A brief but dramatic rumor sparked a surge of optimism in global markets Monday—only to be swiftly dashed. Reports surfaced claiming President Trump was considering a 90-day delay on new tariffs for all countries except China. The White House wasted no time in denying the story.

“Fake news,” declared Press Secretary Caroline Leavitt, shutting down speculation that a broader reprieve was in the works.

The Nasdaq index experienced extreme intraday volatility, plunging nearly 5% before rallying back into positive territory and then retreating to flat—all in under two hours. The rumor reverberated across asset classes, sending shockwaves through an already jittery market.

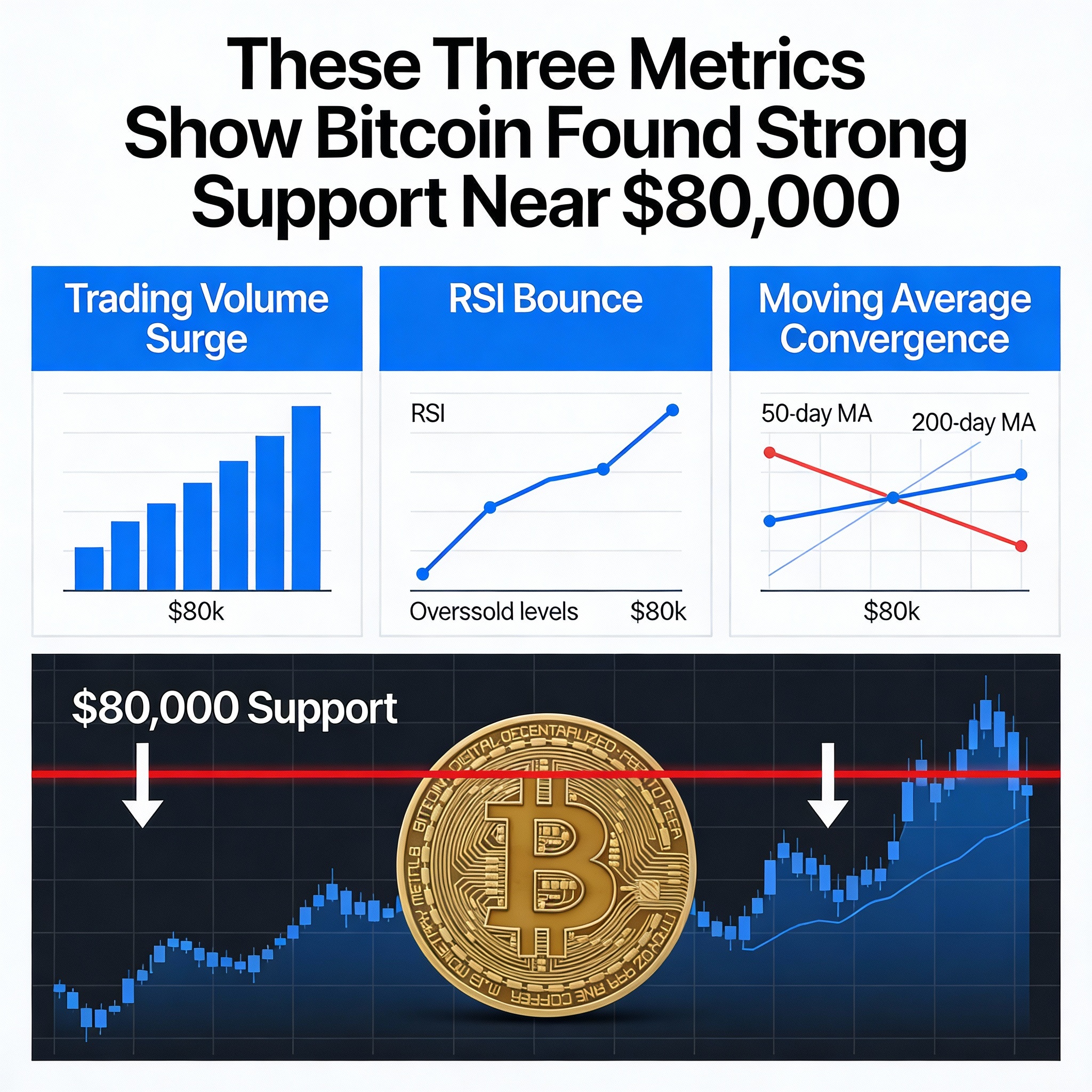

Bitcoin (BTC) briefly rallied from $74,400 to over $80,000 before easing to $79,000, still marking a 4.3% daily decline. Ethereum (ETH) and XRP were also hit hard, falling 11% and 9.3% respectively over the past 24 hours.

Despite the turmoil, some signs of diplomacy emerged. European Commission President Ursula von der Leyen extended an olive branch, saying the EU is willing to negotiate and even explore a zero-tariff agreement on industrial goods.

President Trump later emphasized the breadth of engagement, saying “countries from all over the world are talking to us,” and revealed that Japan is sending a senior delegation for trade talks.

With tariffs dominating the global agenda, markets remain highly reactive—vulnerable to every headline, rumor, and denial.