Bitcoin Reclaims $100K as Markets Settle After U.S. Strikes; OKX Considers U.S. IPO

Bitcoin recovered above the $100,500 mark in early Asian trading on Monday, calming after a volatile weekend that saw markets react to U.S. airstrikes on Iranian nuclear facilities.

The world’s largest cryptocurrency had briefly fallen below $100,000 on Sunday as investors responded to the rising geopolitical tension. But risk appetite returned as equities stabilized, gold edged only slightly higher, and oil held its gains without further escalation.

Analysts say the muted reaction across asset classes suggests that investors are not yet pricing in a prolonged conflict. Many expect Iran’s response to be delayed or strategic rather than immediate, giving markets breathing room.

Crude oil prices hovered near $76 per barrel after jumping nearly 4% on Sunday amid concerns that Iran could disrupt shipments through the Strait of Hormuz, a key global oil artery. For now, traders appear to be in wait-and-see mode.

Altcoins mirrored bitcoin’s weekend volatility but also recovered in early Monday trading. Ethereum (ETH), XRP, and Solana (SOL) all posted modest rebounds after sharp drops tied to broader market risk-off sentiment.

OKX Reportedly Weighing U.S. IPO

Crypto exchange OKX is considering a public listing in the United States, according to a report from The Information.

This comes after the exchange settled with the U.S. Department of Justice earlier this year for operating without proper registration. Since then, OKX has announced plans to expand into the American market.

If it moves forward, OKX would join other major players like Bullish—the parent company of CoinDesk—in exploring IPO opportunities amid renewed investor interest in the crypto sector.

OKX declined to comment on the IPO speculation when contacted by CoinDesk.

Polymarket Odds Shift as Traders Expect Cooler Heads to Prevail

Bettors on decentralized prediction platform Polymarket are dialing back expectations of further military action.

The probability of another U.S. strike on Iran before June 30 dropped to 54%, down from 74% shortly after the initial airstrikes. Meanwhile, the odds that Iran will shut down the Strait of Hormuz—a key chokepoint for oil exports—eased to 49%, down slightly from 52%.

The shifts suggest a growing belief that diplomacy may prevail over immediate escalation.

Market Snapshot

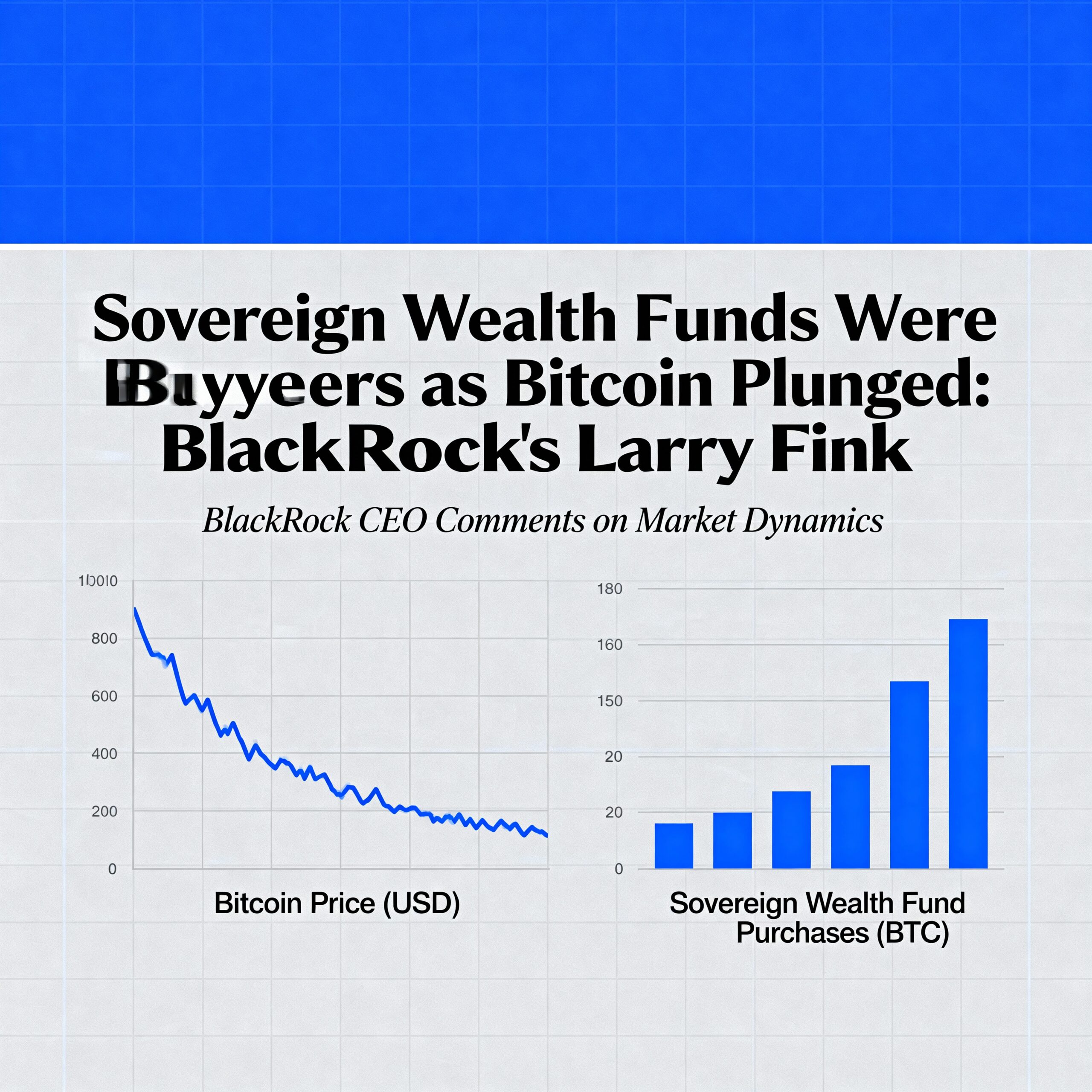

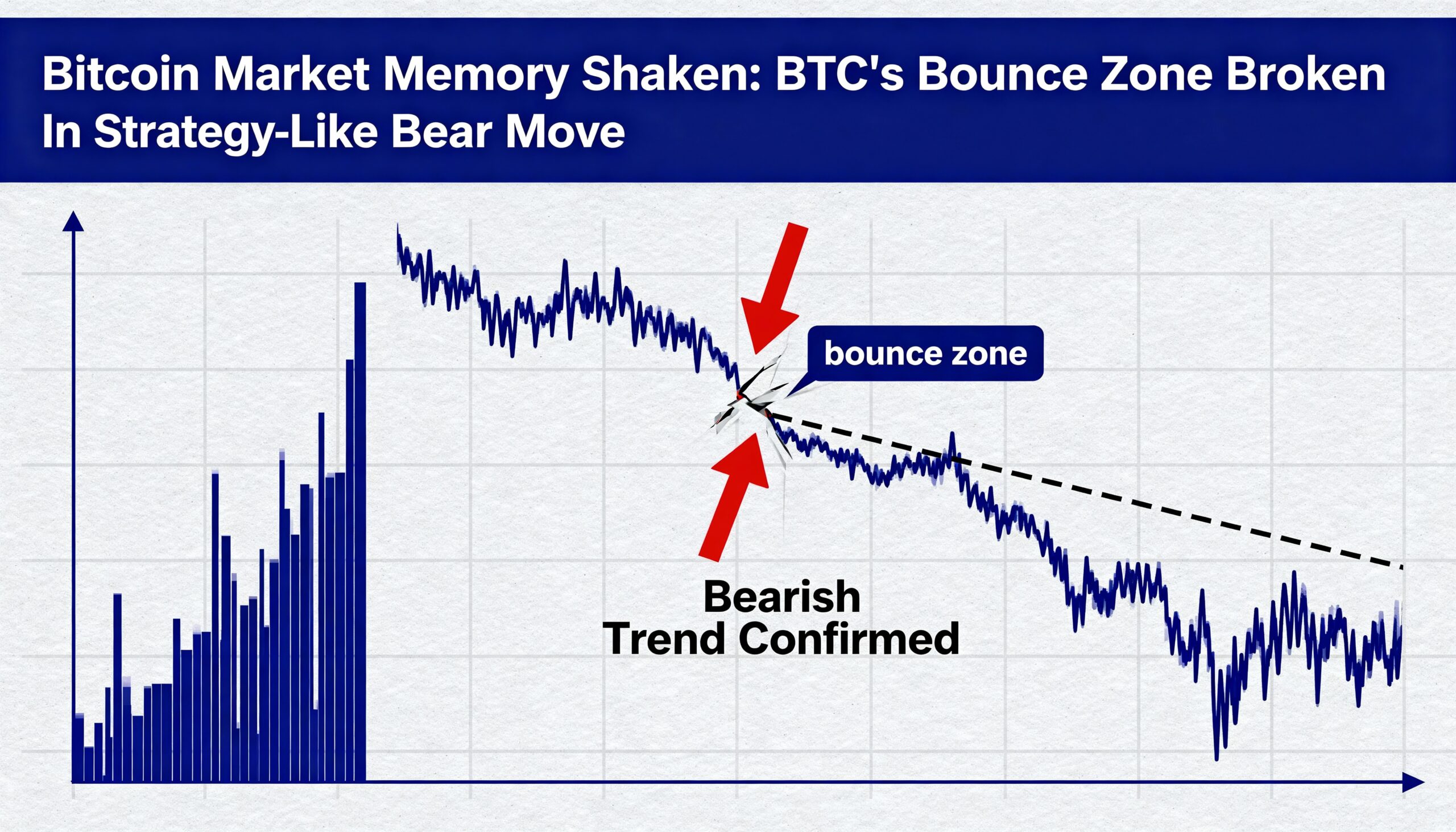

- Bitcoin (BTC): Rebounded to $101,419 after a 4.5% intraday swing; support found near $99,000 amid institutional activity.

- Ethereum (ETH): Down 2.3% to $2,237, breaking a six-week consolidation range despite over $500 million in recent institutional inflows.

- Gold: Bank of America projects gold could climb to $4,000/oz within a year, citing rising U.S. fiscal concerns and central bank demand.

- Oil: Holds near $76 after weekend surge; all eyes remain on Strait of Hormuz developments.

- Nikkei 225: Fell 0.56% as oil-driven inflation fears and Middle East tensions weighed on sentiment.