Sygnum Bank Highlights Bitcoin’s Growing Role as a Safe Haven Amid Supply Crunch and Market Uncertainty

Bitcoin’s appeal as a safe-haven asset is gaining momentum amid disruptions in U.S. Treasury markets and a weakening dollar, according to Sygnum Bank’s latest analysis.

The report points to a sharp decline in Bitcoin’s liquid supply — down roughly 30% over the past 18 months — which could lead to increased price volatility as demand continues to build. “The tightening liquid supply combined with sustained demand creates a perfect storm for potential price surges,” Sygnum analysts said.

Contributing to demand are rising inflows into Bitcoin ETFs and increasing government openness to holding Bitcoin reserves. These trends raise the possibility of a “demand shock,” where the number of buyers significantly outpaces available supply.

Since late 2023, over one million BTC have been withdrawn from exchanges, mainly by ETFs and corporate treasuries accumulating for long-term holdings. This withdrawal limits liquidity, putting pressure on traders who need access during price spikes or to manage short positions.

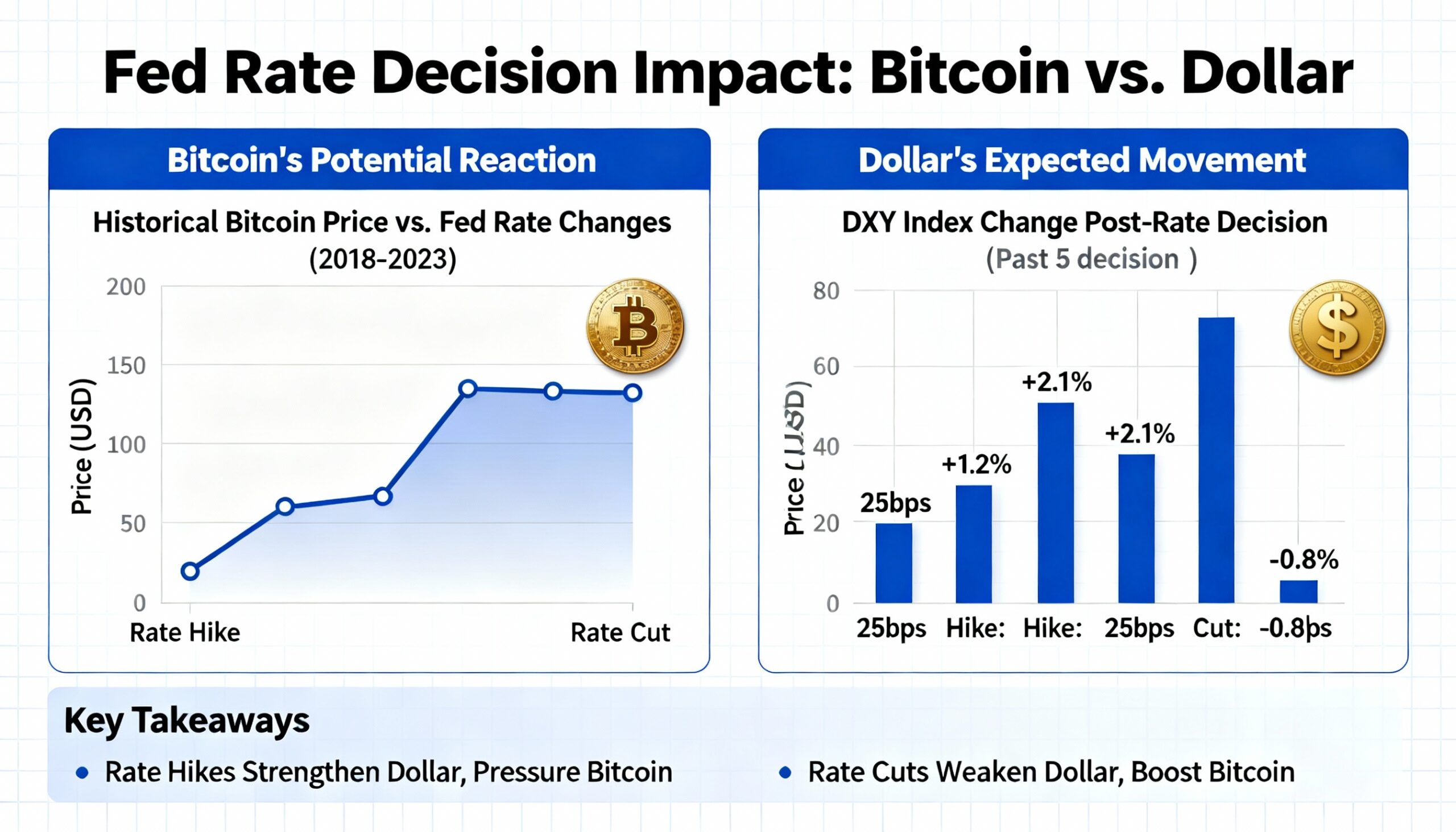

Macro factors are also pushing investors towards Bitcoin. Falling U.S. Treasury prices and mounting federal debt are driving money back into traditional safe havens like gold and Bitcoin, highlighting the crypto’s growing role as a hedge against economic uncertainty.

Geopolitical developments add to the positive outlook: three U.S. states have passed Bitcoin reserve legislation, with New Hampshire enacting its law and Texas poised to follow. Internationally, Pakistan and UK political figures are considering Bitcoin reserve allocations, moves that could boost institutional demand if realized.

Sygnum concludes that the cryptocurrency cycle remains robust, supported by constrained supply and growing demand that set the stage for heightened volatility and potential upside.