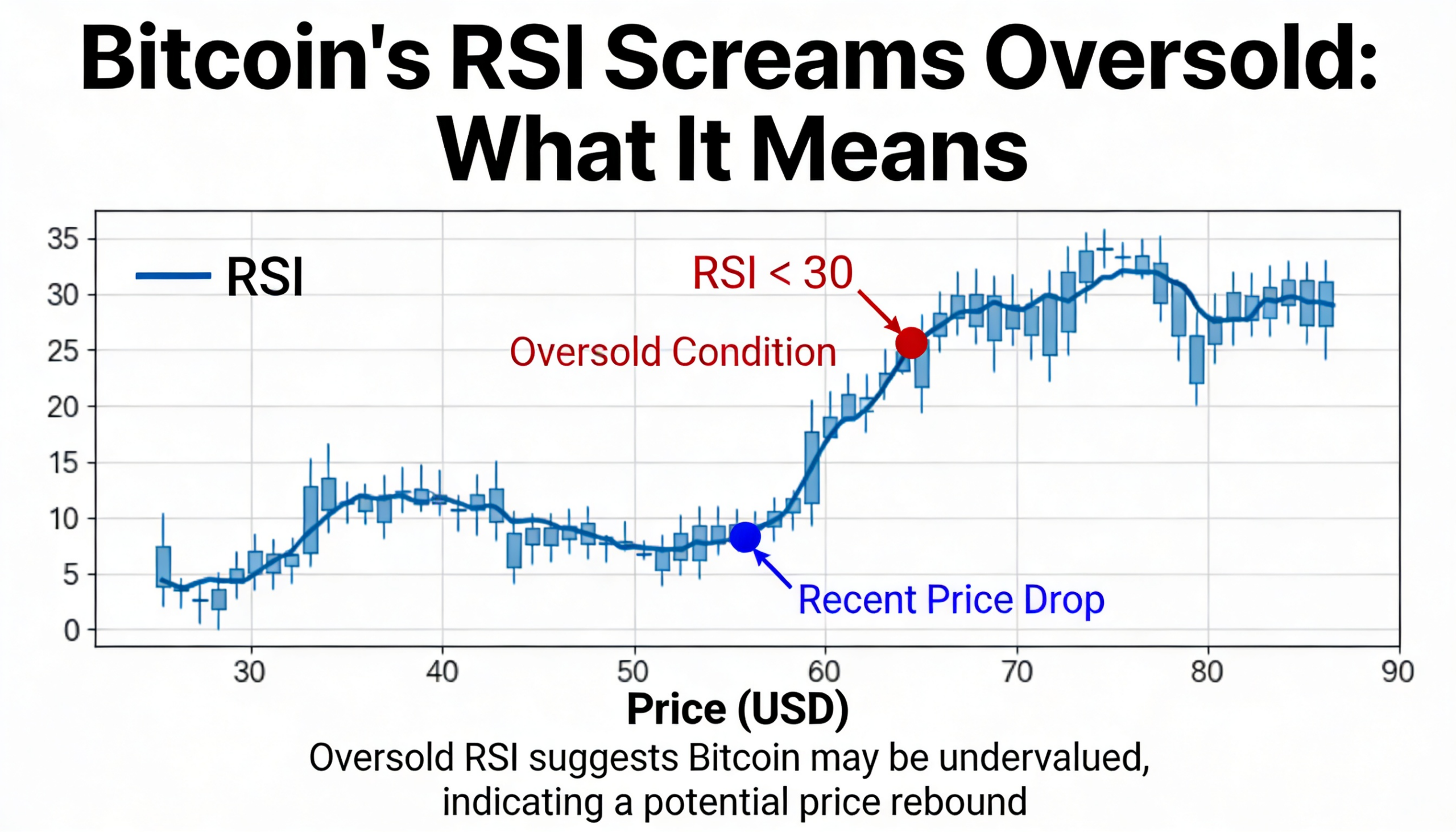

Bitcoin’s relative strength index has dropped below 30, a threshold commonly associated with oversold conditions, as the cryptocurrency trades near an important support band between $73,000 and $75,000.

The RSI is one of the most widely followed technical indicators, used by traders to assess momentum and identify potential extremes in price action. The tool was developed in 1978 by mechanical engineer and technical analyst J. Welles Wilder Jr., who introduced it in New Concepts in Technical Trading Systems.

Calculated over a standard 14-day period, the RSI compares recent gains with losses and produces a reading that ranges from zero to 100. A move below 30 indicates that losses have significantly outpaced gains over the recent period, signaling elevated bearish momentum.

Such readings are typically described as oversold, implying that prices may have declined too sharply relative to recent norms. Markets often see short-term rebounds after the RSI dips below 30, though the signal alone reflects past price action rather than guaranteeing a reversal.

In practice, oversold bounces can become self-reinforcing. Because many discretionary traders and algorithmic strategies track the same indicator, buying interest often emerges when the RSI reaches extreme levels, increasing the likelihood of a relief rally.

The signal tends to carry more weight when it appears near established support levels. Bitcoin is currently trading close to the $73,000–$75,000 zone, an area that has repeatedly acted as a turning point. A sell-off in April 2025 stalled in this range, and the early-2024 rally also lost momentum at similar levels, cementing the zone’s importance over the past two years.

Together, the oversold RSI and nearby support suggest conditions may be in place for a bounce. Still, any rebound would not necessarily mark the start of a new bull phase.

The RSI, like all technical indicators, can produce misleading signals, particularly during broader downtrends. In 2022, oversold readings led to only limited recoveries. More recently, a similar signal in November preceded a multi-week consolidation that ultimately gave way to a deeper decline last month.