Bitcoin ETF Inflows Decline as Market Volatility and Arbitrage Opportunities Diminish

Investor enthusiasm for U.S. spot bitcoin ETFs has faded in 2025, with inflows slowing dramatically compared to the surge seen throughout 2024.

Over the past month, U.S. spot bitcoin (BTC) ETFs have experienced net outflows totaling $180 million, marking one of the most significant withdrawal periods since their launch in early 2024.

The performance of bitcoin ETFs has been lackluster this year, mainly due to bitcoin’s price decline of roughly 10%. Despite a brief resurgence in the last five days—bringing in around $700 million—cumulative net inflows now sit at $36.1 billion, according to Farside data.

Two key drivers have fueled the latest outflows: increased bitcoin price volatility and the unwinding of the basis trade strategy.

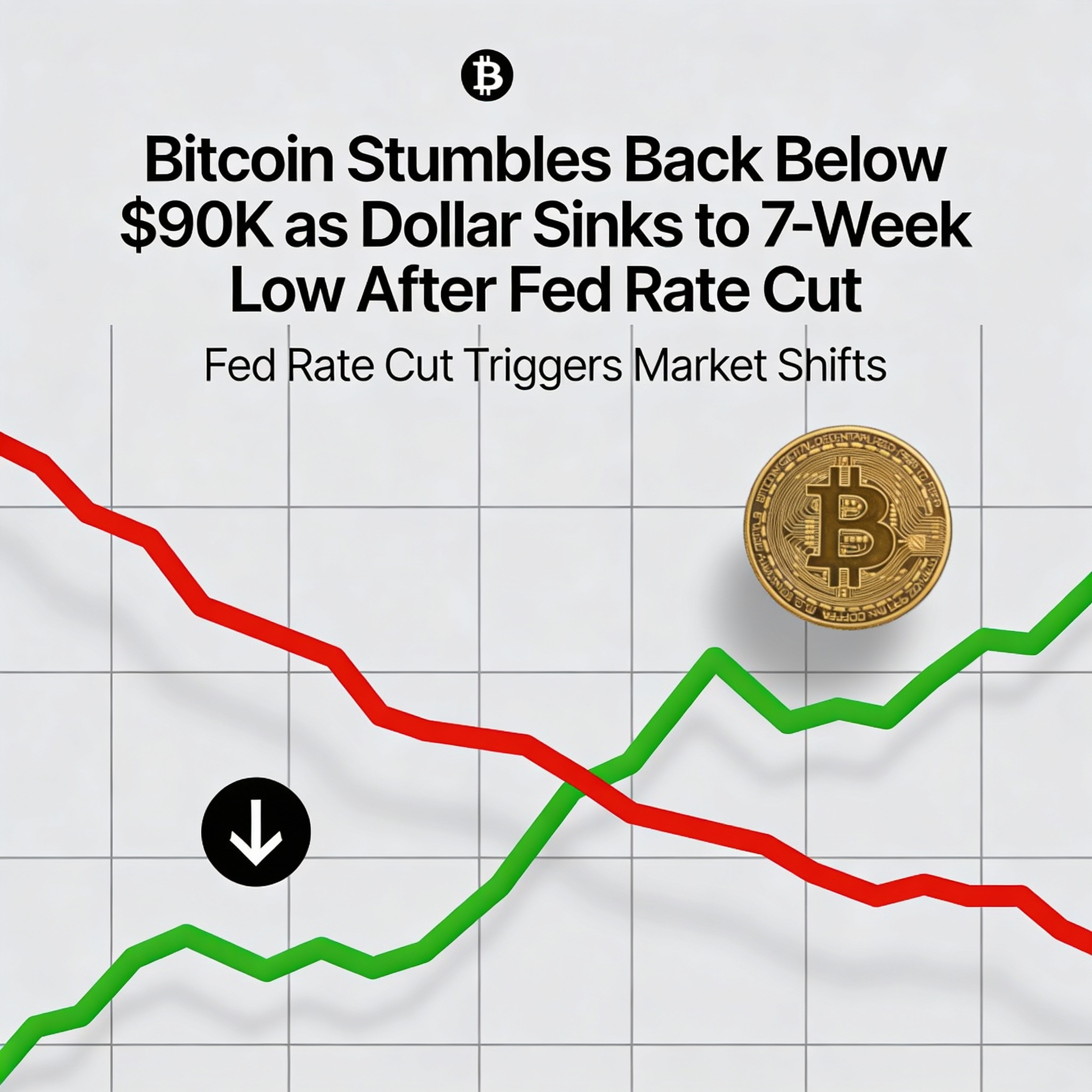

Bitcoin has exhibited extreme price fluctuations in 2025, climbing to a record $109,000 in January amid optimism surrounding President Donald Trump’s pro-crypto stance, only to plunge to $76,000 in early March as concerns mounted over the administration’s tariff-focused economic strategy.

Retail investors often liquidate positions during heightened volatility, reacting emotionally as they would with other high-risk assets. Institutional investors, meanwhile, have been unwinding the basis, or cash-and-carry, trade. This strategy involves taking a long position in a bitcoin ETF while simultaneously shorting CME bitcoin futures, capitalizing on the futures premium over spot prices in a delta-neutral fashion.

At present, this arbitrage opportunity offers only a 2% yield—one of the lowest levels since bitcoin ETFs were introduced. With U.S. Treasury yields providing more attractive low-risk returns, many investors have opted to shift capital to safer fixed-income alternatives.

Historically, ETF inflows and outflows have served as reliable indicators of bitcoin’s market movements. Large outflows often align with local price bottoms, particularly when examined through a 30-day moving average. This trend was evident during bitcoin’s March price drop, as well as in similar downturns in April and August 2024.