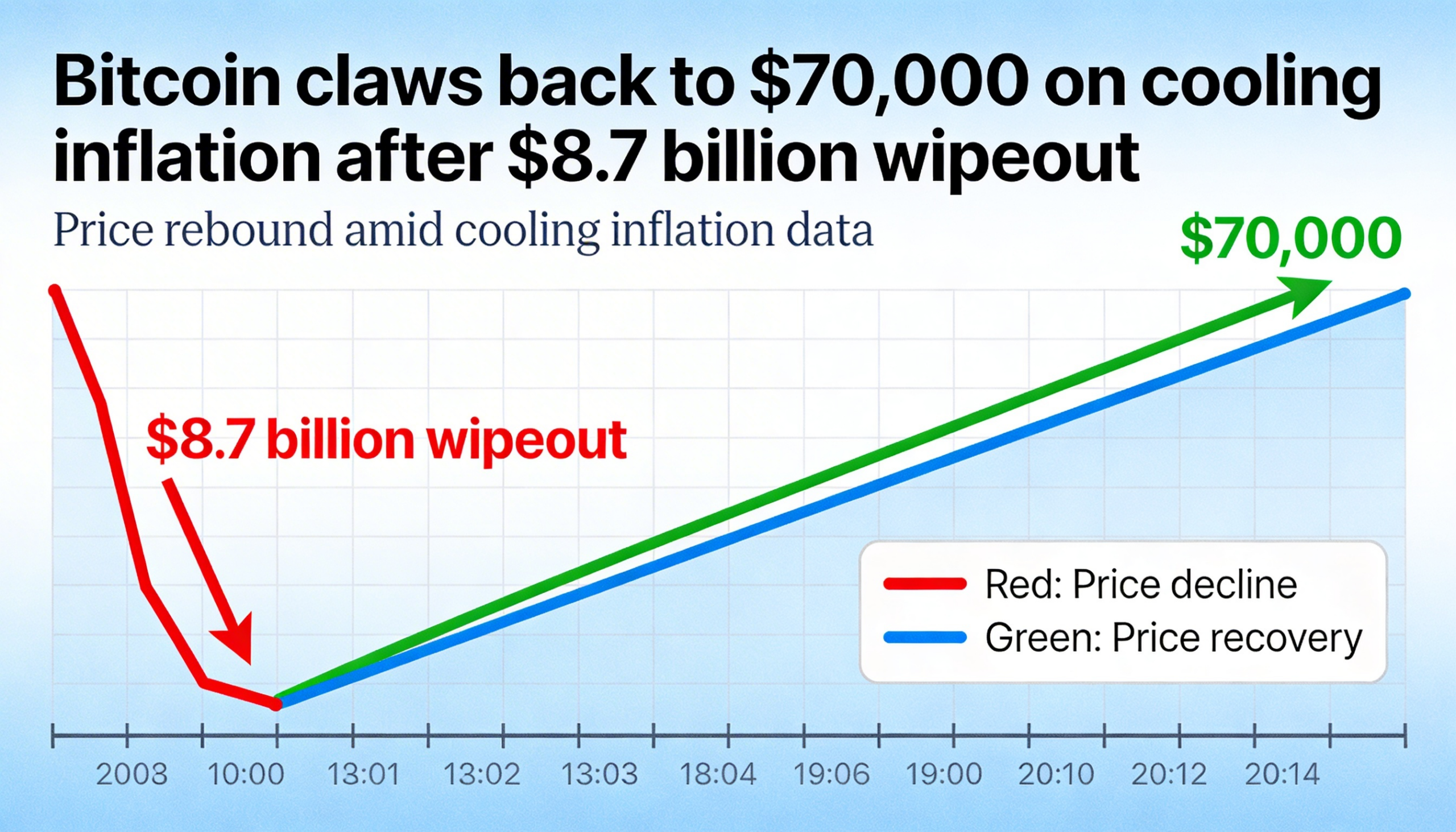

Bitcoin has rebounded above the $70,000 level after tumbling to nearly $60,000 earlier this month, gaining almost 5% over the past 24 hours. The broader CoinDesk 20 (CD20) index advanced 6.2% during the same period.

The recovery follows a softer-than-expected U.S. inflation reading that helped revive risk appetite across markets. January’s Consumer Price Index rose 2.4% year over year, slightly below forecasts of 2.5%, reinforcing hopes that interest rate cuts could arrive sooner than previously anticipated. Lower rates tend to support risk assets, including equities and cryptocurrencies, by reducing returns on safer investments.

On prediction platform Kalshi, traders are pricing in a 26% probability of a 25-basis-point rate cut in April, up from 19% earlier this week. On Polymarket, the odds climbed from 13% to 20%.

Despite the price bounce, sentiment indicators suggest caution. The Crypto Fear & Greed Index remains entrenched in “extreme fear,” levels not seen since the 2022 bear market triggered by the collapse of FTX. The gauge has stayed in that zone since the start of the month, underscoring lingering anxiety.

Analysts at Bitwise Asset Management reported that $8.7 billion in bitcoin losses were realized over the past week — a figure surpassed only during the fallout from the Three Arrows Capital collapse. They described the recent selling as a potential “textbook capitulation event,” noting that such periods often mark a transfer of supply from weaker holders to more conviction-driven investors, though the process can take time to stabilize prices.

Bitcoin treasury companies were at one point facing over $21 billion in unrealized losses, a record high. With the latest rebound, that figure has narrowed to approximately $16.9 billion.

Weekend trading volumes have been relatively thin, amplifying the current move higher as sellers appear exhausted. Still, fear remains the dominant force in the market. As Bitwise research analyst Danny Nelson told CoinDesk, the prevailing sentiment is concern that prices could fall further.

That caution has led some investors to use rallies as opportunities to exit positions. Whether the shift toward longer-term holders ultimately stabilizes the market — or whether selling pressure resumes — remains uncertain.