Crypto-related equities remained under pressure on Monday, even as digital assets staged a modest rebound from sharp weekend losses.

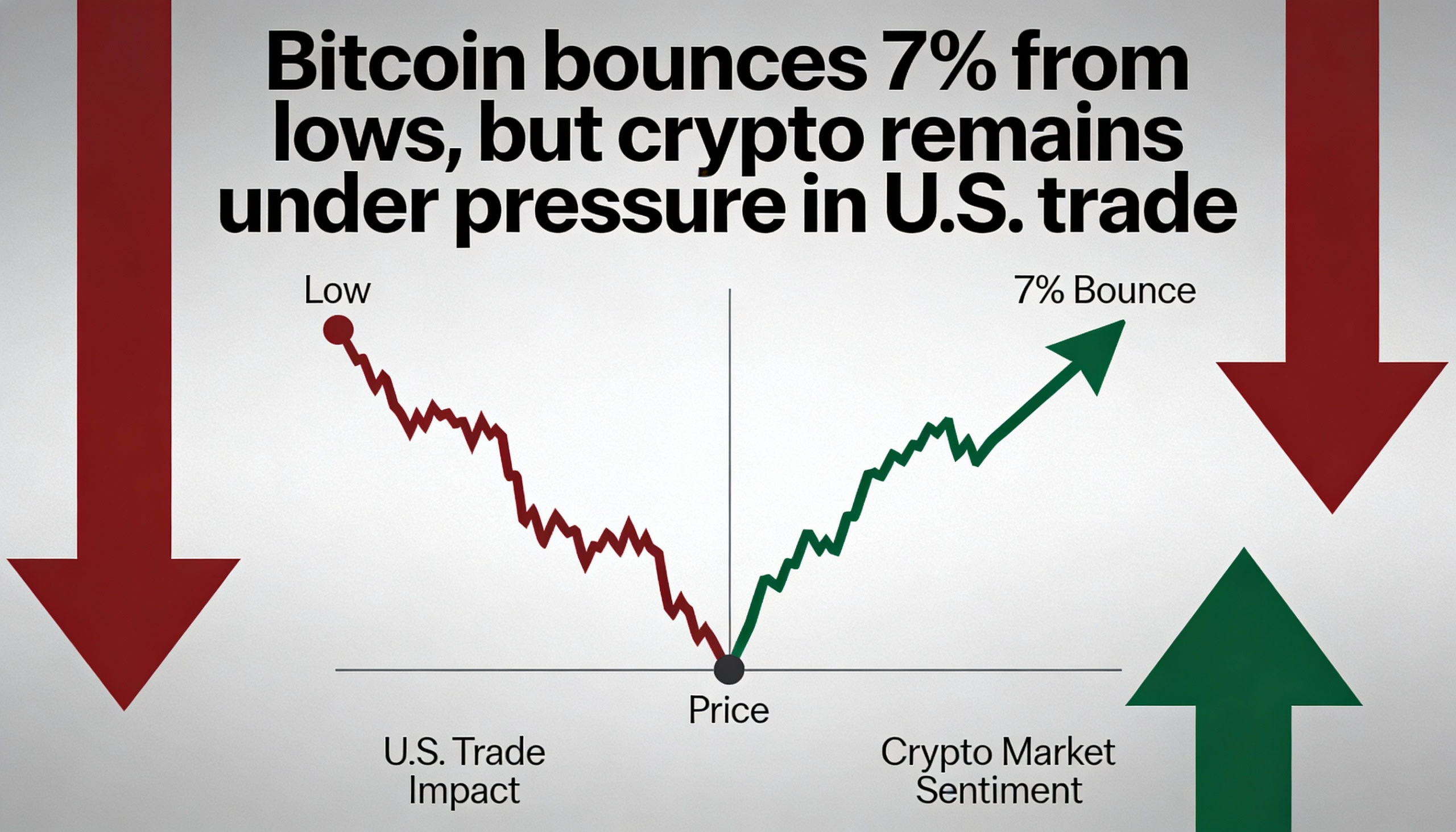

Bitcoin was trading just below $79,000 in midday U.S. trading after bouncing from weekend lows below $75,000. At around $78,700, the largest cryptocurrency was up roughly 2% over the past 24 hours and about 7% from its weakest level of the weekend. Despite the recovery, bitcoin remained more than 10% lower on a week-over-week basis.

Ether also rose about 2% on the day but was still down roughly 19% from a week earlier, underscoring the depth of the recent selloff across the crypto market.

The sharp weekend decline “broke key short-term support and stood out for its speed and depth, even by typical weekend standards,” said Adrian Fritz, chief investment strategist at 21Shares. According to Fritz, the move was driven by another wave of forced deleveraging, with more than $2 billion in crypto derivatives liquidated in a short period. “Liquidations in perpetual futures accelerated the downside momentum, rather than discretionary spot selling,” he said.

U.S. equities, meanwhile, traded higher on Monday. The Nasdaq and S&P 500 were each up about 0.6%, while the Dow Jones Industrial Average gained 0.9%. While bitcoin closed January with its fourth consecutive monthly decline, Ryan Detrick, a market analyst focused on traditional assets, noted that the Dow rose for a ninth straight month in January—one of the longest winning streaks in its history. Detrick added that stock market returns have historically been strong following such runs.

Precious metals were volatile, with gold and silver modestly lower on the day after suffering their worst one-day selloff since 1980 on Friday.

The bounce in crypto prices did little to lift digital asset-related stocks, which remained broadly lower. Robinhood shares fell 9%, Circle declined 5%, and both Coinbase and Strategy were down around 3%.

On the macro front, U.S. economic data released at the start of February showed unexpected strength. The ISM manufacturing purchasing managers’ index rose to 52.6 in January, well above forecasts of 48.5. The reading marked the first expansion in U.S. manufacturing activity in 12 months and the strongest level since 2022.

January is typically a reorder-heavy month following the holiday season, a seasonal pattern that also boosted readings in January 2024 and January 2025.

Looking ahead, investors are now focused on Friday’s U.S. January jobs report for further insight into the Federal Reserve’s policy outlook, after the central bank paused rate cuts at its January meeting.