Dogecoin has surged 23% over the past week, driven largely by a spike in retail trading on platforms like Robinhood and Binance. XRP has also seen a significant uptick in volume on Korean exchanges, while altcoins like Cardano, TRX, and AVAX continue to trade solidly in positive territory.

Bitcoin’s rally to $120,000 this week has sparked a wider breakout across the crypto market. Major assets including ether (ETH), Solana’s SOL, XRP, and Dogecoin have all posted high single-digit gains, reflecting a wave of optimism sweeping through the sector.

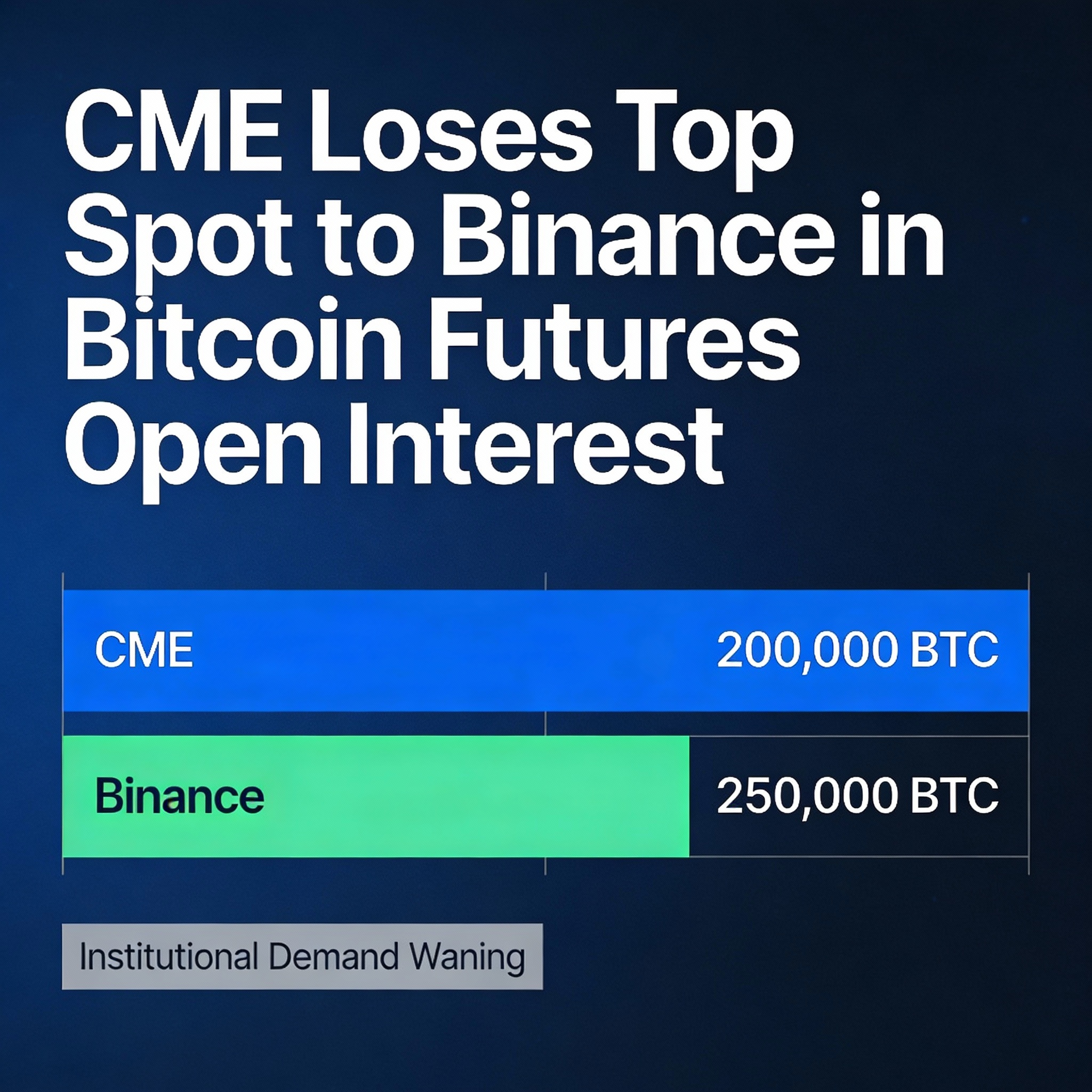

Yet traders say this time feels different. Rather than pure momentum-driven hype, there’s a growing sense that market structure is evolving, shaped by increasing institutional engagement.

“This isn’t a frenzied boom with no foundation,” said Seamus Rocca, CEO of Xapo Bank. “We’re seeing a measured climb, supported by large institutional investors who have a long-term perspective.”

Rocca noted that tighter monetary conditions and geopolitical uncertainty are reinforcing Bitcoin’s role as a macro hedge. “The momentum we’ve witnessed over the last 48 hours is undeniable,” he added. “Bitcoin isn’t just gaining in price—it’s transforming into an asset class that’s beginning to rival traditional finance.”

Ethereum has been a standout performer this week, gaining more than 17% and briefly topping $3,000. “In Q2, corporate treasuries purchased more BTC than flowed into spot ETFs,” the analytics team at Bitcoin yield protocol TeraHash shared in a note to CoinDesk.

“That signals strategic accumulation,” TeraHash continued. “At the same time, custodians like Anchorage and Fidelity are expanding services for institutions, and OTC desks are tightening spreads.”

Solana has climbed over 11% this week to about $163, bolstered by renewed interest from both retail investors and the memecoin community. The network remains a high-beta proxy for traders looking to capitalize on risk-on sentiment. Meanwhile, XRP has surged 25%, lifted by technical breakouts and speculation around regulatory clarity.

“Price action grabs the headlines,” TeraHash observed, “but the true story this summer is the shift in market structure.”

The rally in altcoins has been widespread. Dogecoin’s 23% weekly jump reflects a resurgence in retail enthusiasm, while XRP’s volumes remain elevated in Asian markets. Cardano, TRX, and AVAX are all showing healthy gains.

Lukas Enzersdorfer-Konrad, Deputy CEO of Bitpanda, noted that significant Bitcoin rallies often lead to strong altcoin moves, sometimes with a slight delay. “We also can’t rule out a potential resurgence in meme coins,” he added.

Still, caution lingers among some market watchers.

“Despite briefly reaching this major milestone, Bitcoin remains under a key resistance zone,” said Ruslan Lienkha, Chief of Markets at YouHodler, in an email.

“A definitive breakout and sustained move higher could trigger a sharp rally, potentially aiming for the $130,000 mark,” Lienkha said.