Bitcoin Hits Extreme Oversold Levels, Signaling Potential Surge Ahead

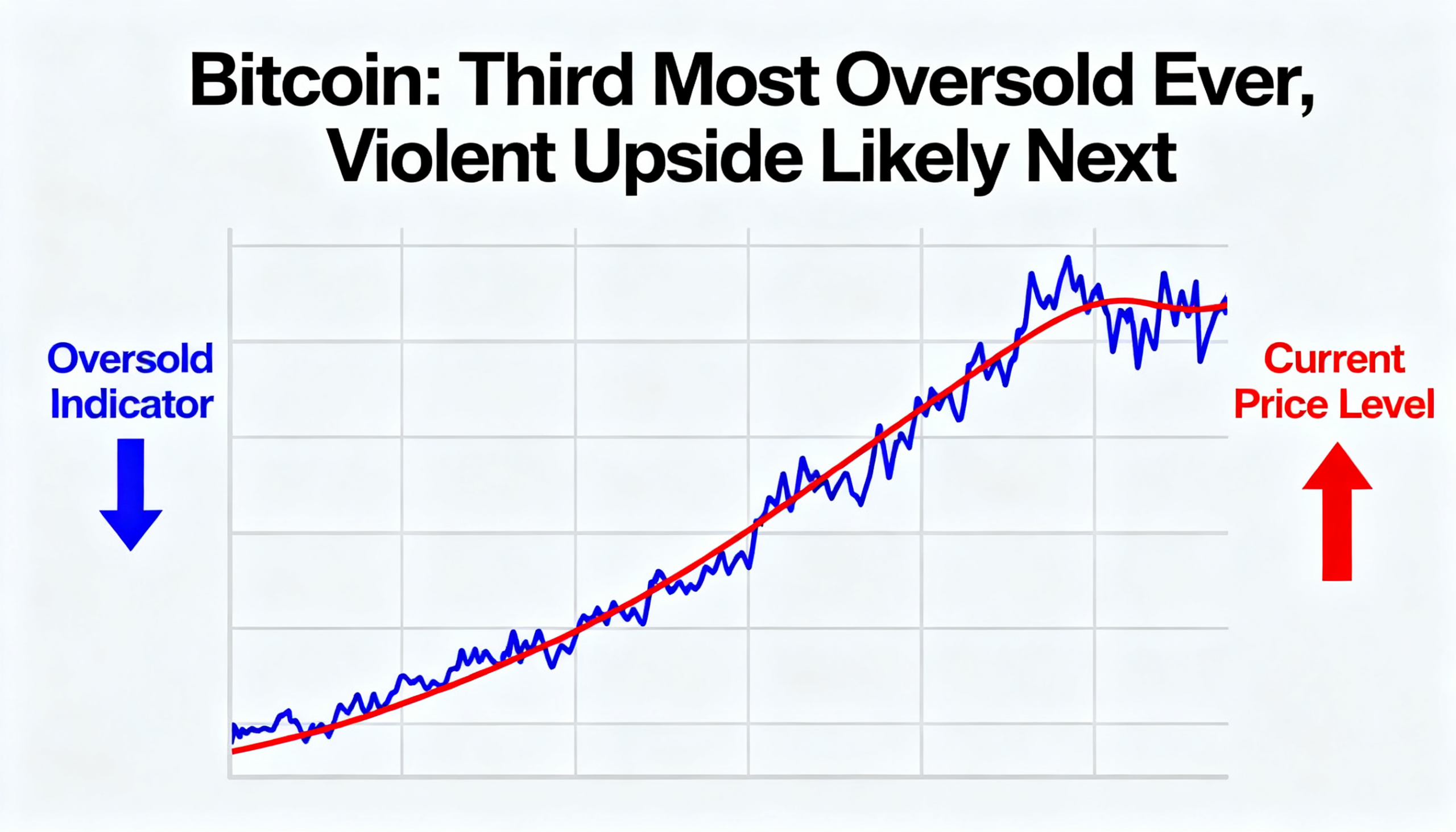

Bitcoin’s Relative Strength Index (RSI), a key momentum indicator used by traders to gauge overbought or oversold conditions, has plunged to 17 — one of the lowest readings in the cryptocurrency’s history. Only the 2018 bear market bottom and the 2020 Covid-driven crash saw lower levels.

The cryptocurrency dropped to around $65,000 on Thursday, driven by a wave of liquidations amid strong bearish sentiment. But the extreme RSI reading suggests the sell-off may be setting the stage for more than a simple bounce, with a potentially sharp upside move looming.

Bitcoin’s daily RSI, which measures momentum on a 0–100 scale, hit 17.6 Thursday. For context, it fell to 15.6 during the 2020 Covid crash and to 9.5 at the 2018 market bottom. Both prior events triggered significant rallies: BTC more than quadrupled from $3,150 to $13,800 over eight months in 2018, and climbed from $3,900 to $65,000 just over a year after the 2020 crash.

Thursday’s liquidation spree wiped out over $1.5 billion across crypto derivatives. While such conditions often prompt panic selling, seasoned traders may view these extreme oversold levels as a prime buying opportunity, especially as liquidity between $70,000 and $80,000 has largely evaporated.