Last week’s crypto sell-off was driven by macro forces tied to traditional finance — particularly the unwinding of yen carry trades — underscoring how closely digital assets are now intertwined with global markets, speakers said at Consensus Hong Kong 2026.

HONG KONG — The sharp downturn in crypto markets last week was not a repeat of the industry-specific blowups seen in 2022, but rather the result of a broader macro deleveraging cycle spilling over from traditional finance, according to panelists at Consensus Hong Kong 2026.

“After Oct. 10, many investors had already reduced risk,” said Fabio Frontini, founder of Abraxas Capital Management. “What we’re seeing now is a spillover from TradFi. Everything is interconnected at this point.”

Market participants pointed to the rapid unwinding of yen carry trades as a primary catalyst. Thomas Restout, group CEO of liquidity provider B2C2, explained that investors had been borrowing in low-interest-rate currencies such as the Japanese yen and deploying that capital into higher-yielding or risk assets — including bitcoin, ether, gold and silver.

The strategy, commonly known as the yen carry trade, involves borrowing yen at relatively cheap rates, converting it into other currencies and investing in assets that offer stronger returns. However, when the yen strengthens or Japanese rates rise, borrowing costs increase and investors must buy back yen to repay loans, triggering a forced unwind that can spark volatility across markets.

“As yen rates moved higher, funding costs increased,” Restout said. At the same time, heightened volatility led to steeper margin requirements. “In metals, margin requirements jumped from 11% to 16%,” he noted, forcing some leveraged players to reduce positions as collateral demands rose.

The deleveraging rippled across risk assets broadly, with crypto caught in the crosscurrents rather than acting as the epicenter of stress.

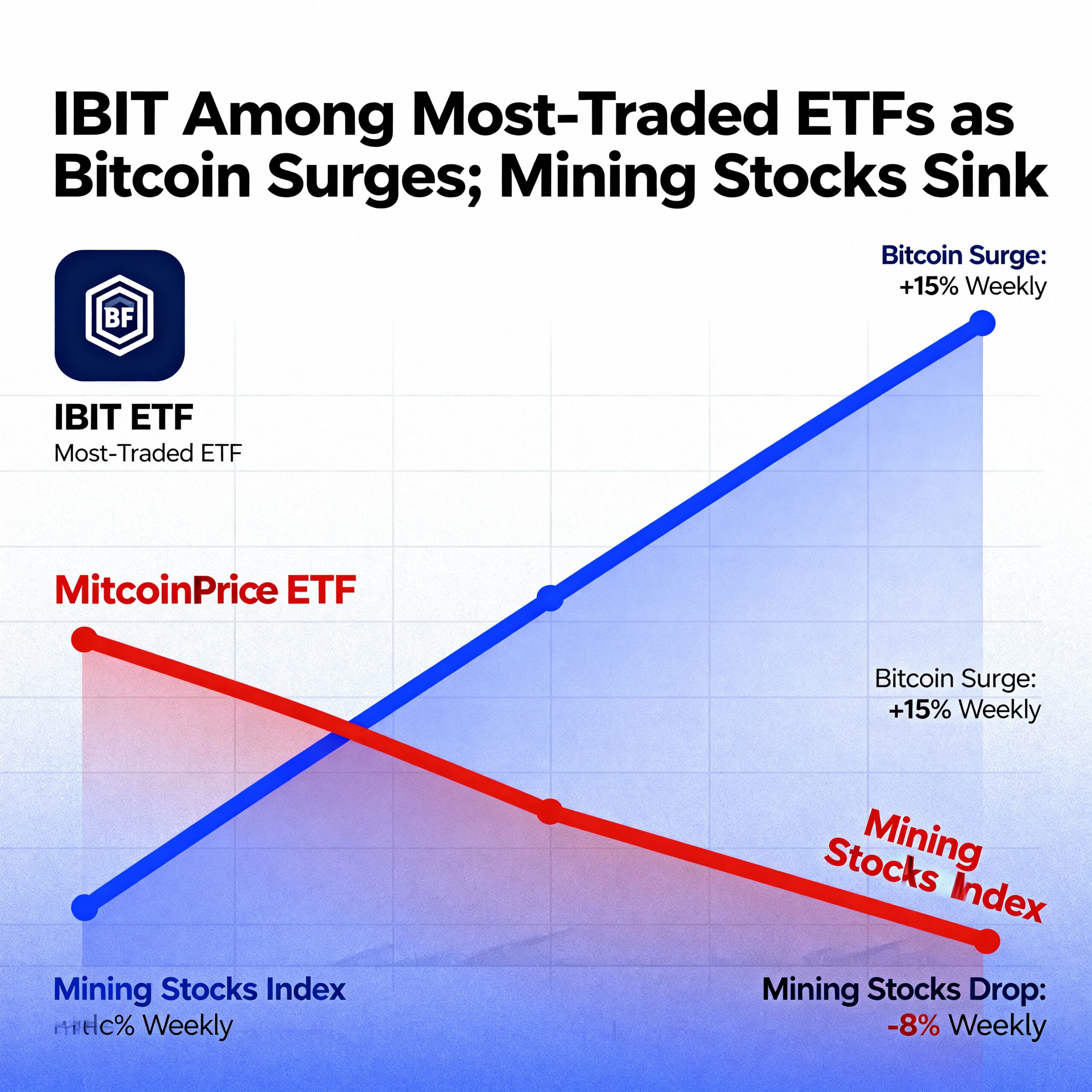

Bitcoin exchange-traded funds (ETFs) also experienced heavy trading volumes during the downturn, though panelists rejected the notion of widespread institutional capitulation. At their peak, spot bitcoin ETFs held approximately $150 billion in assets; that figure now stands near $100 billion, according to Restout. Net outflows since October total around $12 billion — meaningful, but relatively modest compared to overall assets under management.

“If anything, it suggests ownership is rotating rather than exiting entirely,” Restout said.

Looking ahead, speakers argued that the integration between traditional finance and digital assets is likely to deepen further. Emma Lovett, credit lead for Market DLT at J.P. Morgan, described 2025 as a regulatory turning point, particularly in the United States, where a more accommodating policy backdrop has encouraged experimentation beyond private blockchains.

“What we began to see in 2025 was the use of public chains and stablecoins for settling traditional securities,” Lovett said, signaling an accelerating convergence between crypto infrastructure and mainstream financial markets heading into 2026.