India’s Union Budget for 2026–27 has kept the country’s crypto tax framework intact, retaining existing transaction taxes and withholding rules, while introducing a new penalty structure aimed at tightening compliance on crypto-asset reporting.

Under amendments proposed in the Finance Bill, 2026, entities required to report crypto-asset transactions to tax authorities would face financial penalties for lapses. These include daily fines for failing to file required statements and a fixed penalty for inaccurate disclosures that are not corrected. The provisions are scheduled to take effect from April 1, 2026.

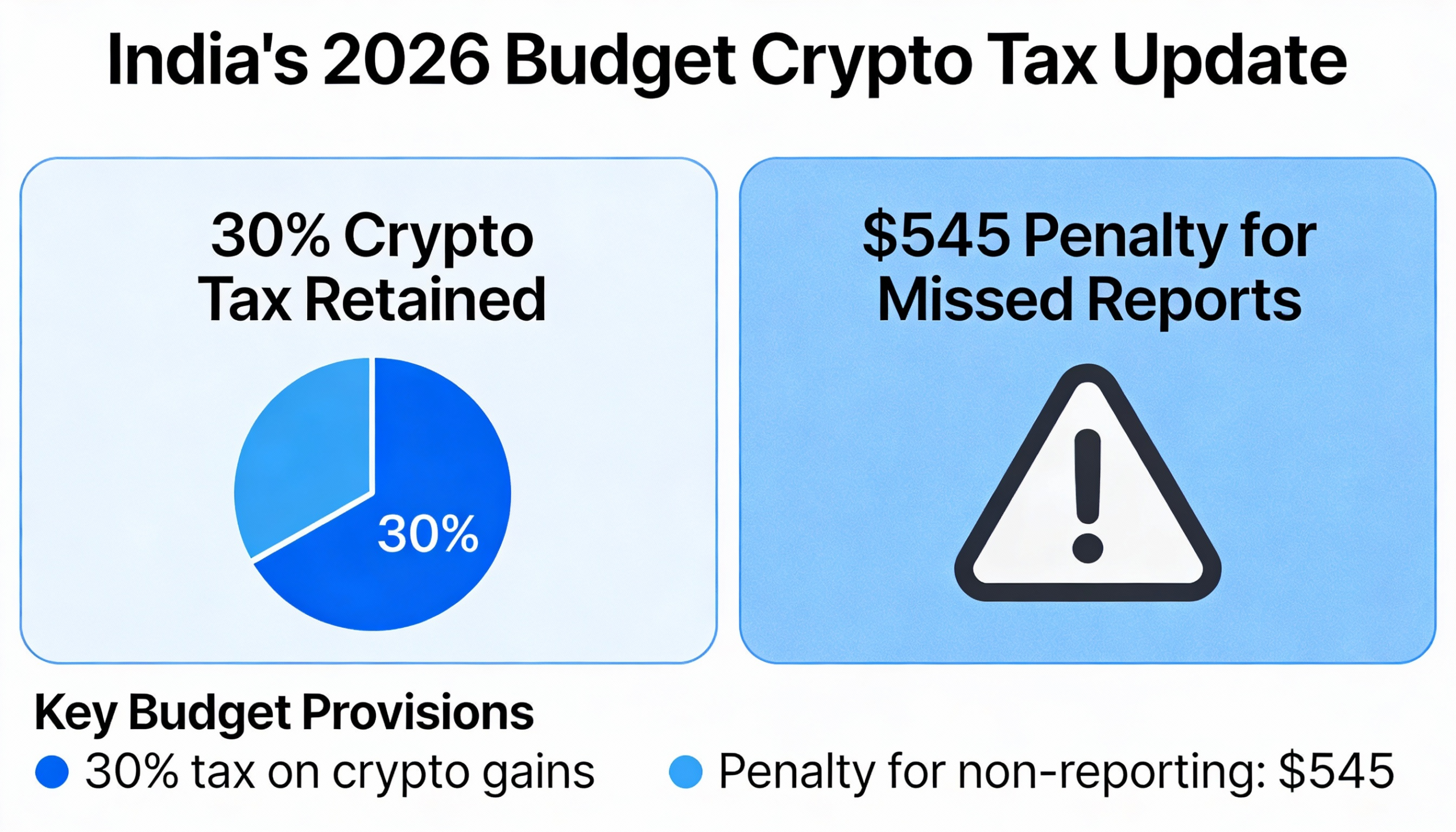

The proposal applies to reporting entities covered under Section 509 of the Income-tax Act, which mandates the submission of statements related to crypto-asset transactions. Failure to furnish these statements would attract a penalty of ₹200 per day — approximately $2.20 — for each day the default continues. A separate flat penalty of ₹50,000, or about $545, would apply in cases involving incorrect information or unrectified errors.

The measures are detailed in the Memorandum Explaining the Provisions in the Finance Bill and would be implemented through amendments to Section 446 of the Act. The memorandum says the changes are intended to strengthen compliance and discourage incomplete or inaccurate reporting.

While reporting enforcement has been tightened, the government did not alter the broader crypto tax regime. India continues to impose a flat 30% tax on gains from crypto transactions, along with a 1% tax deducted at source (TDS) on trades — measures that industry participants say have constrained liquidity and driven activity offshore.

The decision to leave taxes unchanged has disappointed segments of the domestic crypto industry, which had lobbied for adjustments to ease market friction. Market participants argue that compliance obligations are increasing even as structural issues remain unresolved.

“The current tax framework creates challenges for retail participants by taxing transactions without recognising losses, adding friction rather than fairness,” said Ashish Singhal, co-founder of local exchange CoinSwitch, in an emailed statement. “Reducing TDS on virtual digital asset transactions from 1% to 0.01% could improve liquidity, ease compliance, and enhance transparency while preserving transaction traceability.”

Singhal added that raising the TDS threshold to ₹5 lakh would help protect small investors from disproportionate impact.