Investor flows are increasingly pointing to a divergence in positioning across major crypto assets as volatility grips the market.

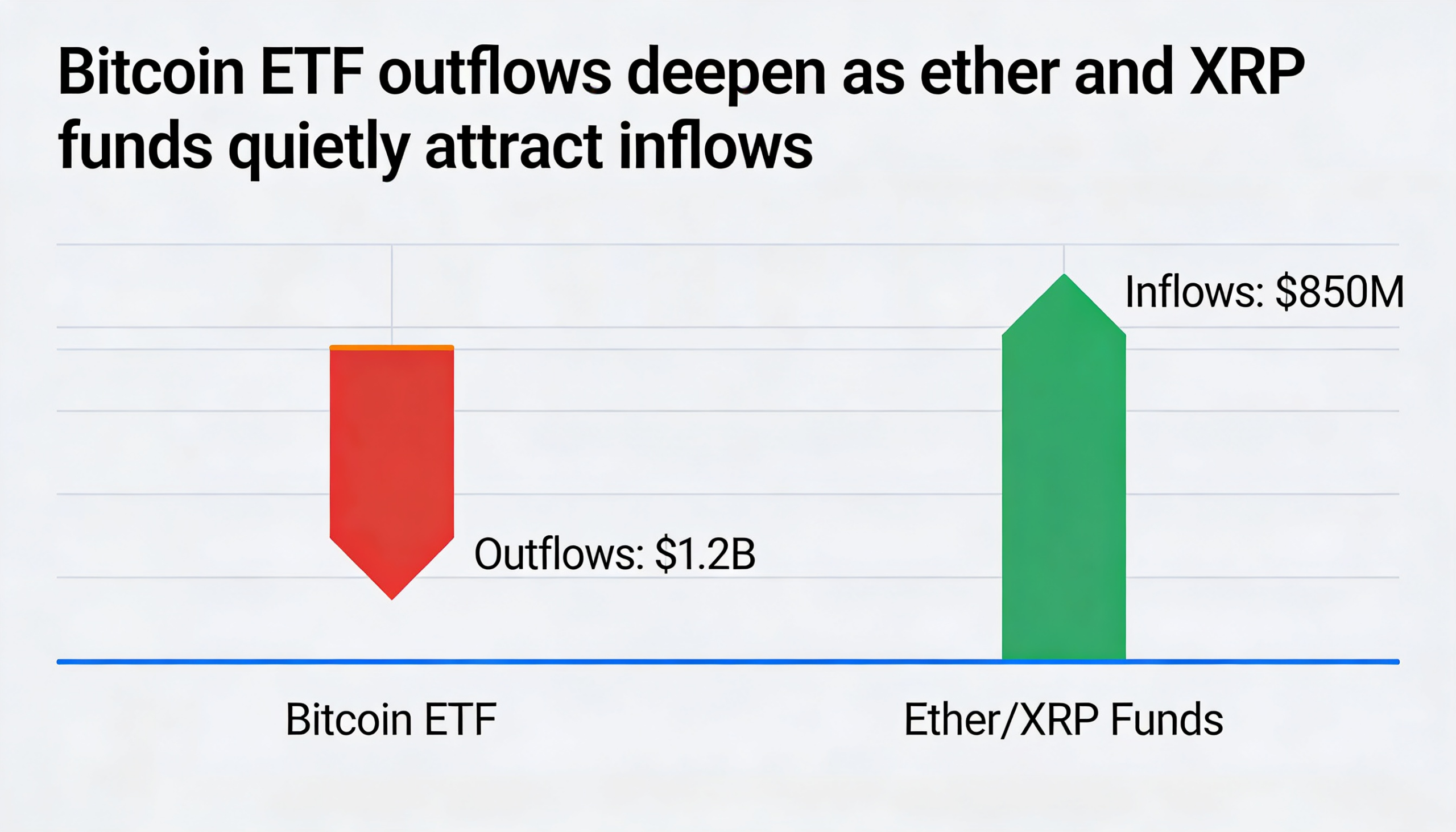

Bitcoin exchange-traded funds extended their run of outflows on Tuesday, even as products linked to ether and XRP attracted fresh capital. U.S.-listed spot bitcoin ETFs recorded roughly $272 million in net outflows on Feb. 3, according to SoSoValue data, reinforcing a distribution trend that has tracked bitcoin’s recent price instability.

The withdrawals coincided with pronounced intraday swings in bitcoin, which fell toward $73,000 before rebounding above $76,000. Market participants cited thin liquidity and fast-moving macro developments as key drivers of the abrupt price moves.

In contrast, spot ether ETFs posted about $14 million in net inflows, while XRP-focused funds drew nearly $20 million. The inflows suggest investors are reallocating within the crypto market rather than stepping away from the asset class entirely.

The split in flows reflects shifting risk appetite rather than a broad deterioration in sentiment toward digital assets. Bitcoin has increasingly behaved like a macro-sensitive risk asset, reacting sharply to equity-market stress, tighter financial conditions, and concerns over technology sector valuations.

Selling pressure intensified alongside a sharp decline in U.S. software stocks after Anthropic’s launch of a new AI automation tool reignited fears of disruption to traditional software business models, weighing on broader tech indices.

Overall, the flow dynamics point to selective risk-taking instead of a blanket risk-off move. While bitcoin ETFs have absorbed most of the near-term de-risking, capital continues to circulate within the crypto ecosystem, favoring assets perceived to offer differentiated exposure or relative value.