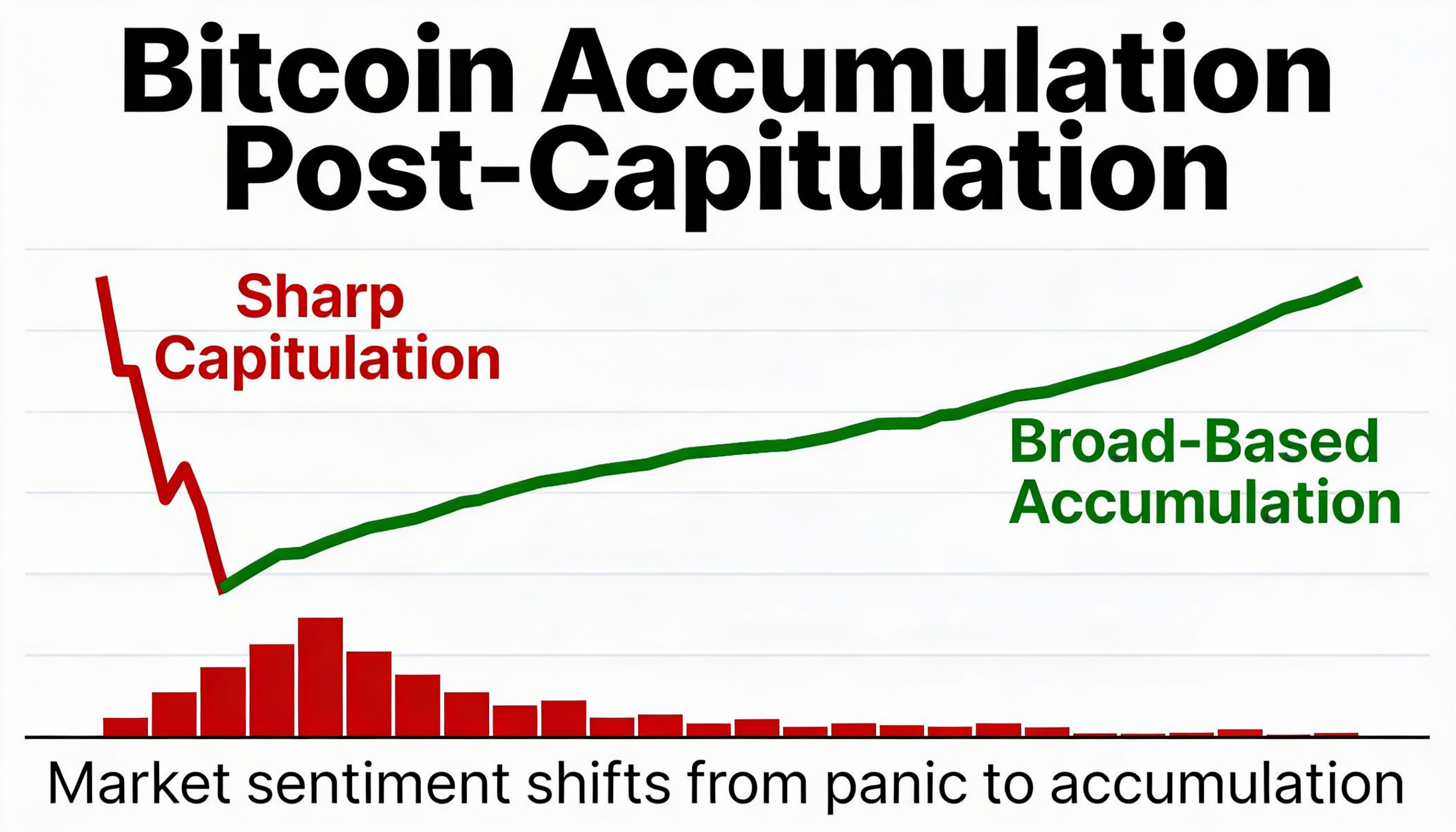

Bitcoin entered February trading near $80,000, with large holders cautiously accumulating while retail investors exited positions. Within a week, the price fell sharply, sliding to $60,000 on Feb. 5. Since then, on-chain data suggests a broad shift toward accumulation across nearly all investor cohorts as participants begin to perceive renewed value.

The move follows one of the most severe capitulation events in bitcoin’s history, which now appears to be transitioning into a more synchronized accumulation phase.

Glassnode’s Accumulation Trend Score by cohort illustrates the change in market behavior. The metric measures accumulation strength across different wallet sizes by accounting for both entity size and the amount of bitcoin accumulated over the past 15 days. Readings closer to 1 indicate accumulation, while values near 0 signal distribution.

On an aggregate basis, the Accumulation Trend Score has climbed above 0.5 to 0.68. This marks the first instance of broad-based accumulation since late November, a period that previously coincided with bitcoin establishing a local bottom near $80,000.

The most aggressive dip buying has come from wallets holding between 10 and 100 BTC, particularly as prices approached the $60,000 level.

While it remains unclear whether the market has definitively found its bottom, the data indicates investors are once again stepping in after a drawdown of more than 50% from bitcoin’s October all-time high.