Social sentiment around bitcoin has turned sharply negative after the token fell to its lowest level since Nov. 21, a setup that analytics firm Santiment says often appears near market capitulation, even if near-term trading remains volatile.

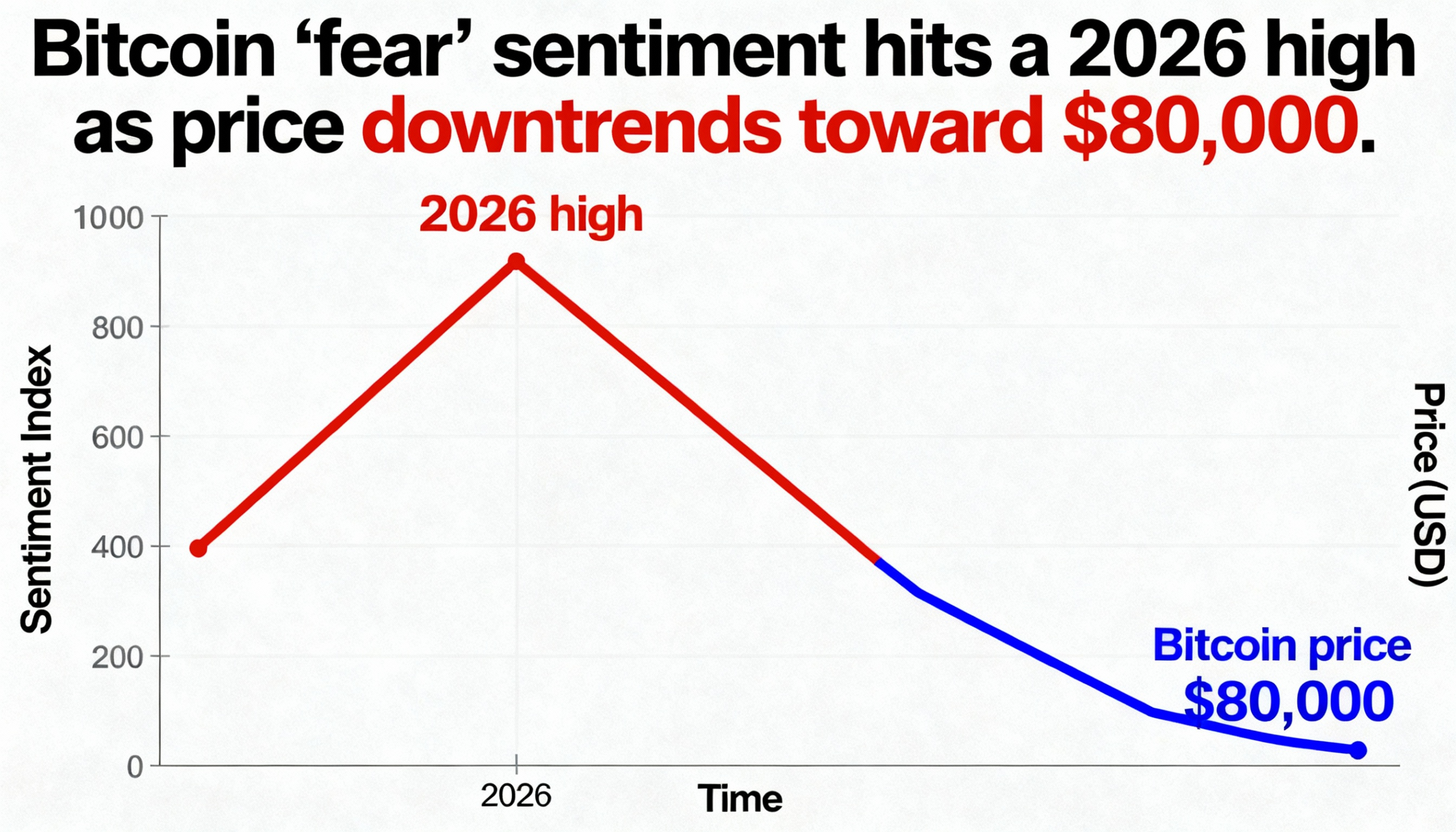

Bitcoin’s drop below $84,200 triggered a surge in panic-driven commentary across social media, with Santiment reporting that negative sentiment has climbed to its highest level of 2026 so far. The move pushed overall BTC sentiment to its weakest reading since late November, flipping market mood from caution to outright fear.

Santiment measures sentiment by tracking the ratio of positive to negative commentary across major social platforms and said the balance has skewed decisively toward pessimism. Historically, such shifts tend to emerge when late sellers capitulate and exit positions under pressure.

Sentiment extremes matter in crypto markets, which are often driven as much by positioning and emotion as by fundamentals. When bearishness becomes overcrowded, markets can run short of marginal sellers, particularly after sharp declines that force traders to unwind leverage or meet margin calls.

That does not guarantee an immediate rebound. Fear spikes can persist for days if broader macro conditions remain unstable or if bitcoin fails to reclaim key technical levels, such as $90,000, that traders closely monitor.

Choppy price action also aligns with a broader risk-off backdrop. Equities, gold, and silver have all pulled back after strong rallies, and cross-market de-risking can spill into crypto through shared liquidity and leverage dynamics.

Still, Santiment characterized the surge in fear as closer to capitulation than the beginning of a renewed speculative phase. Retail traders often sell when losses peak, while larger players with longer time horizons tend to accumulate into periods of forced selling.

If bitcoin manages to stabilize and sentiment cools, traders expressing the most pessimism today could quickly shift into chasing any recovery.