Crypto Markets Reel as U.S. Airstrikes on Iran Trigger $595M in Long Liquidations

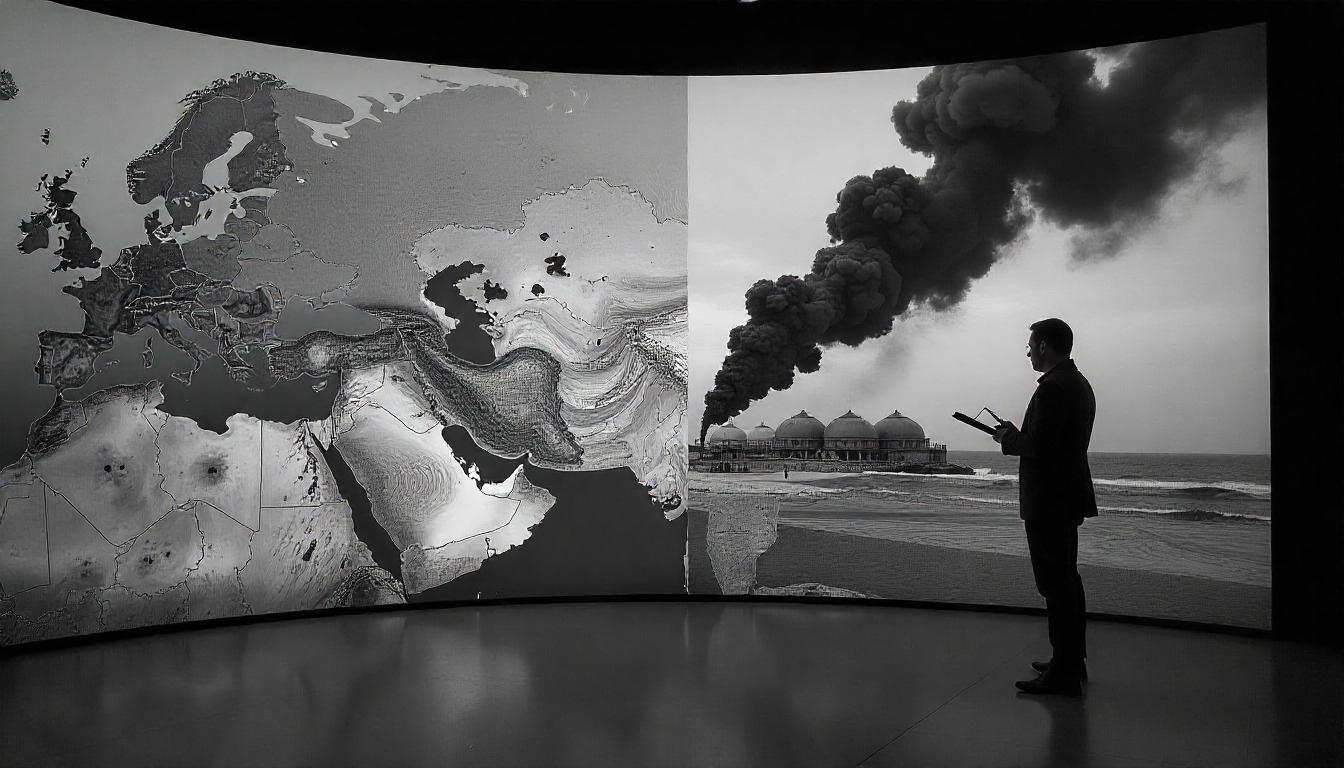

A sudden U.S. airstrike on Iran’s nuclear facilities sparked a sharp selloff in crypto markets, erasing bullish positions across major tokens like Bitcoin and Ethereum.

On Friday, crypto traders were stunned when the U.S. military launched strikes on Iran’s main nuclear sites, igniting heavy selling and leading to $595 million in liquidated long positions.

Former President Donald Trump announced the strikes, which targeted Iran’s significant uranium enrichment facilities at Fordow, Natanz, and Isfahan. The geopolitical shock rippled through global markets and sent crypto prices tumbling over the weekend.

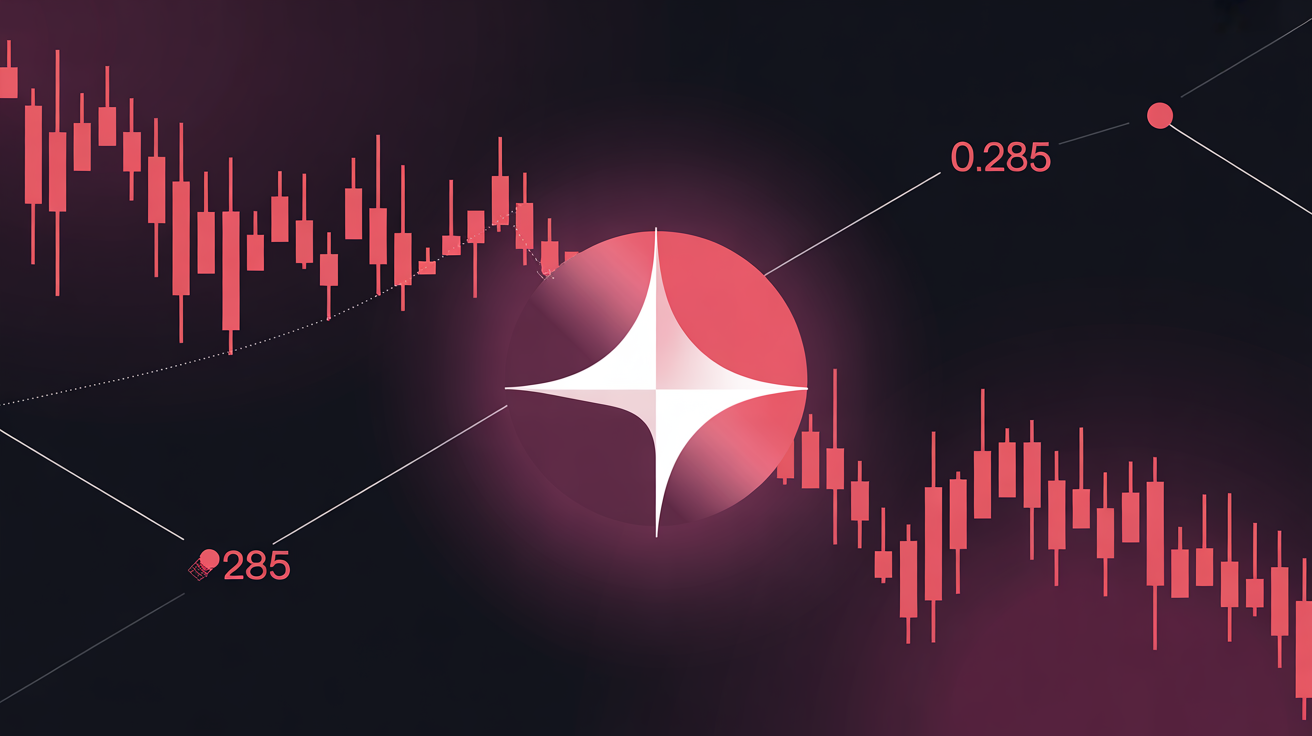

In the past 24 hours, 172,853 traders saw their positions liquidated, totaling $681.8 million in losses. Of this amount, about 87% came from long bets. Ethereum traders took the biggest hit, with $282 million liquidated, while Bitcoin traders saw $151 million in positions wiped out. Other major tokens, including SOL, XRP, and DOGE, also suffered losses, collectively exceeding $22 million.

Liquidations occur when exchanges forcibly close leveraged positions because traders can no longer maintain the required margin. Such cascades often signal extreme market conditions and may hint at potential reversals as prices overshoot in one direction.

Though prices plunged during the chaos, markets found some footing. Bitcoin stabilized around $102,000, while Ethereum hovered just above $2,280, both still down on the day but avoiding deeper crashes.

Bybit and Binance accounted for about two-thirds of the liquidations. With the U.S. threatening even more extensive strikes, traders remain on edge, preparing for further volatility.