U.S. markets are reeling after President Donald Trump’s abrupt rollout of reciprocal tariffs, triggering a $5.4 trillion drawdown across equities. But as traditional assets buckle, bitcoin is displaying unexpected defensive characteristics.

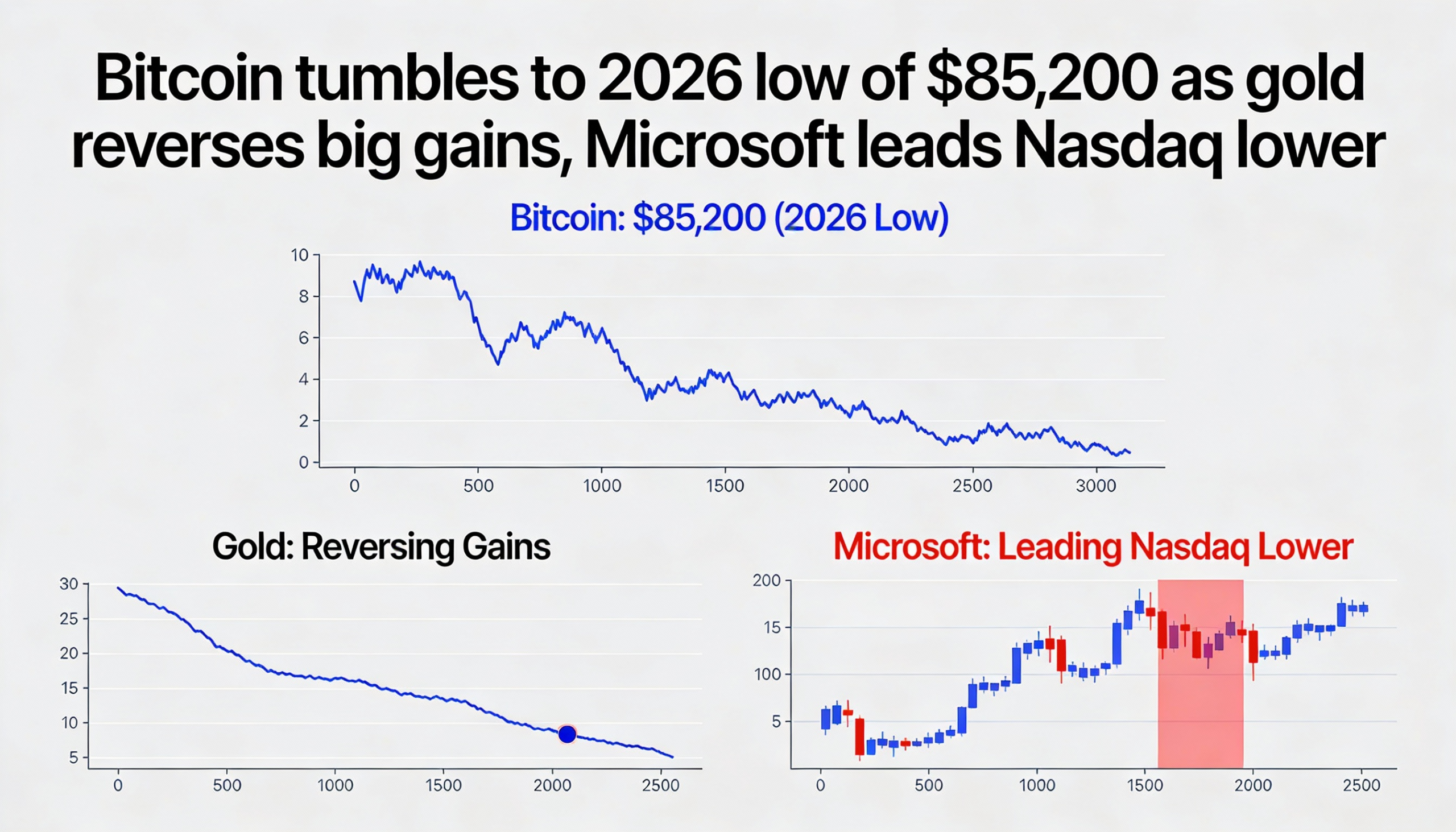

The S&P 500 sank to its lowest level in nearly a year, while the Nasdaq 100 entered bear market territory with an 11% drop over two trading sessions. In comparison, bitcoin (BTC) declined by only 6%, and the CoinDesk 20 Index (CD20), tracking top digital assets, slipped 4.9%.

Crypto’s relative outperformance is gaining attention. The total market cap of digital assets remains stable near $2.65 trillion, according to TheTie. Over the last 24 hours, bitcoin ticked down just 0.3% to $82,619.77, while the CD20 index rose 0.2%, signaling continued investor interest even amid broader market stress.

Crypto equities were mixed. MARA Holdings (MARA) and Core Scientific (CORZ) rose 0.6% and 0.4%, respectively. Meanwhile, MicroStrategy (MSTR) — the public company with the largest BTC holdings — rallied 4%, bucking the downtrend seen across tech, as the Nasdaq fell 5.8% on Friday alone.

Geoffrey Kendrick of Standard Chartered noted a shift in narrative: “Bitcoin is now not just a TradFi hedge, but arguably a ‘U.S. isolation hedge,’” he said in a research note. He also highlighted that only Microsoft managed to outperform BTC among the Magnificent 7 during the recent slide.

Interestingly, the market turmoil coincided with a symbolic date in crypto lore — April 5, believed to be the birthdate of Satoshi Nakamoto, bitcoin’s pseudonymous creator. Though likely chosen for its symbolism rather than accuracy, the date aligns with the anniversary of Executive Order 6102, which in 1933 forced Americans to turn over their gold reserves.

As traditional markets contend with rising geopolitical risk and economic fragmentation, digital assets — once seen as high-risk — are beginning to carve out a new role as alternative macro hedges.