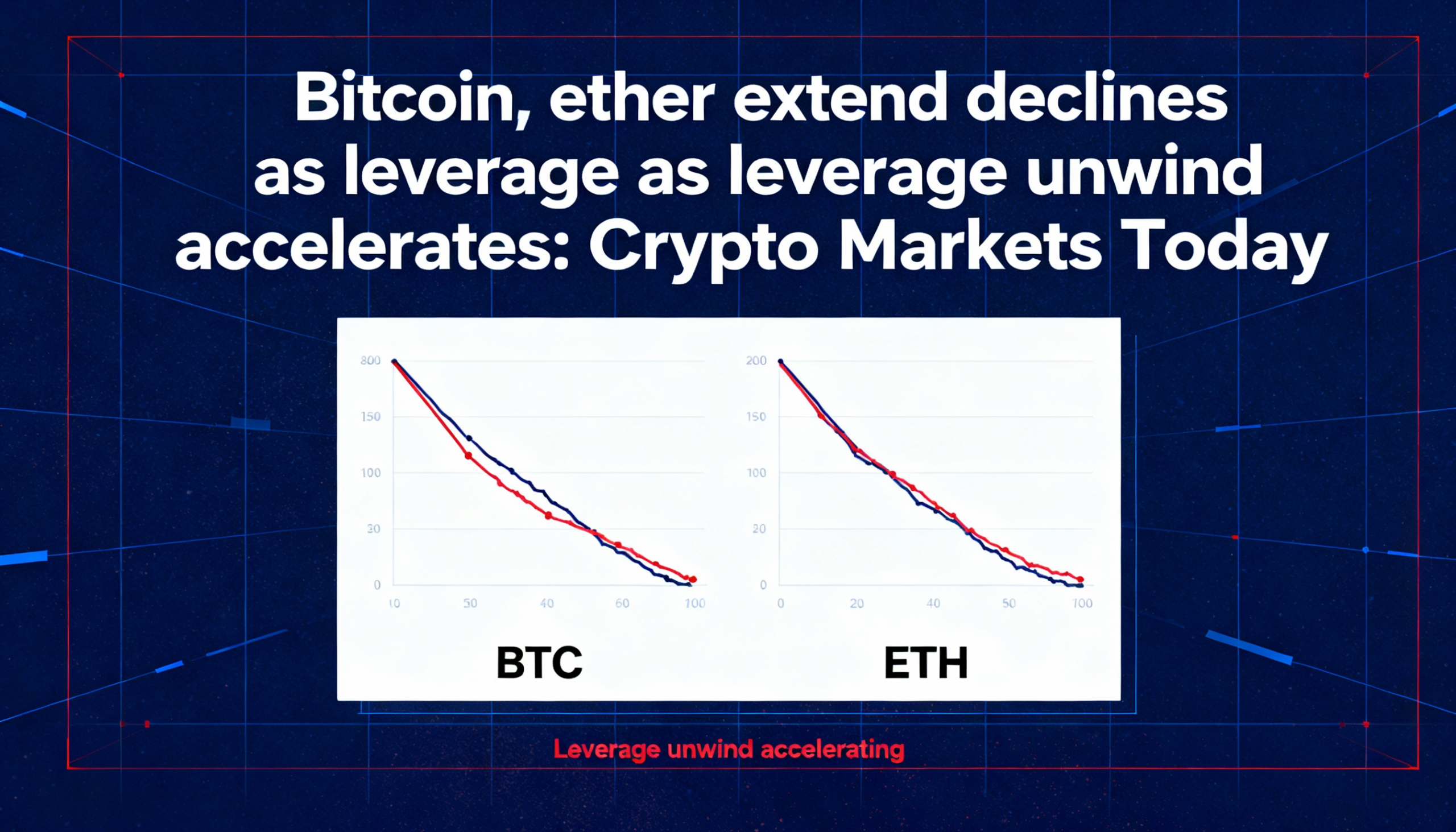

Crypto markets fell sharply overnight, with bitcoin and ether extending losses amid a broader risk-off environment. Precious metals tumbled, and leveraged traders across derivatives markets faced heavy liquidation pressure.

Bitcoin (BTC $76,965) dropped 2.7% since midnight UTC, while ether (ETH $2,310) fell 3.5%, compounding Thursday’s declines. The rout coincided with significant losses in metals: silver slid 20% from Thursday’s record high of $121 to $96, and gold fell 11% from Wednesday’s $5,600 peak, trading back below $5,000.

U.S. equity index futures slipped, and the dollar index (DXY) rose 0.57%, supported by growing expectations that Kevin Warsh may become the next Federal Reserve chair.

The selloff pushed bitcoin to its lowest level since November and triggered $1.8 billion in liquidations across crypto markets as leveraged traders were caught off-guard despite a weak start to the year. The bitcoin-heavy CoinDesk 20 Index (CD20) is now down 6.6% year-to-date, while the altcoin-focused CoinDesk 80 (CD80) has lost 2.28%.

Derivatives Positioning

The market turbulence wiped out $1.8 billion in leveraged futures positions over 24 hours, significantly impacting investor confidence. Open interest (OI) in futures for major cryptocurrencies, including bitcoin and ether, declined alongside the liquidations. DOGE, however, saw a 2% increase in OI, reflecting traders shorting the dip.

Perpetual funding rates for BTC, ETH, XRP, and other tokens turned negative, signaling growing demand for downside bets. Bitcoin’s 30-day implied volatility (BVIV) rose to 47% from 40%, while Wall Street’s VIX also spiked, indicating increased demand for hedging. On Deribit, bitcoin and ether puts became pricier than calls, further highlighting demand for downside protection. Traders employed BTC put spreads and, in ether, put butterfly strategies, suggesting cautious sentiment.

Token Highlights

Layer-1 blockchain Canton’s token, CC, was the only top-100 cryptocurrency to post gains in the last 24 hours, rising 3.35%. Privacy coins—including Monero (XMR $422.40), Zcash (ZEC $291.00), and Dash (DASH $43.23)—fell roughly 5% as investor optimism waned.

Bitcoin dominance dropped to 58.73%, indicating a shift toward speculative altcoins. One notable example, RIVER, lost 55% of its value since Monday, including a 25% drop over the past 24 hours, following an 884% rally between Jan. 1 and Jan. 26 as traders locked in profits.

Friday also saw volatility in tokenized silver on HyperLiquid, with CoinGlass reporting a $47 million long position liquidated during European trading hours as silver prices dropped to $96.