After South Korea’s declaration of emergency martial law, significant crypto market activity was seen on the Upbit exchange as large investors moved substantial amounts of Tether (USDT) stablecoin to capitalize on the sharp drop in cryptocurrency prices, including Bitcoin (BTC).

According to blockchain data from Lookonchain, over $163 million in USDT was transferred to Upbit within just an hour of President Yoon Suk Yeol’s announcement, which accused opposition parties of undermining the government and sympathizing with North Korea. This announcement triggered widespread panic in the market, leading to a sharp flash crash in Bitcoin and other token prices.

The influx of USDT likely indicates a wave of “bottom fishing” by whales looking to take advantage of the sudden price drop. “Many large holders moved USDT to Upbit, likely aiming to buy at discounted rates,” Lookonchain stated on X.

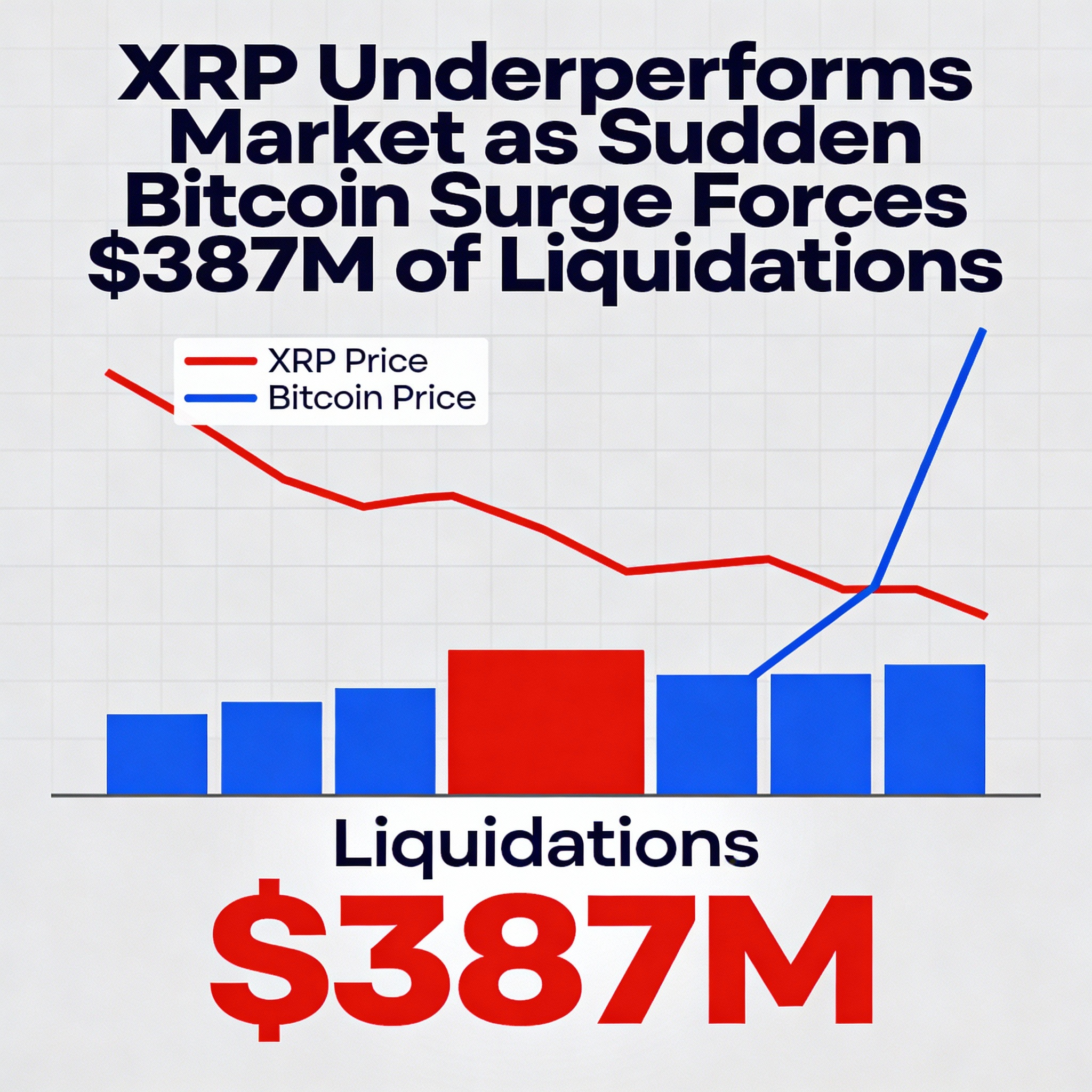

Bitcoin plunged to as low as $63,000 on Upbit following the announcement but has since rebounded to about $94,000, still below the global average of $95,800, based on data from TradingView. The crisis also raised concerns about potential censorship, leading more investors to turn to Bitcoin as a censorship-resistant, decentralized asset.