Bitcoin has emerged as a standout performer amid a brutal equities rout, maintaining stability above $80K while traditional risk assets tumble. But a rapidly expanding risk in the U.S. bond market may soon test even crypto’s newfound macro credibility.

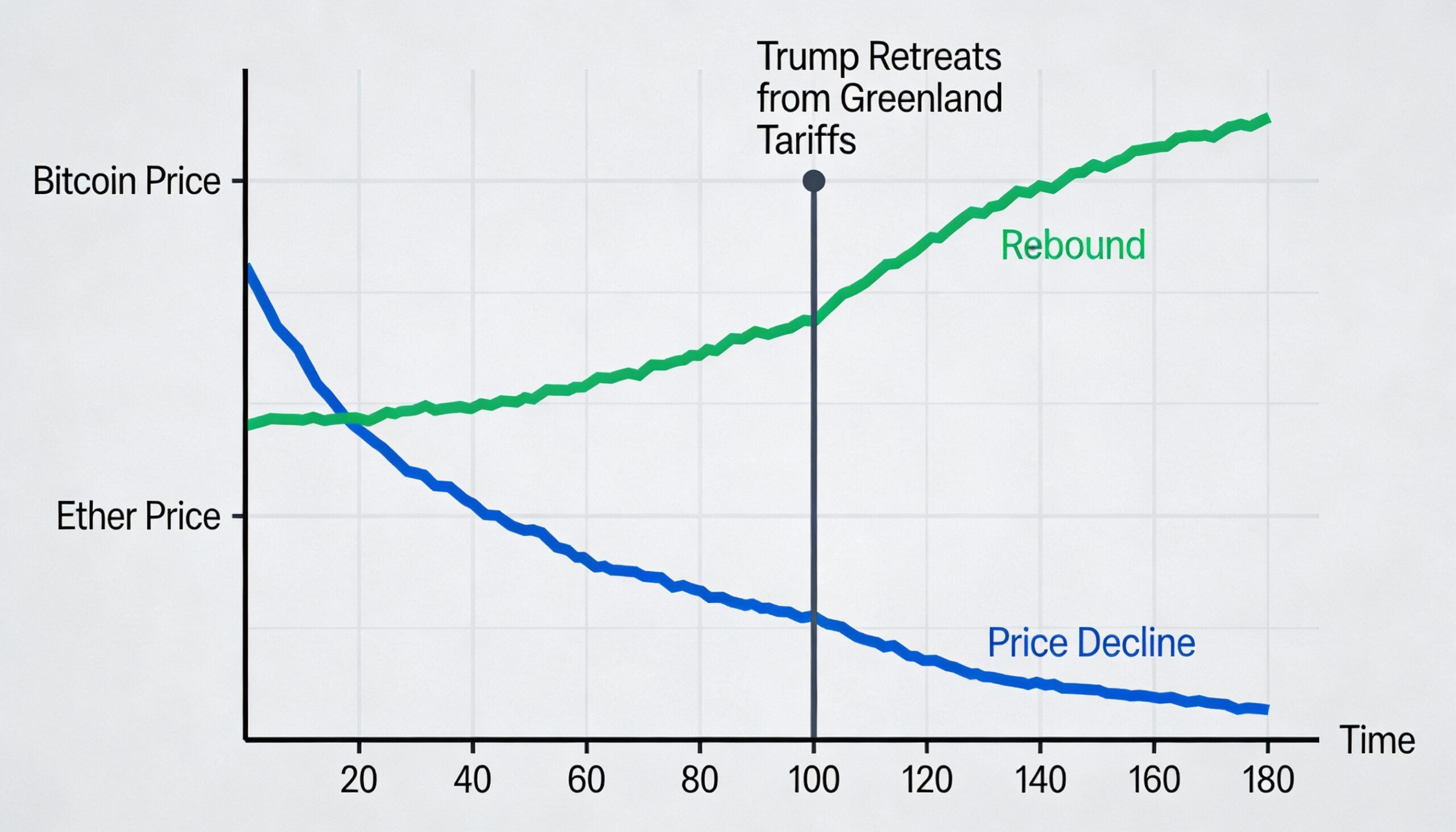

Markets have been rocked by renewed trade tensions. President Donald Trump’s sweeping reciprocal tariffs triggered an 11% plunge in the Nasdaq and sent global equities, commodities, and currencies reeling. BTC, by contrast, has remained remarkably resilient — down only modestly and quickly recovering intraday losses.

“Bitcoin’s stability in the face of this macro shock is significant,” said David Hernandez, strategist at 21Shares. “It’s behaving less like a speculative asset and more like a macro hedge.”

Online analysts are already branding bitcoin as a hedge against U.S. isolation, noting that it outperformed most of the “Magnificent 7” tech giants during this downturn.

But All Eyes Now Shift to Treasury Market Risk

Even so, investors should not overlook brewing instability in the leveraged corners of the bond market — particularly the $1 trillion Treasury basis trade. This trade, involving arbitrage between futures and cash Treasurys, is highly sensitive to volatility. Many hedge funds running this strategy are operating with extreme leverage, reportedly up to 50:1.

This setup mirrors conditions seen during March 2020, when COVID-era panic caused a massive “dash for cash” and the rapid unwind of leveraged trades. Bitcoin plunged nearly 40% that week.

“The market’s fragility is back — only bigger,” said Robin Brooks, Chief Economist at the Institute of International Finance. “Leverage is deeper, positioning is more crowded, and volatility is rising.”

Indeed, the MOVE Index — Wall Street’s Treasury volatility gauge — jumped 12% on Friday, reaching its highest level in five months at 125.70. And according to ZeroHedge, a single basis-point move in yields could swing these positions by $600 million.

A Fragile Calm

With bitcoin showing signs of maturity as a macro-responsive asset, the next stress test may come from outside the crypto sphere. Should basis trades begin to unwind, a rush for liquidity could drag down even high-performing assets.

In a recent report, the Brookings Institution urged the Fed to be ready with targeted market support if Treasury volatility sparks broader contagion — underscoring just how systemic this risk has become.

For now, bitcoin’s relative strength is holding. But with leverage building beneath the surface, the market may soon face a moment of truth.