Bitcoin Traders Pour Billions into $75,000 Puts as Price Hits Nine-Month Lows

A surge in demand for lower-strike put options marks a stark shift from the post-Trump-election trend, when traders were heavily focused on high-strike calls.

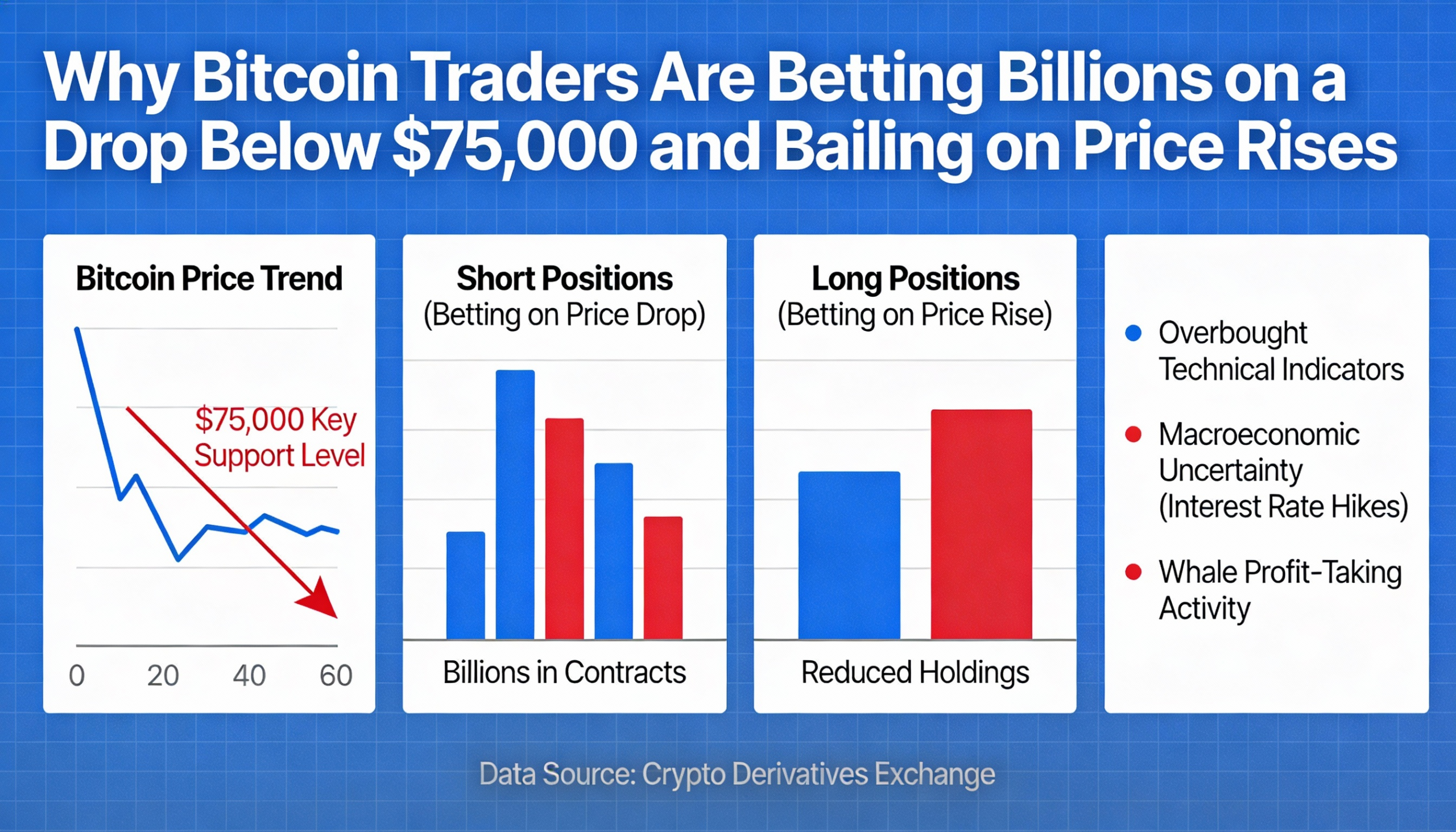

Bitcoin’s price crash to around $78,756 has reshaped market sentiment, with bets on further declines now rivaling speculative plays above $100,000. The leading cryptocurrency has dropped nearly 10% this week, hitting nine-month lows below $78,000, according to CoinDesk data.

Traders are flocking to put options—derivatives that provide protection against price declines, much like insurance covers against illness. As a result, the dollar value of active $75,000 Bitcoin puts on Deribit, the world’s largest crypto options exchange, now stands at $1.159 billion. That nearly matches the $1.168 billion notional open interest in $100,000 call options, which represent wagers on Bitcoin breaking into six figures. Each Deribit contract represents 1 BTC.

Put simply, bearish $75,000 bets are now as popular as the previously dominant $100,000 calls. “[There has been a] massive surge in put buying over the past 48 hours, right as BTC spot crashed from 88k to 75k. Options traders, hedgers, and funds had these exact price ranges targeted with clear playbooks,” noted pseudonymous market observer GravitySucks on X.

While $75,000 puts lead the bearish activity, significant interest also exists at $70,000, $80,000, and $85,000 strikes. In contrast, higher-strike calls—except for the $100,000 level—have seen limited action.

This behavior contrasts sharply with patterns following Donald Trump’s 2016 election, when higher-strike calls consistently drew more attention than lower-strike puts. That bullish positioning reflected hopes for a pro-crypto regulatory environment under the new administration.

Although the Trump administration delivered on some of those regulatory promises, Bitcoin’s rally stalled above $120,000 in early October and has declined since. The ongoing delay of the crypto market structure bill has likely added to traders’ frustration.