Software stocks are under growing pressure from the rapid rise of AI, and one analyst notes that Bitcoin is, in essence, “just open-source software.”

Bitcoin is increasingly moving like a software stock, with its recent pullback unfolding alongside a broader software selloff.

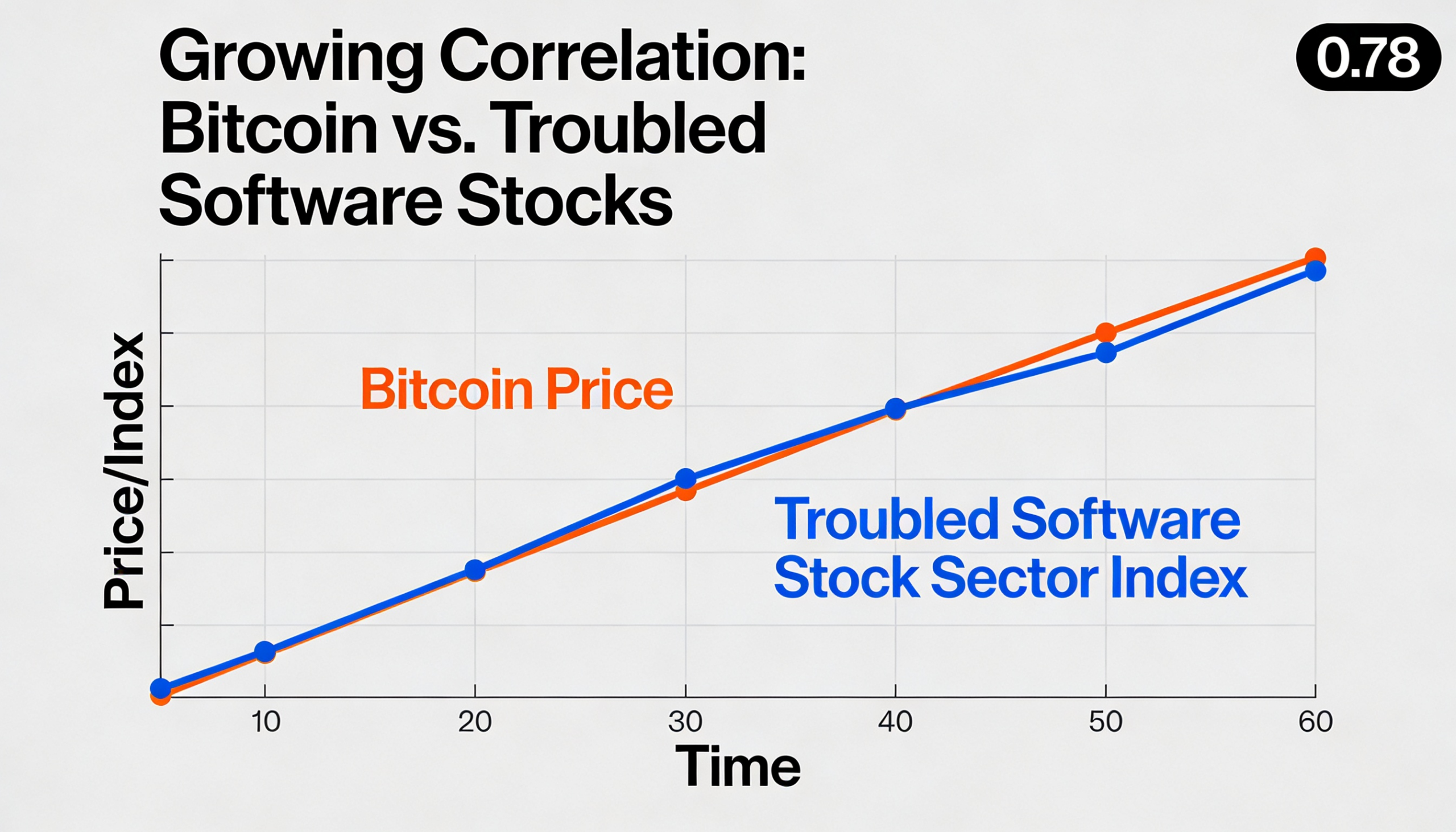

The link between Bitcoin and software equities has strengthened significantly. On a 30-day rolling basis, Bitcoin’s correlation with the iShares Expanded Tech-Software ETF (IGV) is a high 0.73, according to ByteTree. Year to date, IGV is down about 20%, while Bitcoin has declined 16%.

IGV is heavily weighted toward software and services leaders such as Microsoft (MSFT), Oracle (ORCL), Salesforce (CRM), Intuit (INTU), and Adobe (ADBE).

While the broader tech sector remains relatively resilient—the Nasdaq 100 (QQQ) is only around 4% below its record high—software stocks have borne most of the selling pressure. Bitcoin is increasingly tracking this weaker segment rather than the wider index.

The culprit behind the software slump is clear: AI. Rapid progress toward artificial general intelligence (AGI) is being viewed as an existential challenge for many software companies.

“There’s no doubt Bitcoin has been caught up in the technology selloff,” said ByteTree. “At its core, Bitcoin is an internet stock. Software stocks have been the most recent casualty, and over the past five years, Bitcoin’s performance has closely mirrored theirs.”

ByteTree notes that the average technology bear market lasts roughly 14 months. With this downturn beginning in October, pressure on both software equities and Bitcoin could persist through much of 2026. Yet a resilient economic backdrop may still provide support for the cryptocurrency.