Bitcoin’s failure to mount a sustained rebound could set the stage for a painful stretch ahead, one analyst warned, after the cryptocurrency endured a violent bout of volatility on Tuesday.

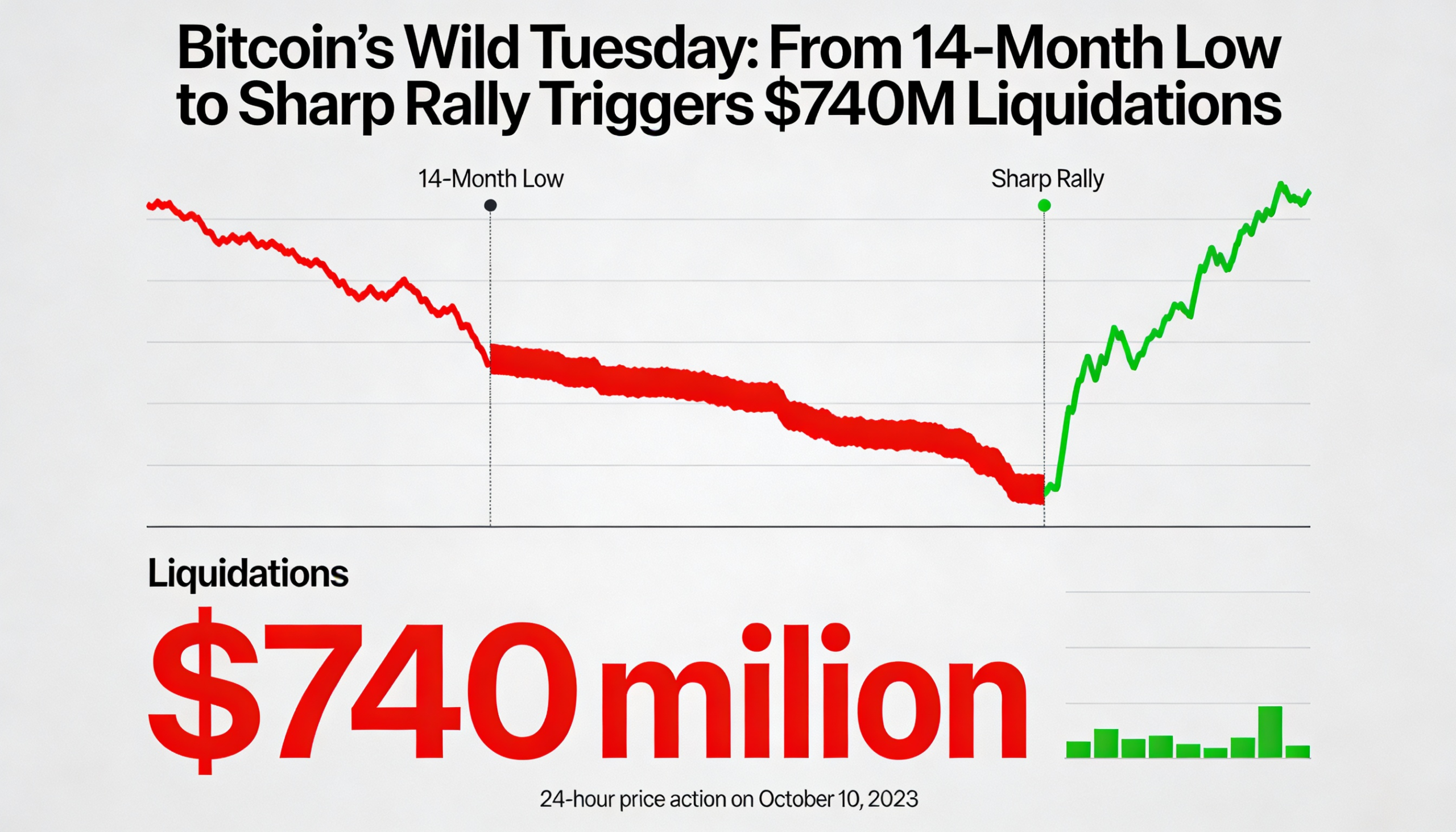

Bitcoin whipsawed during the session, sliding to a 14-month low before staging a sharp recovery above $76,000 as turmoil in tech stocks rippled across global markets. The largest cryptocurrency fell to $72,900 in early U.S. trading—its weakest level since November 2024, when Donald Trump won the presidential election—before rebounding roughly 5% off the lows to around $76,800. The advance later faded.

Ether followed a similar path, jumping as much as 10% from its session low to trade above $2,300 before paring gains, according to CoinDesk data.

The rebound coincided with news that Congress had reached a deal to end the partial U.S. government shutdown, offering near-term relief to risk assets. Sentiment was further buoyed by comments from Nvidia CEO Jensen Huang, who appeared on CNBC and dismissed speculation of tension between Nvidia and OpenAI.

“There’s no controversy at all. It’s complete nonsense,” Huang said, adding that Nvidia plans to participate in OpenAI’s next fundraising round. His remarks came amid growing concerns over the stability of OpenAI, a key pillar of the AI-driven tech rally.

Despite the bounce, the damage across crypto markets was significant. Total liquidations in digital asset derivatives surged to $740 million over the past 24 hours, according to CoinGlass. Long positions absorbed most of the losses, with $287 million in bitcoin longs and $267 million in ether longs wiped out.

Technical breakdown

From a technical perspective, bitcoin’s drop below the April 2025 “tariff tantrum” lows marked a key breakdown, increasing the risk of a deeper correction.

Still, Benjamin Cowen, founder of Into The Cryptoverse, said extreme bearish sentiment could pave the way for a short-term relief rally. Historically, he noted, bitcoin has often staged countertrend bounces after sweeping prior lows.

Cowen cautioned, however, that failure to rebound decisively could point to a prolonged downturn. “If bitcoin doesn’t bounce soon, it could be one hell of a midterm year,” he said, referencing prior bear markets in 2018 and 2022 that also coincided with U.S. midterm election cycles.

“I feel like the bear narrative has been really strong for a while,” Cowen added in a post on X. “That usually sets the stage for a countertrend rally to give bulls some hope—at least temporarily.”