Precious Metals Selloff Could Clear the Way for Bitcoin Rally

Crypto bulls who have long argued that bitcoin’s next major move hinges on money flowing out of red-hot precious metals may soon get their answer.

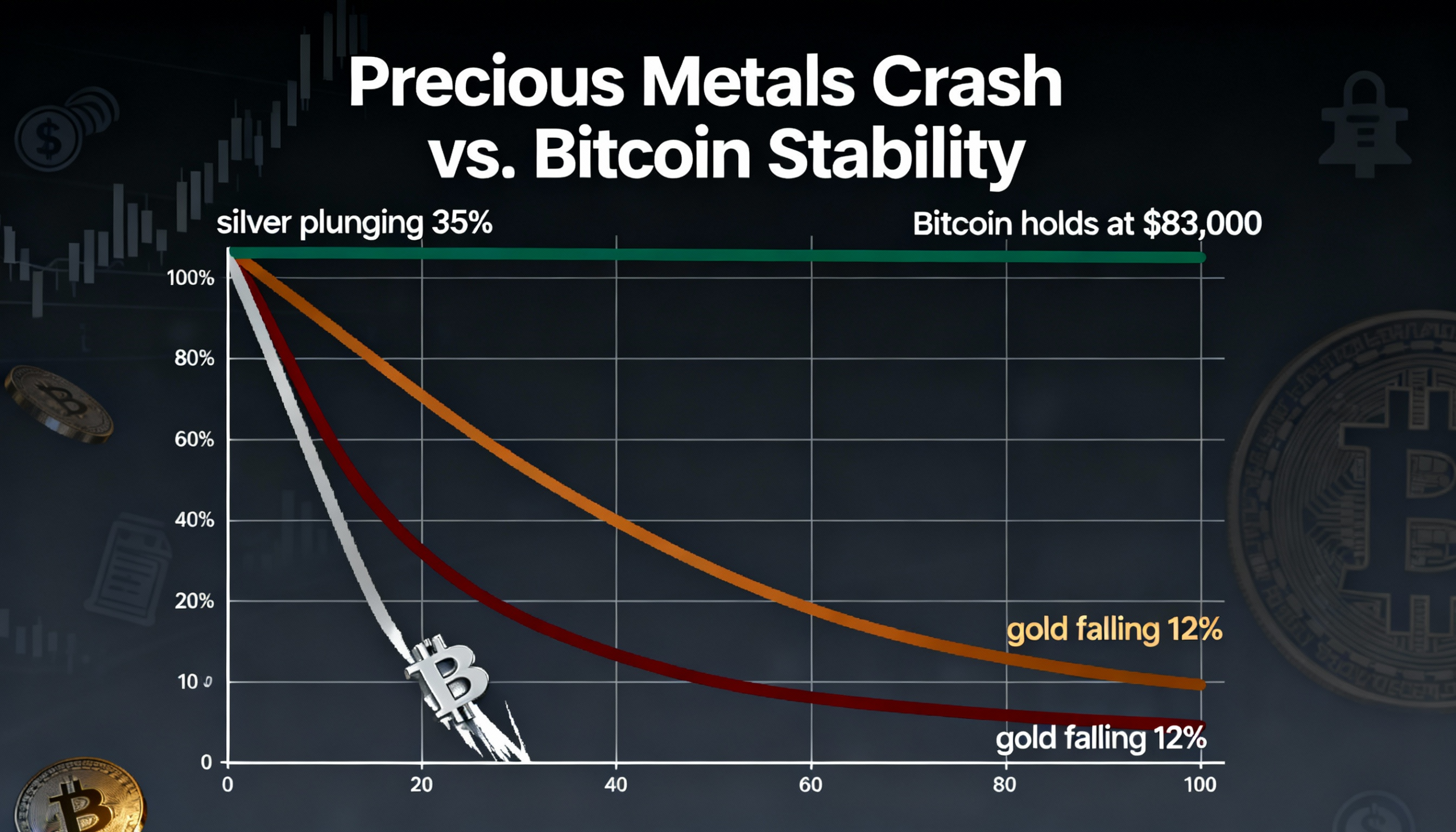

The bubble in metals appears to have burst this week, led by silver’s dramatic decline on Friday. After hitting a record $120 per ounce earlier in the session, silver has plunged to $75 in U.S. afternoon trading, down 35% on the day. Gold, which reached an unprecedented $5,600 on Thursday, has retreated to $4,718, losing 12% in a single session.

Silver’s swift reversal has wiped out nearly all of its massive January gains in just a few hours. While crypto traders are familiar with rapid price swings, only veterans of the 1980 Hunt Brothers silver saga might recall such extreme volatility in precious metals.

U.S. equities are also weaker, with the Nasdaq down 1.25% and the S&P 500 off 0.9%. In contrast, cryptocurrencies have held relatively steady on Friday, trading above Thursday’s panic lows. Bitcoin is hovering around $83,000, compared with an overnight bottom of $81,000.

Market observers point to President Trump’s nomination of Kevin Warsh as Federal Reserve chair as a potential catalyst for the selloff. Warsh is widely seen as a hawkish pick, which may have spurred selling across risk assets.

Crypto Bulls See Opportunity

Paul Howard, director at trading firm Wincent, says the parabolic moves in commodities in recent months drew risk capital away from crypto markets—a trend that may now be reversing.

“Cryptocurrency markets have been the victim of risk capital flowing into the still-popular commodities trade,” Howard said. He noted that interest in crypto options is growing, particularly February BTC 105,000 calls, which rank among the most actively traded contracts.

“The outlook reflects what many crypto traders are feeling right now—that their market is long overdue for a commodity-style catch-up,” Howard added.

Regarding Warsh’s nomination, Howard said, “What was meant to be a bullish move for markets appears to have coincided with a broad risk sell-off. The reaction may be more of a knee-jerk as markets recalibrate.”