Bitcoin Reclaims $70K as Bernstein Calls Current Pullback ‘Weakest Bear Case’

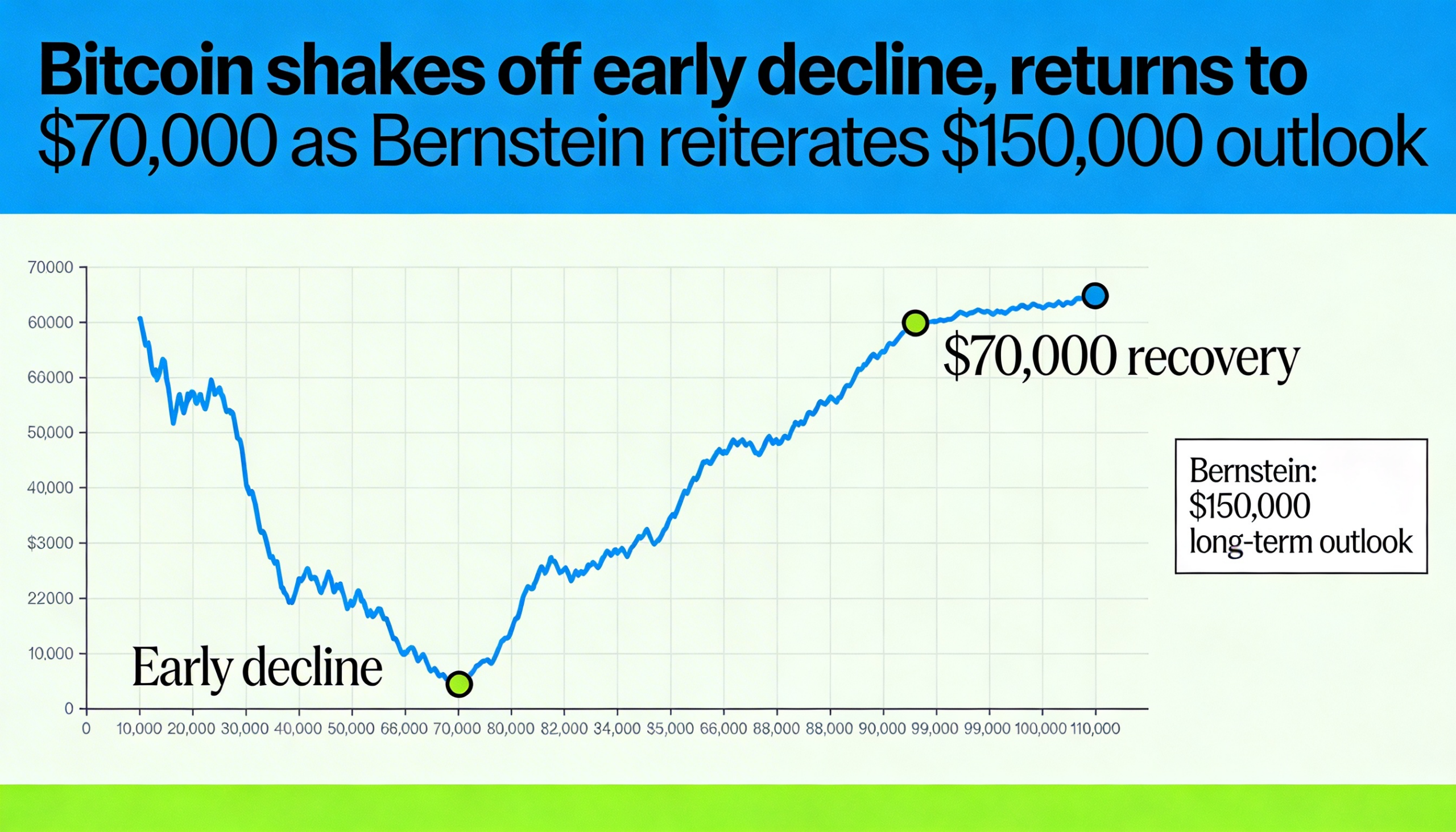

Bitcoin (BTC) pushed higher during U.S. trading hours, rebounding from an early slide to just above $68,000 and climbing to $70,800. The move leaves the cryptocurrency up about 0.5% over the past 24 hours.

Major altcoins outpaced bitcoin’s gains. Ether (ETH), XRP and solana (SOL) each rose roughly 1.5% on the day.

The broader market backdrop was constructive. The Nasdaq advanced 1% and the S&P 500 gained 0.5%, while commodities surged. Gold climbed 1.9% to $5,075 per ounce and silver jumped 7.4% to $82.50.

Bernstein analyst Gautam Chhugani dismissed the latest weakness as overstated, reiterating the firm’s $150,000 year-end bitcoin price target. He described the current downturn as “the weakest bitcoin bear case in its history,” arguing that the market has manufactured unnecessary fear despite a lack of structural breakdowns.

“Nothing blew up, no skeletons will unravel,” Chhugani wrote, suggesting that recurring cycles of doubt are part of bitcoin’s history. “Time remains a flat circle on Bitcoin.”

From a technical perspective, Schwab’s Jim Ferraioli pointed to mining economics as a key signal for identifying potential market bottoms. Historically, bitcoin has found support near its production cost, as less efficient miners shut down during downturns. This process typically shows up in declining network difficulty.

That pattern is emerging again. Mining difficulty recently posted its largest drop since 2021, indicating some degree of miner capitulation. Ferraioli noted that a sustained rebound in difficulty could serve as confirmation that the worst of the selloff has passed.

Crypto-related equities tracked the rebound. Bullish (BLSH) surged 14.2%, Galaxy Digital (GLXY) gained 8.2%, and Circle (CRCL) rose 5.1%. Strategy (MSTR) added 3%, while Coinbase (COIN) edged up 1%.

Bitcoin miners with AI exposure also rallied after Morgan Stanley initiated favorable coverage on TeraWulf (WULF) and Cipher Mining (CIFR), both up around 14%. Hut 8 (HUT), IREN (IREN) and Bitfarms (BITF) each advanced roughly 7%.