Market data indicates bitcoin’s latest rebound is unfolding in a cooling, risk-off environment, with trading activity shrinking and retail engagement continuing to wane.

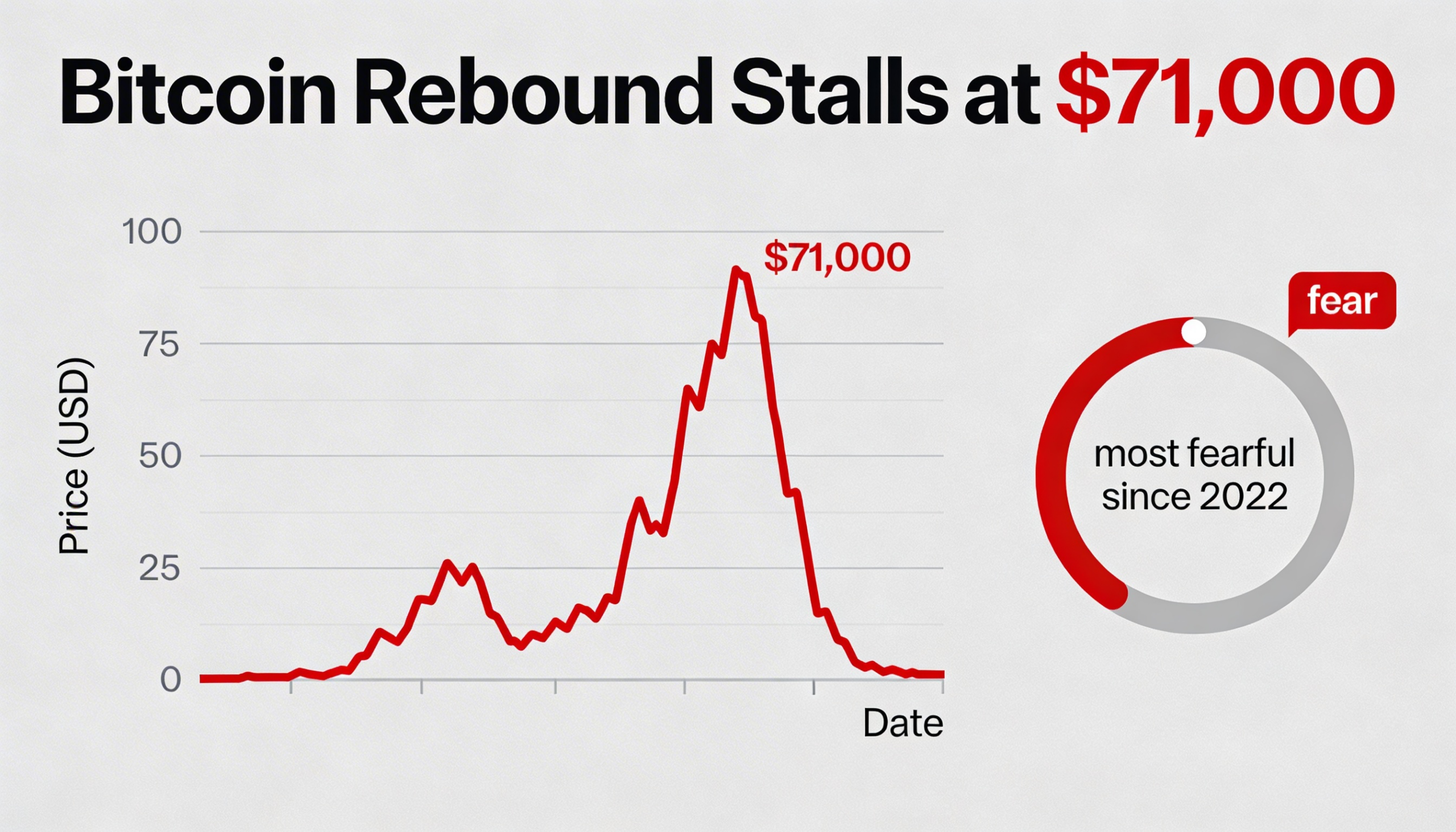

After tumbling into the low-$60,000 range in what many described as a capitulation-style move last week, bitcoin (BTC) staged a sharp weekend recovery toward $70,000. That bounce, however, is already losing steam, casting doubt on whether the rally has real staying power.

The hesitation has led some analysts to interpret the move as a textbook bear-market rally — a swift recovery that entices sidelined buyers before encountering a wall of supply from investors eager to exit at improved prices.

“There remains substantial supply from participants looking to sell into strength,” said Alex Kuptsikevich, chief market analyst at FxPro. He cautioned that under these conditions, the market should be prepared for another potential test of the 200-week moving average.

Kuptsikevich noted that the rebound’s momentum faded quickly near the $2.4 trillion total crypto market capitalization level, reinforcing his skepticism about the near-term outlook. “It’s possible we’ve only witnessed a temporary bounce within a broader decline that hasn’t fully played out,” he said.

Sentiment metrics underscore the fragility. The Crypto Fear and Greed Index plunged to 6 over the weekend — levels last seen during the FTX-driven collapse in 2022 — before recovering modestly to 14 by late Monday. Even with that uptick, the index remains firmly in extreme fear territory.

According to Kuptsikevich, such depressed sentiment readings are typically inconsistent with confident, sustained buying, suggesting the market’s unease runs deeper than short-term volatility.

Liquidity conditions are adding another layer of instability. With order books thinner than in previous months, relatively small sell orders can generate outsized price swings. Those moves can trigger cascading stop-losses and forced liquidations, creating a feedback loop that exaggerates volatility and undermines attempts at breakout rallies.

This structural fragility — rather than a single headline event — helps explain how bitcoin can swing thousands of dollars in a single session while repeatedly failing to overcome key resistance levels.

A Monday research note from Kaiko characterized the broader environment as a risk-off unwind. The firm reported that aggregate trading volumes across major centralized exchanges have dropped by roughly 30% since late 2025. Monthly spot volumes, which once hovered near $1 trillion, have fallen to around $700 billion.

Although last week featured several bursts of heightened activity, Kaiko said the overarching trend remains a steady decline in participation. Retail investors, in particular, appear to be gradually stepping back rather than exiting in a single wave of panic selling.

In thinner markets, prices can slide on relatively modest pressure, without the heavy, climactic volume typically associated with a durable bottom. That absence of decisive capitulation can prolong uncertainty and invite repeated failed rebounds.

Kaiko also framed the correction within bitcoin’s traditional four-year halving cycle. After peaking near $126,000 in late 2025 or early 2026, the asset has retraced sharply, with the move back into the $60,000–$70,000 range marking a drawdown of more than 50% from the highs.

Historically, cycle troughs tend to take months to form and are often characterized by multiple false starts before a sustainable recovery emerges.

For now, the $60,000 level stands as a critical support zone. If buyers continue to defend it, bitcoin may settle into a volatile consolidation phase. A breakdown below that threshold, however, could quickly reignite the thin-liquidity dynamics that amplified the recent selloff — particularly if macroeconomic conditions remain tilted toward risk aversion.